🥺

Trusts • Creation of Trusts

TRUSTS#012

Legal Definition

Often, where a settlor creates an inter vivos trust, they include a provision in their will divising part (or all of) the estate to the trustee of a trust.

Plain English Explanation

As you've learned in other cards, trusts are an efficient way to manage access and ownership of assets by packing them into a "trust" and then deciding who gets to use them. In other words, think of a trust as a little red wagon that you pull behind you. You can put all sorts of stuff into your wagon. Real estate, cars, baseball cards, just about anything you want. When you die, rather than the court having to figure out who gets each individual item, you can designate who gets to pick up the handle to the wagon and pull it next. It's a super efficient way to handle transitioning assets between parties.

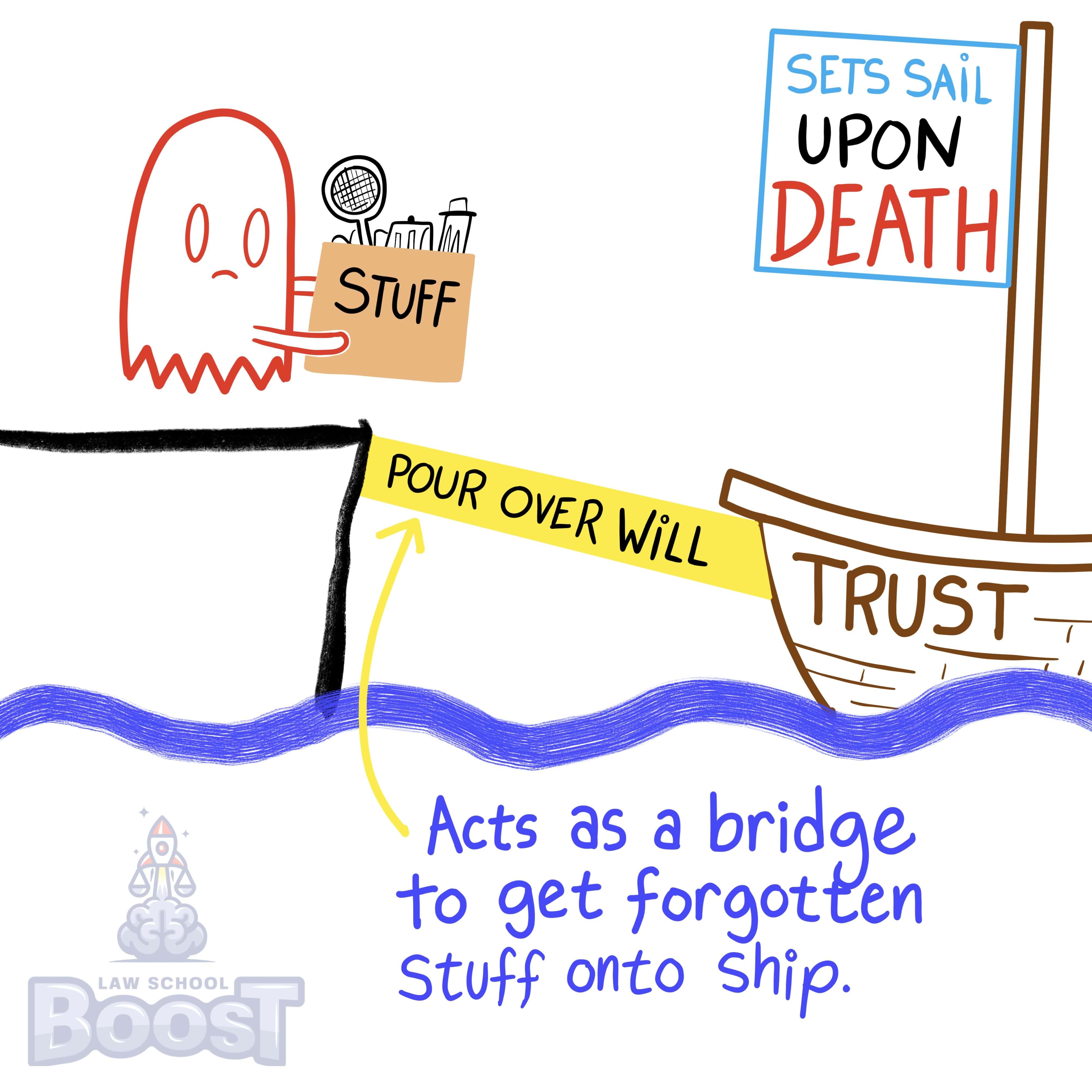

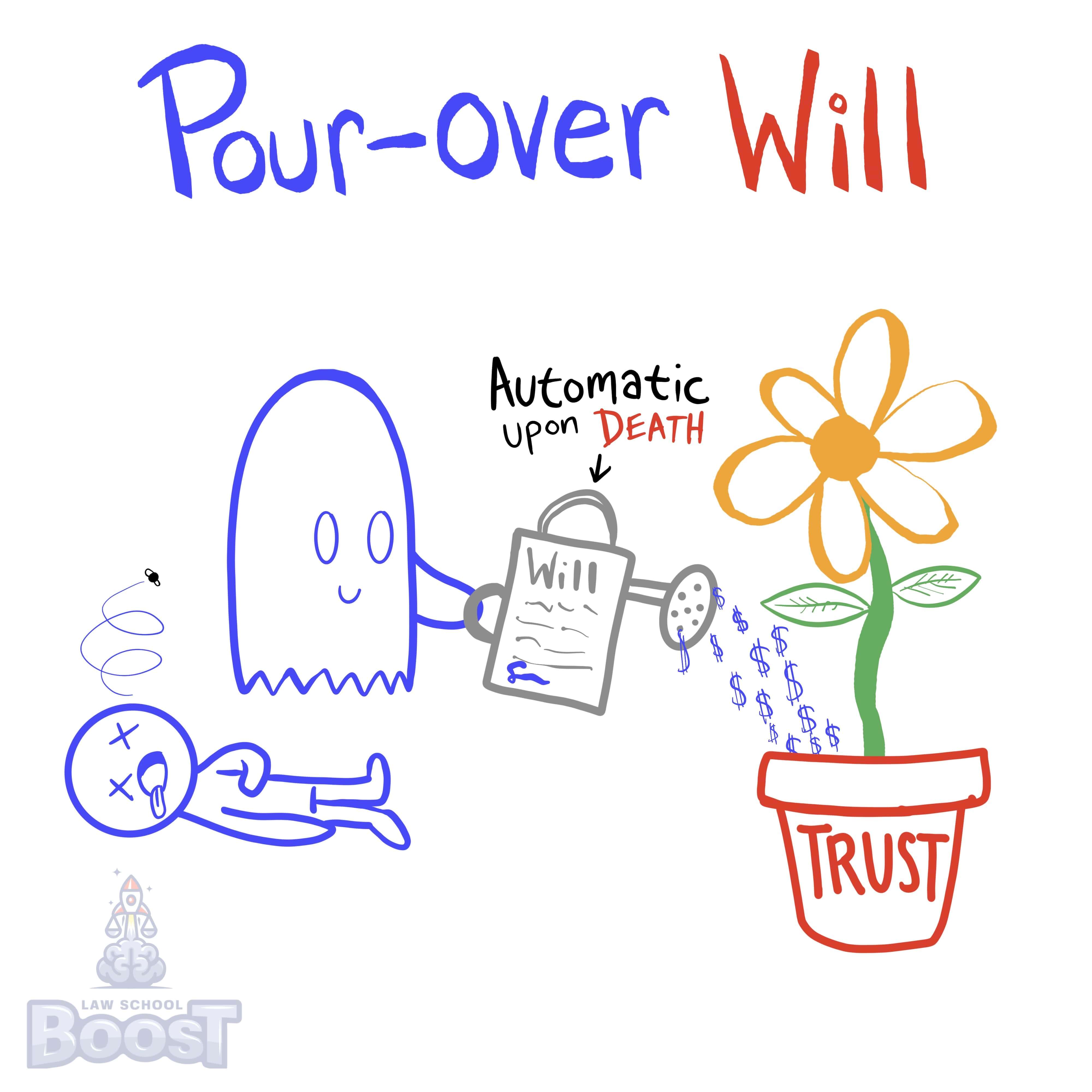

In general, trusts require their creators to identify which property go into them. So if something isn't placed into the trust, then it is not considered to be inside of it. With this in mind, a pour-over will is a legal document where, upon the testator's death, their property is automatically transferred into a trust that was already created. It's sort of a fail-safe.

/In other words, a pour-over will ensures property that is not "titled into a decedent's trust" (at the time of their death) is put into the trust via probate. It's a catch-all document used in conjunction with a trust established during the decedent's lifetime.

In general, trusts require their creators to identify which property go into them. So if something isn't placed into the trust, then it is not considered to be inside of it. With this in mind, a pour-over will is a legal document where, upon the testator's death, their property is automatically transferred into a trust that was already created. It's sort of a fail-safe.

/In other words, a pour-over will ensures property that is not "titled into a decedent's trust" (at the time of their death) is put into the trust via probate. It's a catch-all document used in conjunction with a trust established during the decedent's lifetime.

Hypothetical

Hypo 1: Bob creates a trust and places his house, car, and coin collection inside it. In his will, Bob includes a pour-over provision stating that any other property he owns should be transferred to the trust. When Bob dies, he has a stash of antique books not included in the original trust. Result: The pour-over clause in Bob's will operates to transfer the antique books into the existing trust through probate.

Hypo 2: Sam creates a trust with his primary residence and brokerage account. His will contains a pour-over provision transferring any other property into the trust at death. When Sam dies, he owns a classic car not included in the original trust. Result: Through the pour-over clause, the classic car will be added to Sam's trust through probate.

Hypo 3: Bob creates a trust but does not have a pour-over will. He acquires new assets after setting up the trust but forgets to include them. Result: In this case, the assets Bob acquired and forgot to include in the trust cannot be added posthumously (after he dies), as there is no pour-over will to cover these assets. They will have to go through the normal probate process, which might result in a distribution that differs from Bob's intentions.

Hypo 2: Sam creates a trust with his primary residence and brokerage account. His will contains a pour-over provision transferring any other property into the trust at death. When Sam dies, he owns a classic car not included in the original trust. Result: Through the pour-over clause, the classic car will be added to Sam's trust through probate.

Hypo 3: Bob creates a trust but does not have a pour-over will. He acquires new assets after setting up the trust but forgets to include them. Result: In this case, the assets Bob acquired and forgot to include in the trust cannot be added posthumously (after he dies), as there is no pour-over will to cover these assets. They will have to go through the normal probate process, which might result in a distribution that differs from Bob's intentions.

Visual Aids