🤧

Community Property • Analysis of Creditor's Rights

CPROP#056

Legal Definition

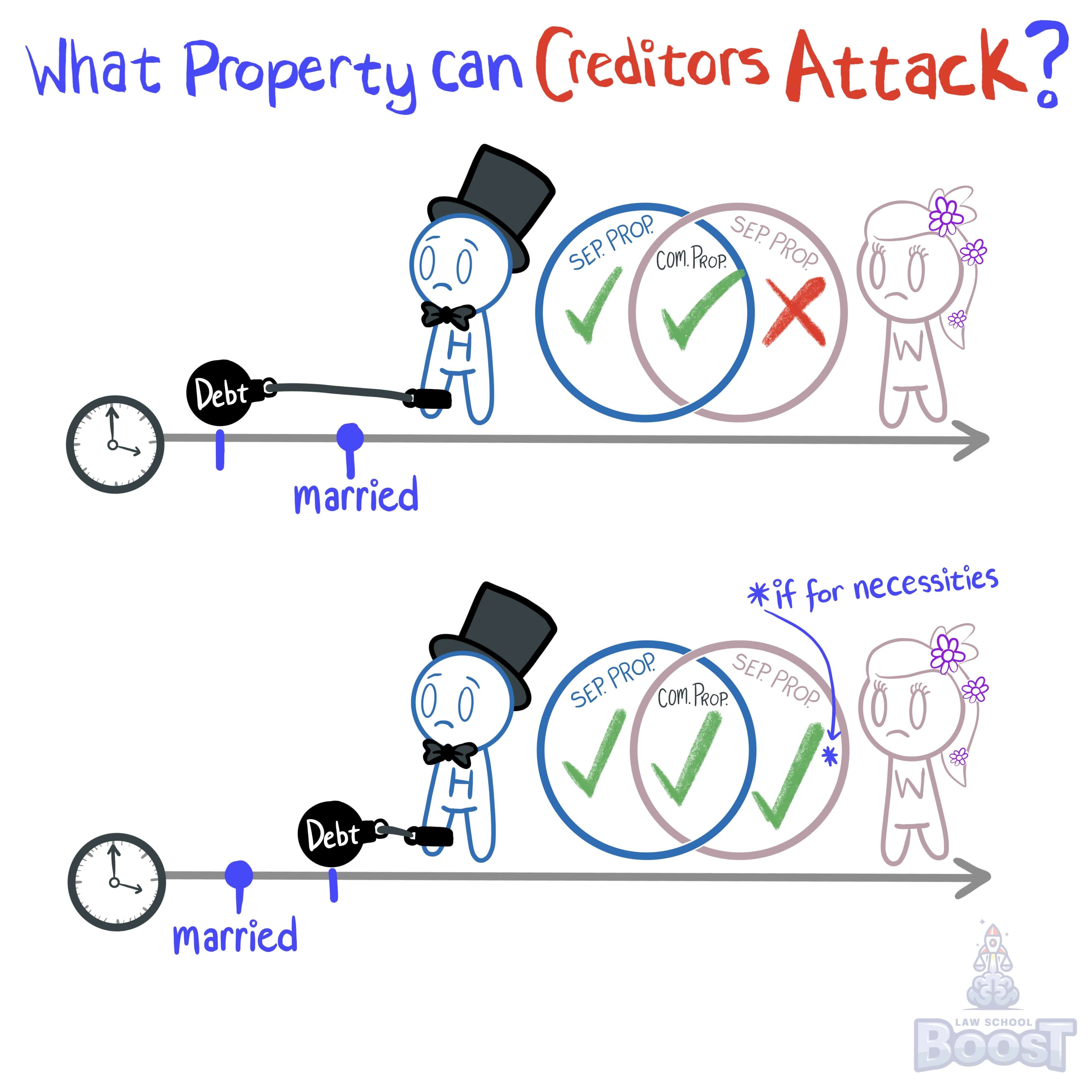

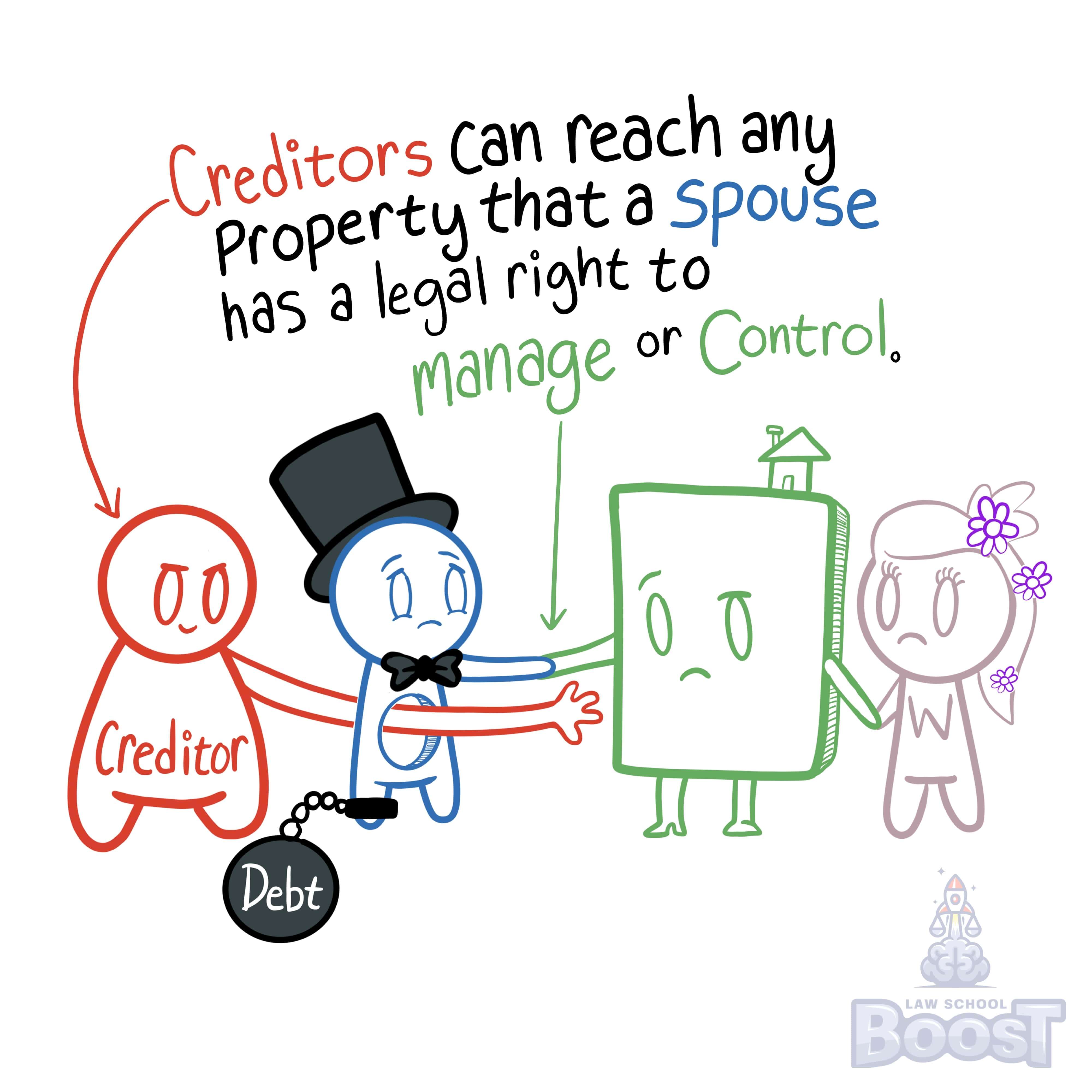

Where a debt is incurred before marriage, a creditor may reach all the community property and the debtor's separate property, but not the non-debtor's separate property. For child and spousal support, the community is entitled to reimbursement if, at the time the community property was applied, separate income of the debtor spouse was available but not applied to satisfy the obligation.

Plain English Explanation

Marrying someone doesn't automatically make you responsible for debts they already had. That wouldn't be fair or reasonable. But anything that's earned or bought after saying "I do" is shared between spouses. That's called community property. If a creditor like a bank comes looking to get paid back for a debt that happened before the wedding bells rang, they can take community property because both spouses own that. And they can take the property and money that belongs only to the spouse who was originally responsible for the debt. But they have to leave the other spouse's separate home, car, and bank accounts alone if that spouse didn't cause that debt. However, there's an exception if child support or spousal support wasn't paid when it should've been from one spouse's separate money. Then the community can ask to be paid back if its money was used instead. Because that separate money should've been used to provide for any children or ex-spouses in the first place.

Hypothetical

Hypo 1: Bob had a car loan before he married Amy. After their marriage, he still owes money on the car. Result: Creditors can try to get payment from Bob and Amy's joint bank account or Bob's personal savings. However, they cannot take money from Amy's personal account that she had before marrying Bob.

Hypo 2: Before marrying Amy, Bob had a credit card debt. He continues to use his credit card irresponsibly even after marriage. Result: The creditors can seek repayment from the couple's joint property and Bob's separate property. Amy's separate property, which she owned before the marriage, is not accessible to these creditors.

Hypo 3: Bob had a child from a previous relationship and was paying child support before marrying Amy. He uses their joint account to pay for child support, even though he has enough personal funds. Result: The joint account can be used for child support payments. However, since Bob had personal funds, the community is entitled to reimbursement of the amount used from their joint account back into it.

Hypo 2: Before marrying Amy, Bob had a credit card debt. He continues to use his credit card irresponsibly even after marriage. Result: The creditors can seek repayment from the couple's joint property and Bob's separate property. Amy's separate property, which she owned before the marriage, is not accessible to these creditors.

Hypo 3: Bob had a child from a previous relationship and was paying child support before marrying Amy. He uses their joint account to pay for child support, even though he has enough personal funds. Result: The joint account can be used for child support payments. However, since Bob had personal funds, the community is entitled to reimbursement of the amount used from their joint account back into it.

Visual Aids

Related Concepts

What are the most common type of debts incurred and how are they treated?

When a debt is incurred during marriage, whose property is available to creditors attempting to satisfy the debt?

When debts are incurred for the benefit of the community, whose property is available to creditors attempting to satisfy the debt?

When debts are incurred NOT for the benefit of the community, whose property is available to creditors attempting to satisfy the debt?