😭

Wills • Classification of Gifts

WILLS#036

Legal Definition

Whether stock is general or specific depends on the language used. In most cases, it is general unless the testator says "my shares" of some particular stock, or unless the stock is a small, closely held corporation not traded on a national exchange, in which case it is specific. Under the modern trend, increases (such as stock splits) are allocated entirely to the beneficiary of the asset, if at the time of the execution of the will the testator owned the asset.

Plain English Explanation

Stock can be weird. If you owned 1 share of Apple stock on June 8, 2014, when you woke up the next day, you would have had 7 shares. Why? Because one June 9, 2014, Apple did a "7-to-1 split." In other words, Apple took every single share of its stock and divided them into 7 separate shares. Companies do this for a lot of reasons, the main reason being to reduce the price of the shares on the market. In other words, if you own a single share of stock worth $1,000, it may make people feel like it's too expensive to buy-in. To increase the market's willingness to buy shares, a company may split their shares and do, for example, a 10-to-1 split. This would take 1 share worth $1,000 and turn it into 10 shares worth $100 that, together, equal $1,000. Now someone can buy a share for $100 while the people who already owned shares still hold the same value.

So what does this have to do with wills? Well, things can get tricky when Bob leaves Sam "1 share of Apple" in his will, but, prior to Bob dying, there is a stock split and 1 share becomes 7. Should Sam get all 7 shares even though the will only said he gets 1? Or should Sam get only 1 share, even though it is only worth 1/7th the value that Bob may have intended.

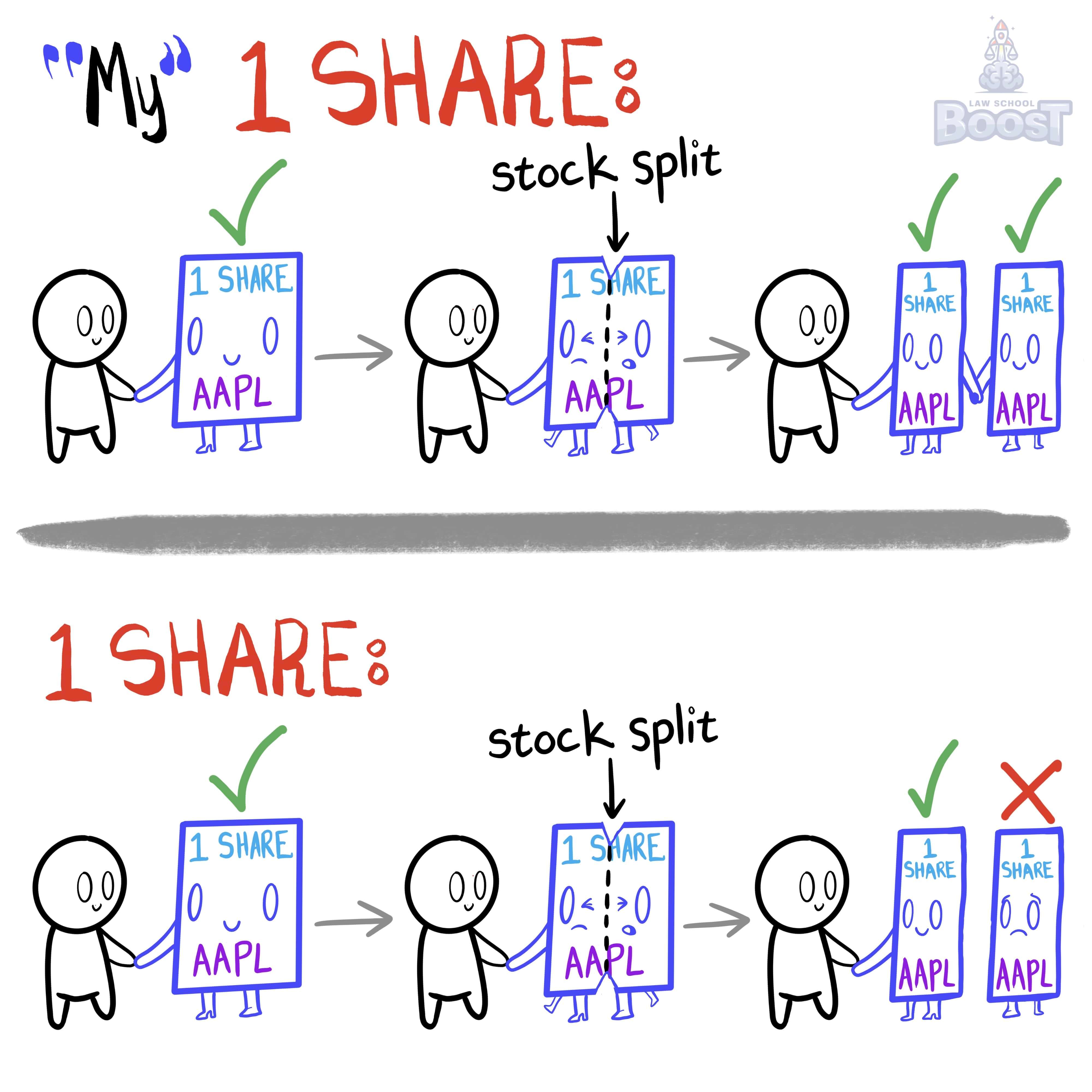

Generally, this is solved by figuring out if the stock was considered a general legacy or a specific legacy. If it was a general legacy, then the beneficiary will only receive whatever number of shares was identified in the will, regardless of splits. If it was a specific legacy, the beneficiary will own all of the shares, even if there was a split. You can usually figure out if it was specific because it will use the word "my" in front of the bequest. Using the above example, "I leave 1 share of Apple to Sam" is a general legacy, while "I leave my 1 share of Apple to Sam" or "I leave my shares of Apple to Sam" would be specific.

So what does this have to do with wills? Well, things can get tricky when Bob leaves Sam "1 share of Apple" in his will, but, prior to Bob dying, there is a stock split and 1 share becomes 7. Should Sam get all 7 shares even though the will only said he gets 1? Or should Sam get only 1 share, even though it is only worth 1/7th the value that Bob may have intended.

Generally, this is solved by figuring out if the stock was considered a general legacy or a specific legacy. If it was a general legacy, then the beneficiary will only receive whatever number of shares was identified in the will, regardless of splits. If it was a specific legacy, the beneficiary will own all of the shares, even if there was a split. You can usually figure out if it was specific because it will use the word "my" in front of the bequest. Using the above example, "I leave 1 share of Apple to Sam" is a general legacy, while "I leave my 1 share of Apple to Sam" or "I leave my shares of Apple to Sam" would be specific.

Hypothetical

Hypo 1: Bob writes a will leaving "50 shares of XYZ Corporation" to Sam. XYZ Corporation then undergoes a 2-for-1 stock split. Result: Since Bob's will mentioned a specific number of shares without indicating they were his, it's a general legacy. Sam is entitled to 50 shares post-split, even though each share is now half the value it was when Bob wrote the will.

Hypo 2: Bob's will states, "I leave my 100 shares of ABC Inc. to Sam." ABC Inc. is a small company and the shares are not traded on a national exchange. After the will, ABC Inc. undergoes a 3-for-1 stock split. Result: Because Bob referred to the shares as "my 100 shares" and the company is closely held, it's a specific legacy. Sam will inherit all 300 shares post-split, maintaining the full value of Bob's original holding.

Hypo 2: Bob's will states, "I leave my 100 shares of ABC Inc. to Sam." ABC Inc. is a small company and the shares are not traded on a national exchange. After the will, ABC Inc. undergoes a 3-for-1 stock split. Result: Because Bob referred to the shares as "my 100 shares" and the company is closely held, it's a specific legacy. Sam will inherit all 300 shares post-split, maintaining the full value of Bob's original holding.

Visual Aids