😭

Wills • Intestate Succession

WILLS#043

Legal Definition

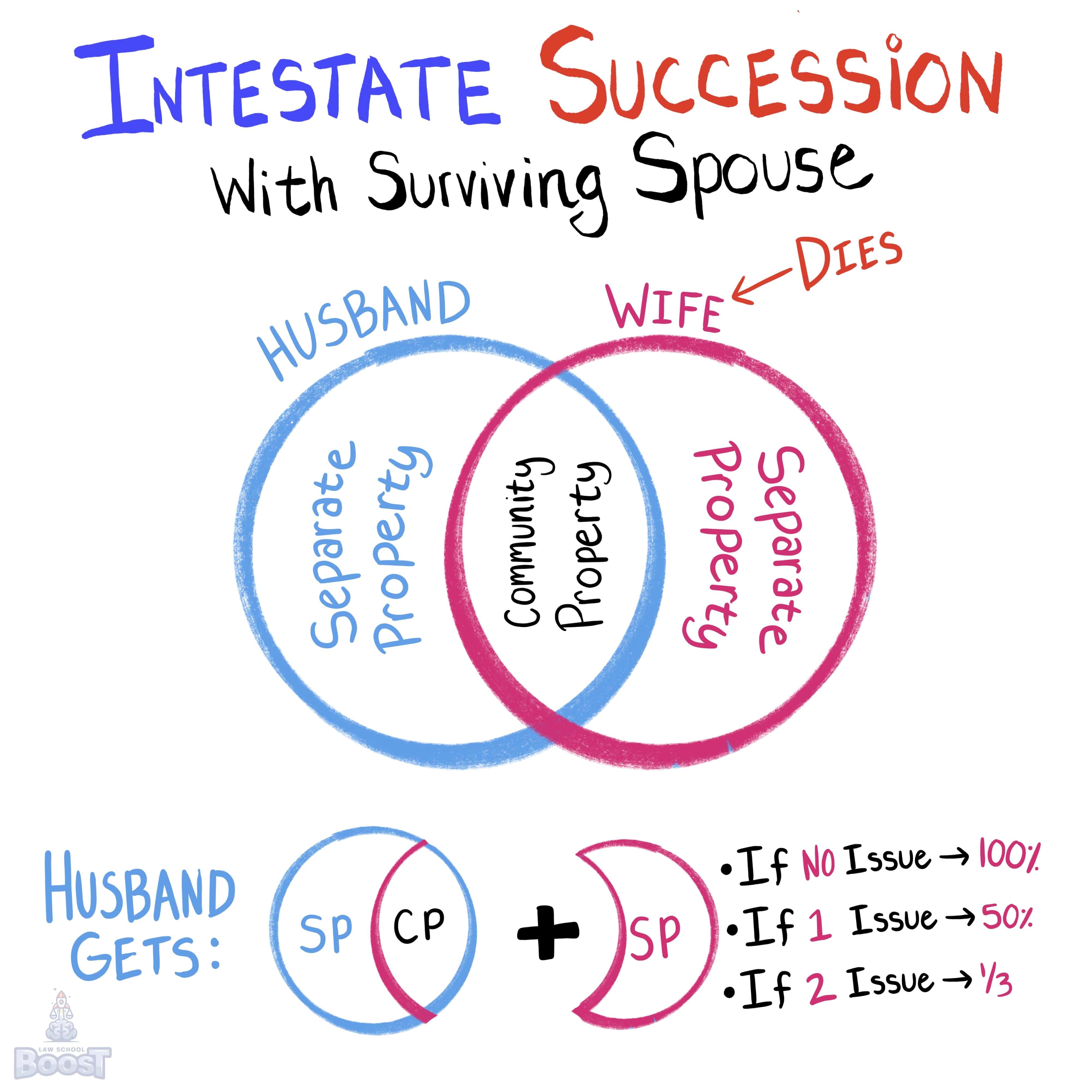

A surviving spouse takes their own half of the community property as well as the decedent's half of the community property and quasi-community property. If the decedent leaves no issue, parent, sibling, or issue of a deceased sibling (i.e., nieces and nephews, etc.), the spouse also takes the decedent's separate property.

If the decedent leaves one child, one issue of a deceased child, or no children but a parent or issue of a parent, the spouse takes half the decedent's separate property. If the decedent leaves more than one child, one child and the issue of the deceased child, or two or more issue of a deceased child, the spouse takes one-third the decedent's separate property.

If the decedent leaves one child, one issue of a deceased child, or no children but a parent or issue of a parent, the spouse takes half the decedent's separate property. If the decedent leaves more than one child, one child and the issue of the deceased child, or two or more issue of a deceased child, the spouse takes one-third the decedent's separate property.

Plain English Explanation

First, let's set up some base facts that we can add to in different scenarios: Imagine if Bob and Amy were married in California and all they owned together was a bank account with $10,000 in it, and each of them had 30 Bitcoins that they bought before marriage. Neither Bob or Amy have a will. One day, Bob is hit by a meteor and dies.

Scenario 1: Bob and Amy had no kids, and Bob has no living blood relatives. In this scenario, Amy gets everything. All $10,000 in community property, and all 30 of Bob's Bitcoins.

Scenario 2: Bob and Amy have 1 child. Amy still gets all $10,000, but she must split the 30 Bitcoins with the child (Amy gets 15, and the child gets 15). This is also what would happen if (a) Bob had living blood relatives (parents, siblings, etc.), or (b) if Bob and Amy had one grandchild, but that child's parent was dead. In other words, the law puts a preference on creating a split in separate property for either a single child or grandchild, or any single or group of blood relatives.

Scenario 3: Bob and Amy have 2 children. In this scenario, Amy still gets the $10,000, but she only gets one-third of the Bitcoins. The remaining two-thirds are split among the children. Note that this is true no matter how many children Bob and Amy have. As you saw in Scenario 1, a single child gets 50%, but once there are 2 or more children, the children will always split two-thirds of the separate property. Thus, if Bob and Amy had 5 children, Amy still gets 10 Bitcoins (1/3 of 30), and the 5 children will split 20 Bitcoins evenly. Note that this also applies if there are no living children, but there are two or more grandchildren.

So what can we take from this in general? Community property will always be absorbed by the community spouse or partner. But separate property that passes without a will will be shared with people directly related to the dead person. The law prefers those people to be down the family tree (i.e., children and grandchildren), but where that doesn't apply, the law will look up the family tree (i.e., parents, siblings, etc.).

Scenario 1: Bob and Amy had no kids, and Bob has no living blood relatives. In this scenario, Amy gets everything. All $10,000 in community property, and all 30 of Bob's Bitcoins.

Scenario 2: Bob and Amy have 1 child. Amy still gets all $10,000, but she must split the 30 Bitcoins with the child (Amy gets 15, and the child gets 15). This is also what would happen if (a) Bob had living blood relatives (parents, siblings, etc.), or (b) if Bob and Amy had one grandchild, but that child's parent was dead. In other words, the law puts a preference on creating a split in separate property for either a single child or grandchild, or any single or group of blood relatives.

Scenario 3: Bob and Amy have 2 children. In this scenario, Amy still gets the $10,000, but she only gets one-third of the Bitcoins. The remaining two-thirds are split among the children. Note that this is true no matter how many children Bob and Amy have. As you saw in Scenario 1, a single child gets 50%, but once there are 2 or more children, the children will always split two-thirds of the separate property. Thus, if Bob and Amy had 5 children, Amy still gets 10 Bitcoins (1/3 of 30), and the 5 children will split 20 Bitcoins evenly. Note that this also applies if there are no living children, but there are two or more grandchildren.

So what can we take from this in general? Community property will always be absorbed by the community spouse or partner. But separate property that passes without a will will be shared with people directly related to the dead person. The law prefers those people to be down the family tree (i.e., children and grandchildren), but where that doesn't apply, the law will look up the family tree (i.e., parents, siblings, etc.).

Visual Aids