🤧

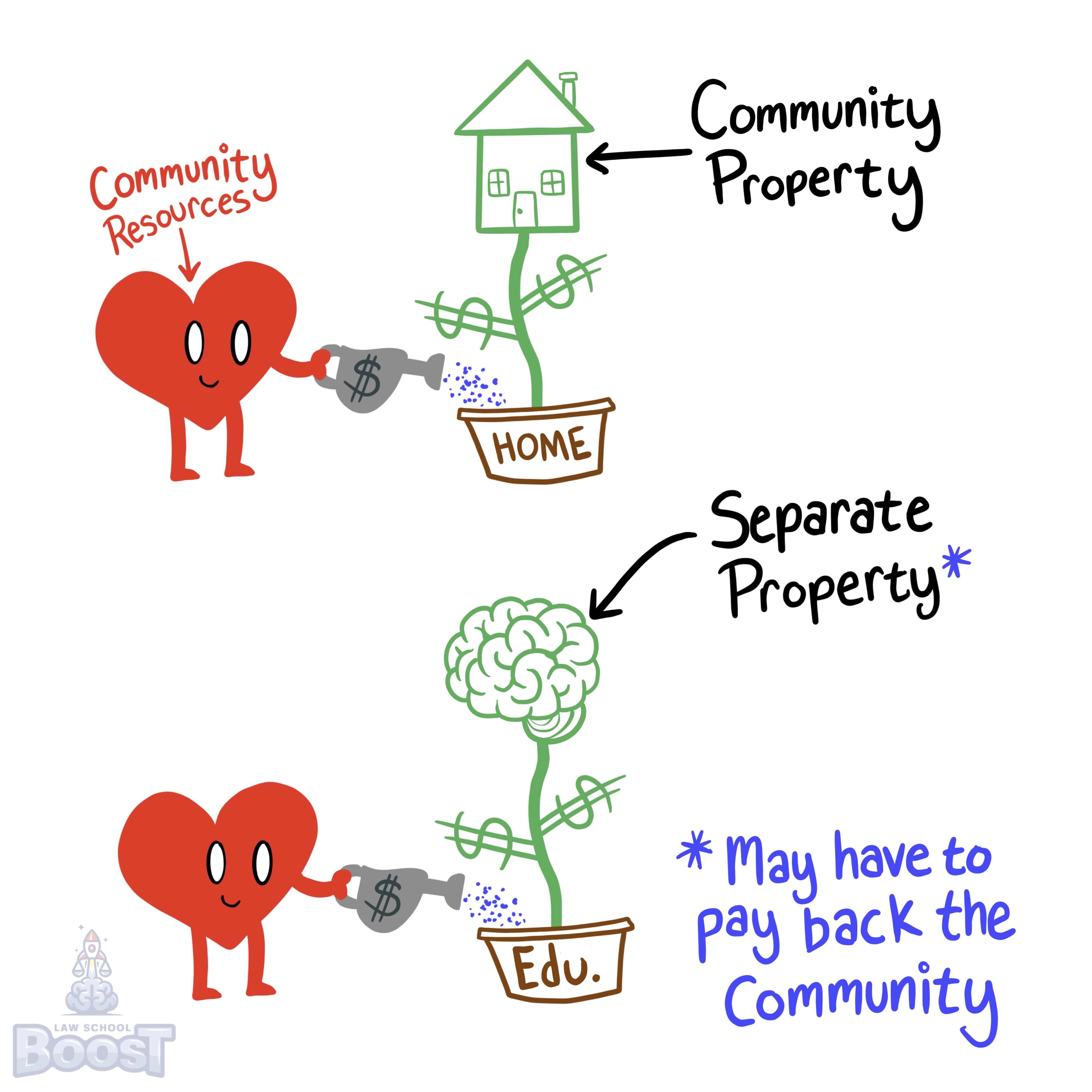

Community Property • Education and Training

CPROP#027

Legal Definition

Education and training acquired during marriage is not treated as community property. Absent an agreement to the contrary, the community has an equitable right of reimbursement, with interest, for the cost of education when community funds are (1) used either to pay for education or training or used to repay a loan used for education or training, and (2) the education or training substantially enhances the earning capacity of the educated party.

Plain English Explanation

When two people in a community property jurisdiction get married and buy a house together, it's easy to acknowledge that their shared money went to purchase a shared piece of property, and that shared piece of property should be divided if they get a divorce. But education is more abstract.

When a married couple pays for one of the spouses to receive an education, the result isn't shared property. How could it be? The information was uniquely transferred (hopefully) into the brain of one of the spouses, and that spouse uniquely got to experience the various trainings and curriculum. Even the end result, a diploma, is a reflection and validation of one spouse's efforts. For example, if Amy earns a medical degree while married to Bob, Bob has no right after they divorce to claim he is "half a doctor."

Ultimately, though, the law recognizes that the community has the right to get paid back, with interest, for costs related to education or training if (1) community money paid for it or was used to repay loans for it, and (2) the education or training greatly improved the earning ability of the spouse who got educated or trained.

When a married couple pays for one of the spouses to receive an education, the result isn't shared property. How could it be? The information was uniquely transferred (hopefully) into the brain of one of the spouses, and that spouse uniquely got to experience the various trainings and curriculum. Even the end result, a diploma, is a reflection and validation of one spouse's efforts. For example, if Amy earns a medical degree while married to Bob, Bob has no right after they divorce to claim he is "half a doctor."

Ultimately, though, the law recognizes that the community has the right to get paid back, with interest, for costs related to education or training if (1) community money paid for it or was used to repay loans for it, and (2) the education or training greatly improved the earning ability of the spouse who got educated or trained.

Hypothetical

Hypo 1: Bob decides to pursue a law degree while married to Amy, using their joint savings for tuition. After graduation, his earning capacity significantly increases. After landing a Big Law job with a Big Law salary, Bob divorces Amy. Result: Since the education enhanced Bob's earning capacity and was paid for with community funds, the community is entitled to reimbursement for the tuition costs, with interest, which is then divided.

Hypo 2: Amy uses community funds to attend culinary school, but after completing her course, she decides not to work as a chef. Result: Although the education was funded by community money, since it did not enhance Amy's earning capacity, there is no right of reimbursement upon divorce.

Hypo 3: Bob obtains a business degree during his marriage to Amy, financing it through a student loan. After graduating, he lands a high-paying job and divorces Amy. Result: The community has a right to be reimbursed for the loan payments made with community funds, with interest, since Bob's education substantially enhanced his earning capacity.

Hypo 4: Amy attends a weekend painting workshop using community funds. This does not lead to any change in her income. Result: Since the workshop didn't substantially enhance Amy's earning capacity, there is no right of reimbursement to the community upon divorce.

Hypo 5: Bob attends a professional development course paid for by his employer, not affecting the community funds. Result: Since no community funds were used for the course, the rule of reimbursement does not apply here.

Hypo 2: Amy uses community funds to attend culinary school, but after completing her course, she decides not to work as a chef. Result: Although the education was funded by community money, since it did not enhance Amy's earning capacity, there is no right of reimbursement upon divorce.

Hypo 3: Bob obtains a business degree during his marriage to Amy, financing it through a student loan. After graduating, he lands a high-paying job and divorces Amy. Result: The community has a right to be reimbursed for the loan payments made with community funds, with interest, since Bob's education substantially enhanced his earning capacity.

Hypo 4: Amy attends a weekend painting workshop using community funds. This does not lead to any change in her income. Result: Since the workshop didn't substantially enhance Amy's earning capacity, there is no right of reimbursement to the community upon divorce.

Hypo 5: Bob attends a professional development course paid for by his employer, not affecting the community funds. Result: Since no community funds were used for the course, the rule of reimbursement does not apply here.

Visual Aids