‼️

Prof Responsibility • Administrative

PR#047

Legal Definition

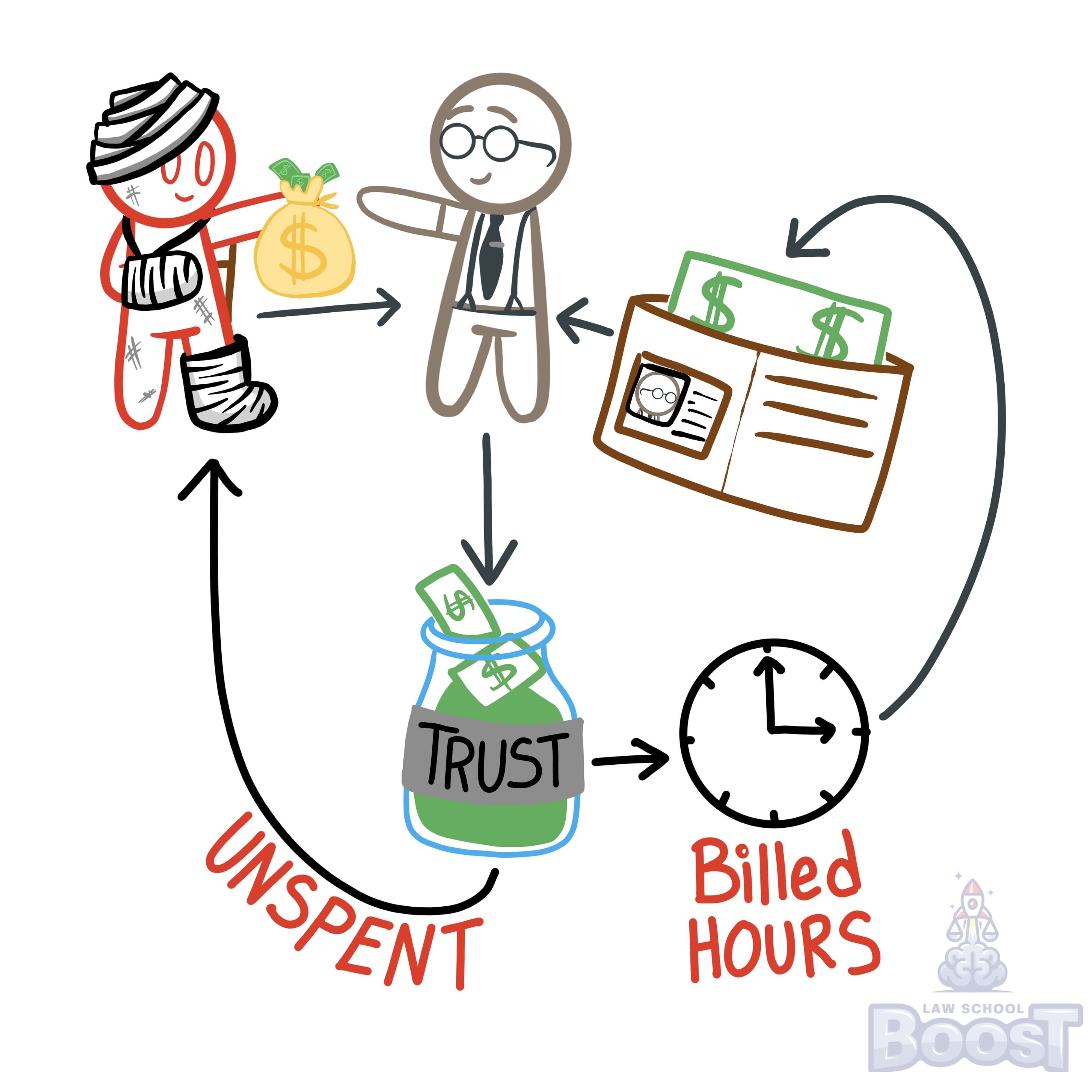

Under Rule 1.15, a lawyer must hold property of clients or third persons separate from the lawyer's own property and must keep client funds in a client trust account. A lawyer must also keep records of client funds and other property, keep the client informed, and deliver such funds or other property to one entitled to receive them.

Plain English Explanation

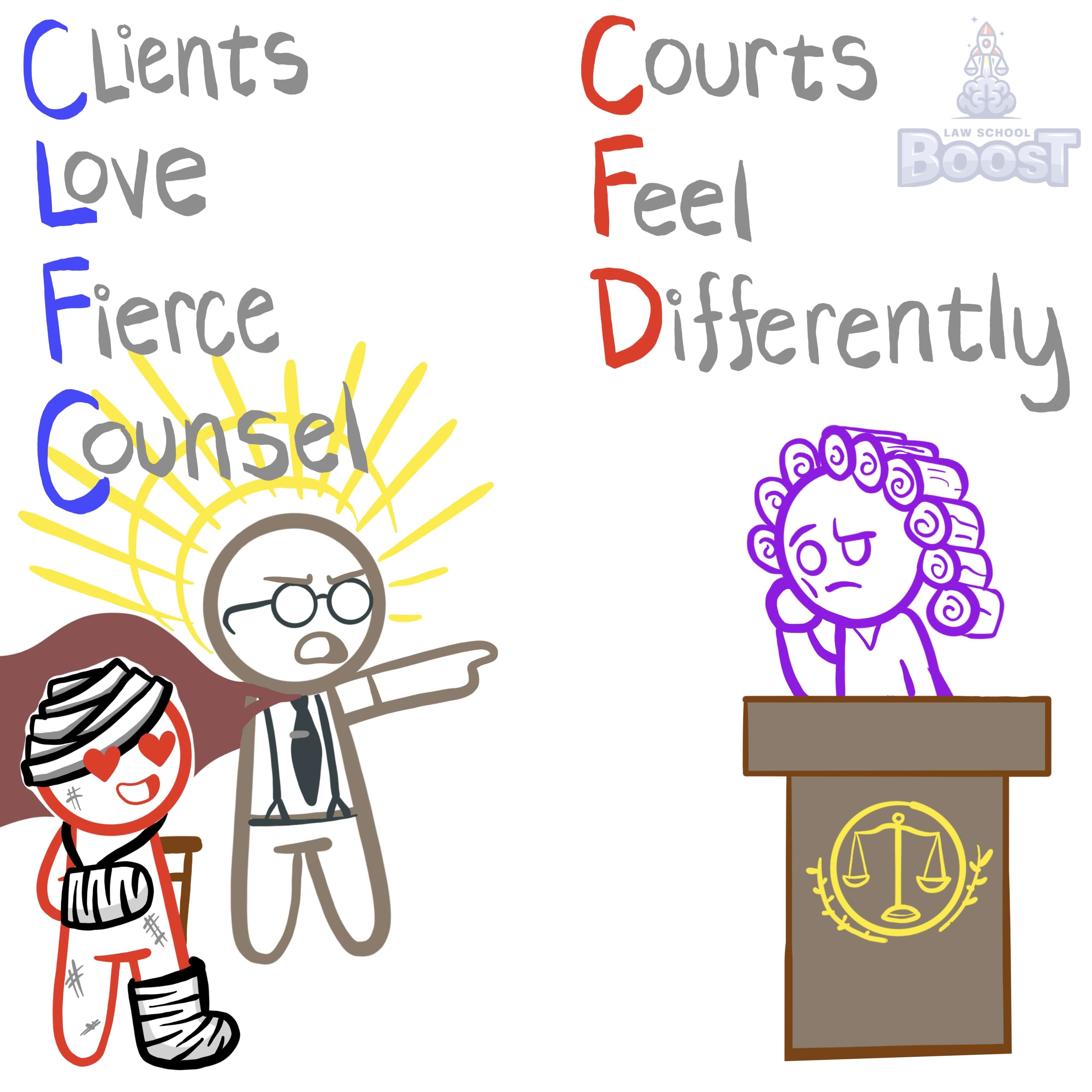

Imagine you're hiring a contractor to remodel your kitchen. You give them a $10,000 deposit for materials. You'd expect the contractor to use that money only for your project, not to pay their personal bills or mix it with their own cash. Lawyers have a similar, but even stricter, responsibility when handling money or property for their clients. In fact, mismanaging client funds is one of the most common situations that results in a lawyer actually losing their license and being disbarred.

This rule exists to protect clients and maintain trust in the legal profession. It ensures that client funds are safe and used only for their intended purpose. By keeping client money separate, it prevents commingling, which could lead to misuse (even if unintentional) or the appearance of impropriety.

The client trust account is like a special safe deposit box at a bank. It's where lawyers must put money that belongs to clients or third parties related to a legal matter. This could include settlement funds, real estate closing proceeds, or retainer fees that haven't been earned yet.

Keeping detailed records is important. If there's ever a dispute or question about client funds, the lawyer can quickly show exactly what came in, what went out, and why. It's like keeping a meticulous check register, but with much higher stakes.

This rule exists to protect clients and maintain trust in the legal profession. It ensures that client funds are safe and used only for their intended purpose. By keeping client money separate, it prevents commingling, which could lead to misuse (even if unintentional) or the appearance of impropriety.

The client trust account is like a special safe deposit box at a bank. It's where lawyers must put money that belongs to clients or third parties related to a legal matter. This could include settlement funds, real estate closing proceeds, or retainer fees that haven't been earned yet.

Keeping detailed records is important. If there's ever a dispute or question about client funds, the lawyer can quickly show exactly what came in, what went out, and why. It's like keeping a meticulous check register, but with much higher stakes.

Hypothetical

Hypo 1: Bob, an attorney, receives a $50,000 settlement check for his client Sam. Instead of depositing it into his client trust account, Bob deposits it into his personal checking account, intending to write Sam a check later. Result: Bob has violated Rule 1.15 by failing to keep client funds separate from his own. Even if Bob plans to pay Sam promptly, depositing client funds into a personal account is a serious violation that could result in disciplinary action.

Hypo 2: Bob receives a $10,000 retainer from Sam for future legal work. Bob immediately deposits the entire amount into his firm's operating account and begins using it for office expenses. Result: Bob has violated Rule 1.15. Retainer fees for future work must be placed in a client trust account until earned. By depositing the retainer into his operating account before earning the fees, Bob has improperly commingled client funds with his own.

Hypo 3: Bob settles a case for Sam and receives a $100,000 check. Bob deposits it into his client trust account and promptly notifies Sam. However, Sam is out of the country for a month, so Bob decides to keep the funds in the trust account until Sam returns. Result: Bob has complied with Rule 1.15. He properly deposited the funds into a client trust account, notified the client, and is holding the funds until he can deliver them to Sam. Keeping the funds safe in the trust account while the client is unavailable is appropriate.

Hypo 2: Bob receives a $10,000 retainer from Sam for future legal work. Bob immediately deposits the entire amount into his firm's operating account and begins using it for office expenses. Result: Bob has violated Rule 1.15. Retainer fees for future work must be placed in a client trust account until earned. By depositing the retainer into his operating account before earning the fees, Bob has improperly commingled client funds with his own.

Hypo 3: Bob settles a case for Sam and receives a $100,000 check. Bob deposits it into his client trust account and promptly notifies Sam. However, Sam is out of the country for a month, so Bob decides to keep the funds in the trust account until Sam returns. Result: Bob has complied with Rule 1.15. He properly deposited the funds into a client trust account, notified the client, and is holding the funds until he can deliver them to Sam. Keeping the funds safe in the trust account while the client is unavailable is appropriate.

Visual Aids

Related Concepts

In California, can an attorney hold a client's materials hostage as leverage to get paid?

In California, how long must a lawyer preserve records of client funds or other property?

What must a lawyer do if some of the property or funds they possess are in dispute with a client?

When there is no longer a dispute about an attorneys fees, what must happen to funds still held in the trust account?