🤧

Community Property • General Principles

CPROP#003

Legal Definition

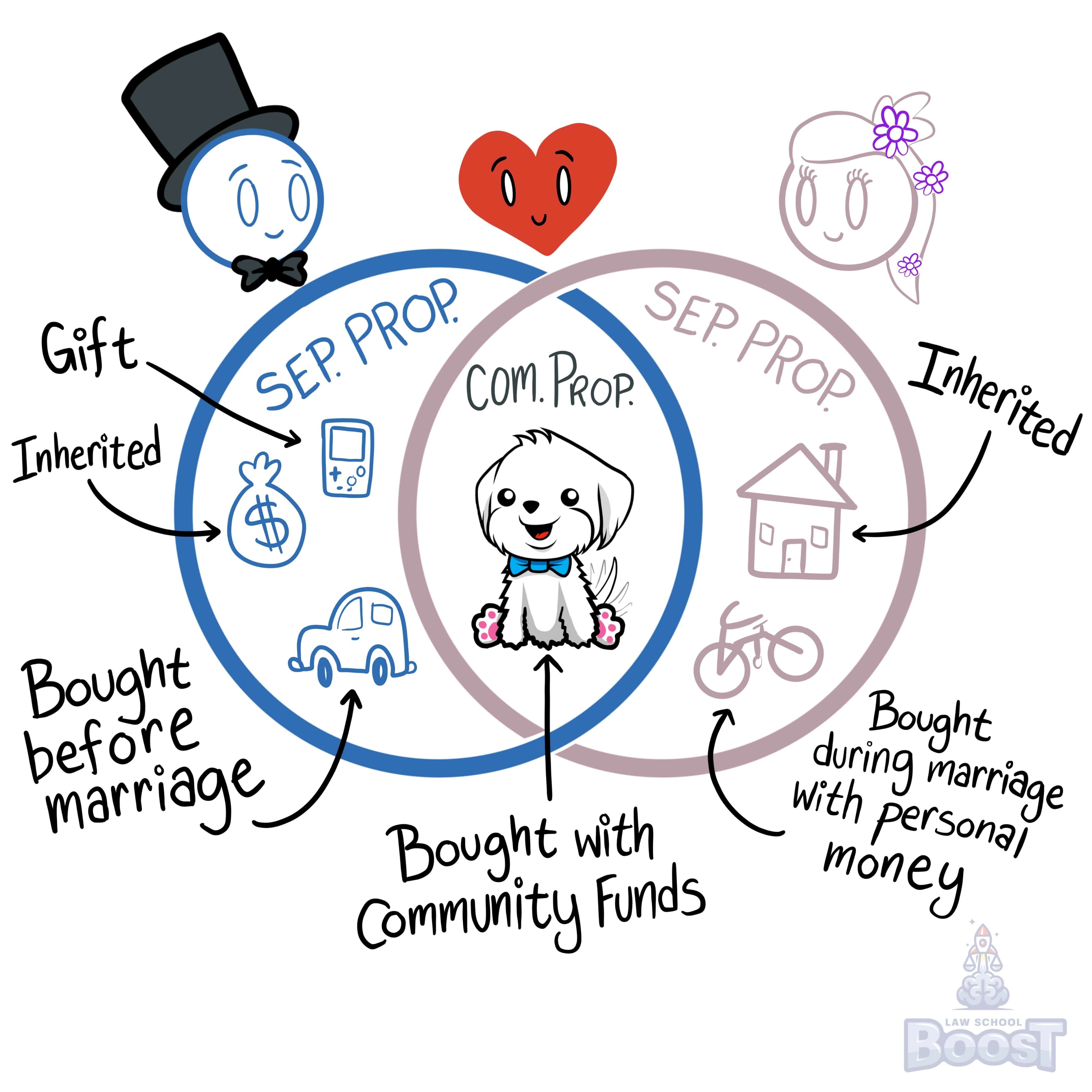

Separate property is (1) property owned by either spouse before marriage, (2) property acquired during marriage by gift, will, or inheritance, (3) property acquired during marriage with the expenditure of separate funds, or (4) the rents, issue, and profits derived from separate property.

Plain English Explanation

You can think of separate property as property that belongs to one individual spouse. Let’s go through the checklist to see the ways that that can be true. (1) Someone owned the property before they were married. This one’s easy. If they paid for it or were given it before the couple had any community property at all (i.e. hadn’t tied the knot yet), that property is considered separate from community property. (2) If someone in the couple was gifted or willed the property during marriage (as in it was given to them and them alone), that’s separate property. (3) If property was bought with <separate funds>, that falls under separate property. (4) Finally, separate property also includes any money earned from a separate property. That means any rent or profits coming from a property that only one person in the couple owns.

Hypothetical

Hypo 1: Bob and Sam are a legally married couple and, in their divorce proceedings, you’re trying to figure out if a gothic mansion that the couple owns can be considered separate property. They’ve been renting the house out to other people for about 2 years, and they’ve made hundreds of thousands of dollars from it. They came to own the property because Bob’s grandmother left it to him in her will. Result: There are two examples of separate property in this hypothetical. For one, the house itself can be considered Bob’s separate property because it was left to him specifically in an inheritance. Secondly, all the rent money they’ve made from the house can be considered Bob’s separate property, because it all comes from Bob’s other separate property: the house. If they’ve paid for any repairs, Sam should be partly reimbursed for the cost of those repairs from the money earned, as it was investment from their shared money toward Bob’s separate property.

Hypo 2: Jill and Amy are trying to figure out if a motorcycle they share can be considered community or separate property. Jill bought the motorcycle, a gorgeous BMW R nineT, years before they were married, but Amy bought the cute sidecar that goes with the bike with money she had in her college fund, which her parents created years before the marriage. What should they do? Result: Unfortunately, it looks like the sidecar’s getting divorced from the motorcycle. The motorcycle is Jill’s separate property because she purchased it before the marriage, while the sidecar is Amy’s separate property because she bought it with money she had before the marriage, also known as separate funds.

Hypo 2: Jill and Amy are trying to figure out if a motorcycle they share can be considered community or separate property. Jill bought the motorcycle, a gorgeous BMW R nineT, years before they were married, but Amy bought the cute sidecar that goes with the bike with money she had in her college fund, which her parents created years before the marriage. What should they do? Result: Unfortunately, it looks like the sidecar’s getting divorced from the motorcycle. The motorcycle is Jill’s separate property because she purchased it before the marriage, while the sidecar is Amy’s separate property because she bought it with money she had before the marriage, also known as separate funds.

Visual Aids