🥺

Trusts • Will Alternatives

TRUSTS#014

Legal Definition

A Totten trust is a tentative bank account trust wherein the named beneficiary takes whatever is left in the account at the death of the owner of the account. The depositor-trustee owns the account during their lifetime and owes the beneficiary no fiduciary duties (since it is not a proper trust).

The Totten account typically reads "X as trustee for Y," and can be elevated to a proper trust if there is sufficient manifestation of trust intent (e.g., telling the beneficiary that a trust has been created for them).

The Totten account typically reads "X as trustee for Y," and can be elevated to a proper trust if there is sufficient manifestation of trust intent (e.g., telling the beneficiary that a trust has been created for them).

Plain English Explanation

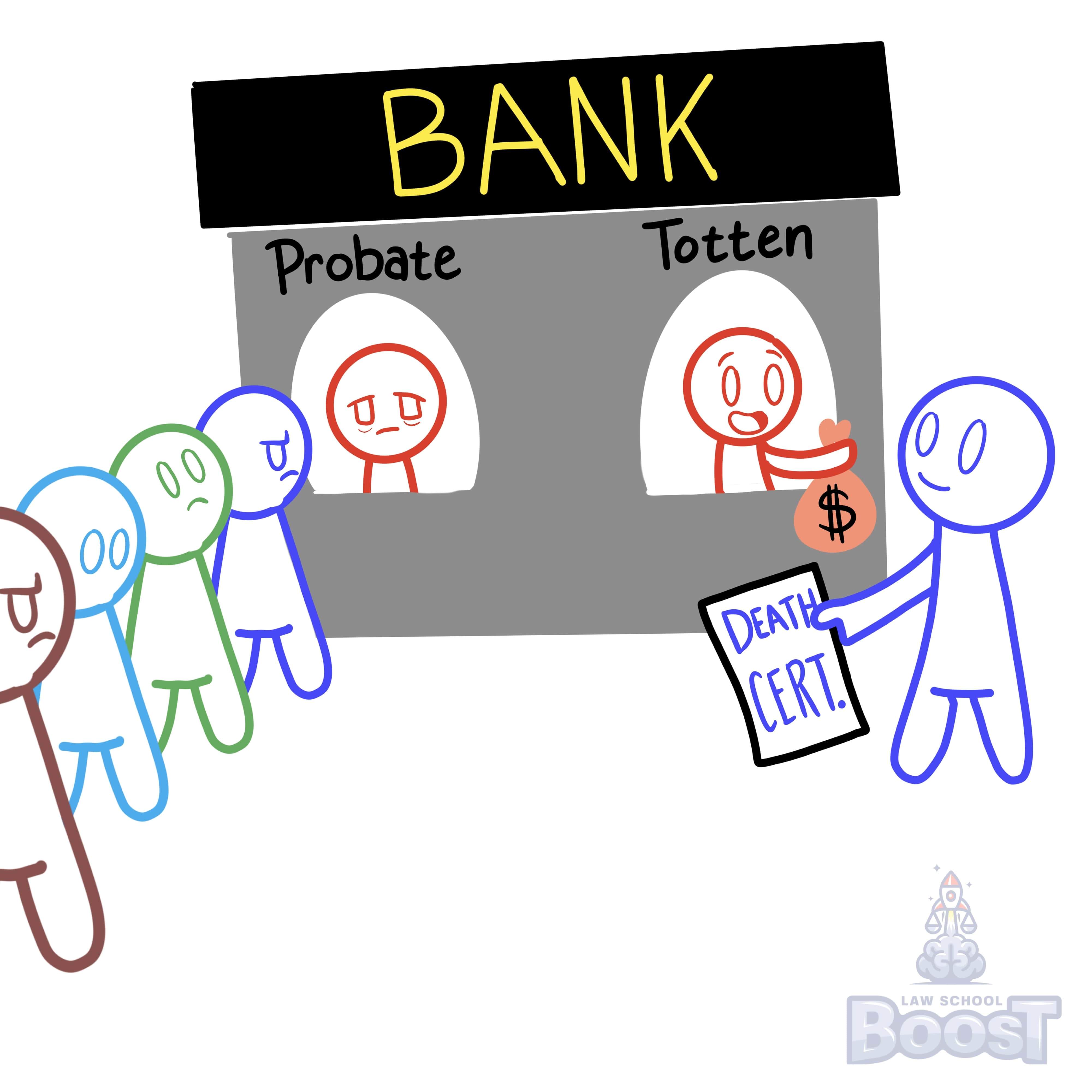

Totten trusts are sort of a lazy loophole to avoid probate by creating a bank account that passes to a specific person upon the account holder's death. These used to not be allowed because they tried to act like wills without the required formalities, but a case in 1904 called In re Totten held that they were allowable. As a result, they have become more common over the years and better known as "payable-on-death" (POD) bank accounts.

Totten trusts function pretty simple. A person basically creates a POD bank account and names a beneficiary. That person is free to put money into that bank account, take money out, or change the beneficiary at any time before their death. The moment they die, the beneficiary can bring proof of their death (via a death certificate) to the bank, and the bank will simply transfer funds over to them without the need of consulting an executor or going through probate.

Totten trusts function pretty simple. A person basically creates a POD bank account and names a beneficiary. That person is free to put money into that bank account, take money out, or change the beneficiary at any time before their death. The moment they die, the beneficiary can bring proof of their death (via a death certificate) to the bank, and the bank will simply transfer funds over to them without the need of consulting an executor or going through probate.

Hypothetical

Hypo 1: Bob opens a bank account and names Sam as the beneficiary, saying, "Sam, this account is for you when I'm gone." Bob uses the account normally, adding and withdrawing money. When Bob passes away, Sam brings Bob's death certificate to the bank and is given the remaining funds in the account. Result: The Totten trust here ensures that Sam easily receives the money left in the account without needing a will or going through probate.

Hypo 2: Bob creates a POD account for his son, Timmy. He occasionally deposits money into it as a gift. One day, Bob decides to change the beneficiary to his friend Sam instead, without telling Timmy. After Bob's death, Sam presents the death certificate and receives the funds. Result: In this case, the flexibility of the Totten trust allows Bob to change the beneficiary at any time before his death, and Sam legally receives the funds.

Hypo 3: Bob tells Sam he has set up a bank account for his education and will leave money in it. He never officially names him as a beneficiary. When Bob dies, the money in the account goes through probate and is not directly given to Sam. Result: Since Bob didn't formally create a Totten trust by naming Sam as a beneficiary on the account, the rule doesn't apply, and the money is subject to probate.

Hypo 2: Bob creates a POD account for his son, Timmy. He occasionally deposits money into it as a gift. One day, Bob decides to change the beneficiary to his friend Sam instead, without telling Timmy. After Bob's death, Sam presents the death certificate and receives the funds. Result: In this case, the flexibility of the Totten trust allows Bob to change the beneficiary at any time before his death, and Sam legally receives the funds.

Hypo 3: Bob tells Sam he has set up a bank account for his education and will leave money in it. He never officially names him as a beneficiary. When Bob dies, the money in the account goes through probate and is not directly given to Sam. Result: Since Bob didn't formally create a Totten trust by naming Sam as a beneficiary on the account, the rule doesn't apply, and the money is subject to probate.

Visual Aids