🇺🇸

Constitutional Law • Federal Taxation

CONLAW#045

Legal Definition

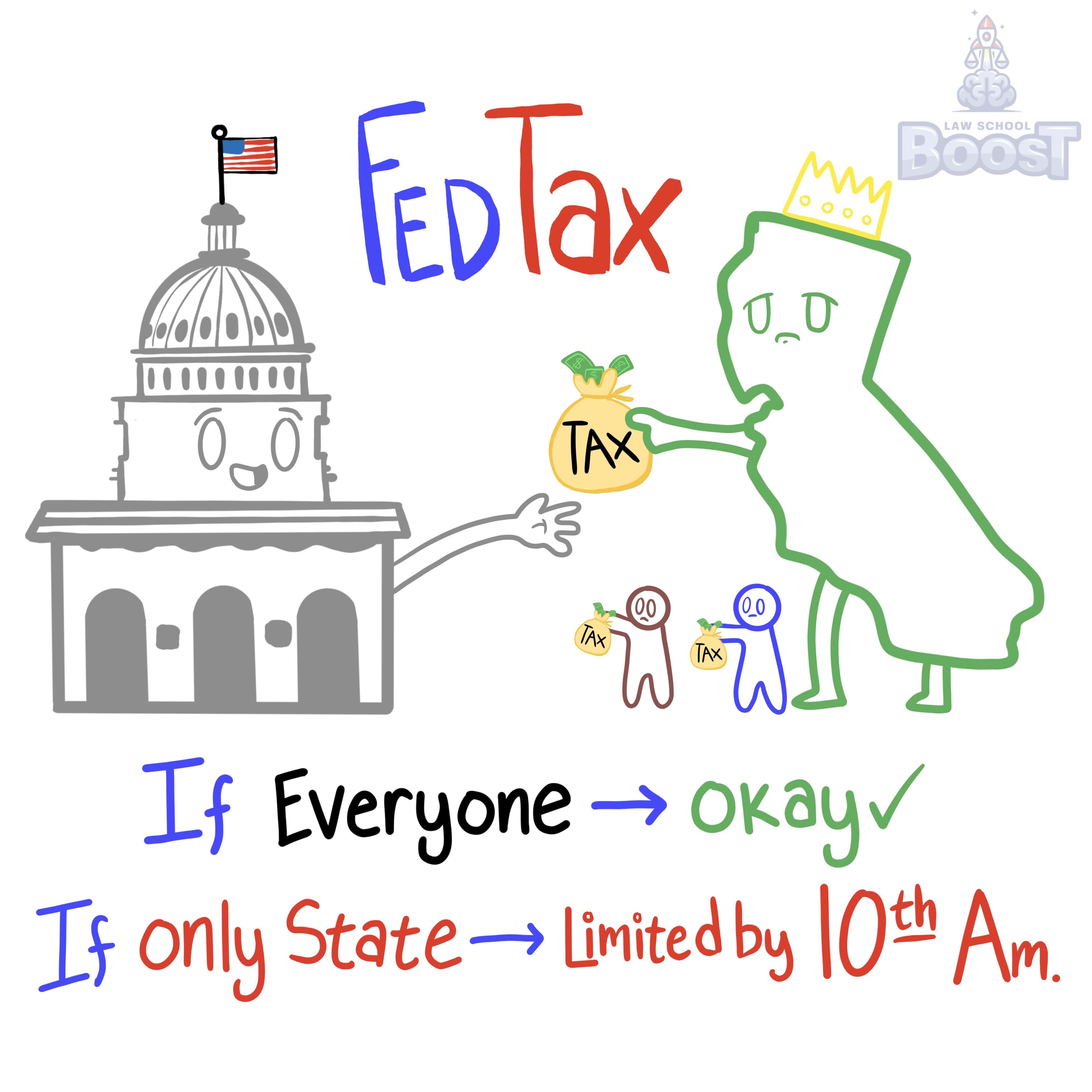

Congress may subject state and local government activities to regulation or taxation if the law or tax applies to both the public and private sectors. A tax applicable to only the state government may be limited by the 10th Amendment. Further, Congress may not coerce or commandeer state governments, but may indirectly regulate states using its Spending Power by imposing conditions on the grant of federal funds.

Plain English Explanation

The U.S. government can make rules or charge taxes that affect both state and local governments and private businesses if the rules or taxes apply to everyone equally. However, a tax that targets only state governments could be stopped by the 10th Amendment. Also, the U.S. government cannot force state governments to follow federal laws directly but can encourage them by offering money with certain conditions attached.

Hypothetical

Hypo 1: The federal government passes a law requiring all employees, including those employed by state governments, to contribute a portion of their salary to a national retirement fund. Bob, a state employee, and his private sector friend, Sam, both see deductions from their salaries as a result of this law. Result: Since the law applies equally to public and private sector employees, it is a valid exercise of the federal government's power to regulate and tax, respecting the balance between federal authority and state autonomy.

Hypo 2: Hypofornia decides to upgrade its computer systems for all state offices. The federal government offers grants to states that upgrade to energy-efficient systems, which indirectly requires states to follow a federal standard for energy efficiency. Hypofornia applies and receives the grant, using it to comply with the energy-efficient upgrade. Result: This scenario demonstrates the federal government using its Spending Power to indirectly influence state behavior by offering financial incentives for following federal guidelines, without directly commanding the state to make the upgrades.

Hypo 3: A new federal law requires all vehicles, including those owned by state and local governments, to meet strict emission standards. Hypofornia and New Hypoland must ensure their official vehicles comply with these standards, just like private citizens' vehicles. Result: This law is a permissible regulation by the federal government because it applies equally to both public and private sector vehicles, aligning with the rule that federal regulations must treat state and private entities the same.

Hypo 2: Hypofornia decides to upgrade its computer systems for all state offices. The federal government offers grants to states that upgrade to energy-efficient systems, which indirectly requires states to follow a federal standard for energy efficiency. Hypofornia applies and receives the grant, using it to comply with the energy-efficient upgrade. Result: This scenario demonstrates the federal government using its Spending Power to indirectly influence state behavior by offering financial incentives for following federal guidelines, without directly commanding the state to make the upgrades.

Hypo 3: A new federal law requires all vehicles, including those owned by state and local governments, to meet strict emission standards. Hypofornia and New Hypoland must ensure their official vehicles comply with these standards, just like private citizens' vehicles. Result: This law is a permissible regulation by the federal government because it applies equally to both public and private sector vehicles, aligning with the rule that federal regulations must treat state and private entities the same.

Visual Aids