😭

Wills • Probate and Estate Administration

WILLS#050

Legal Definition

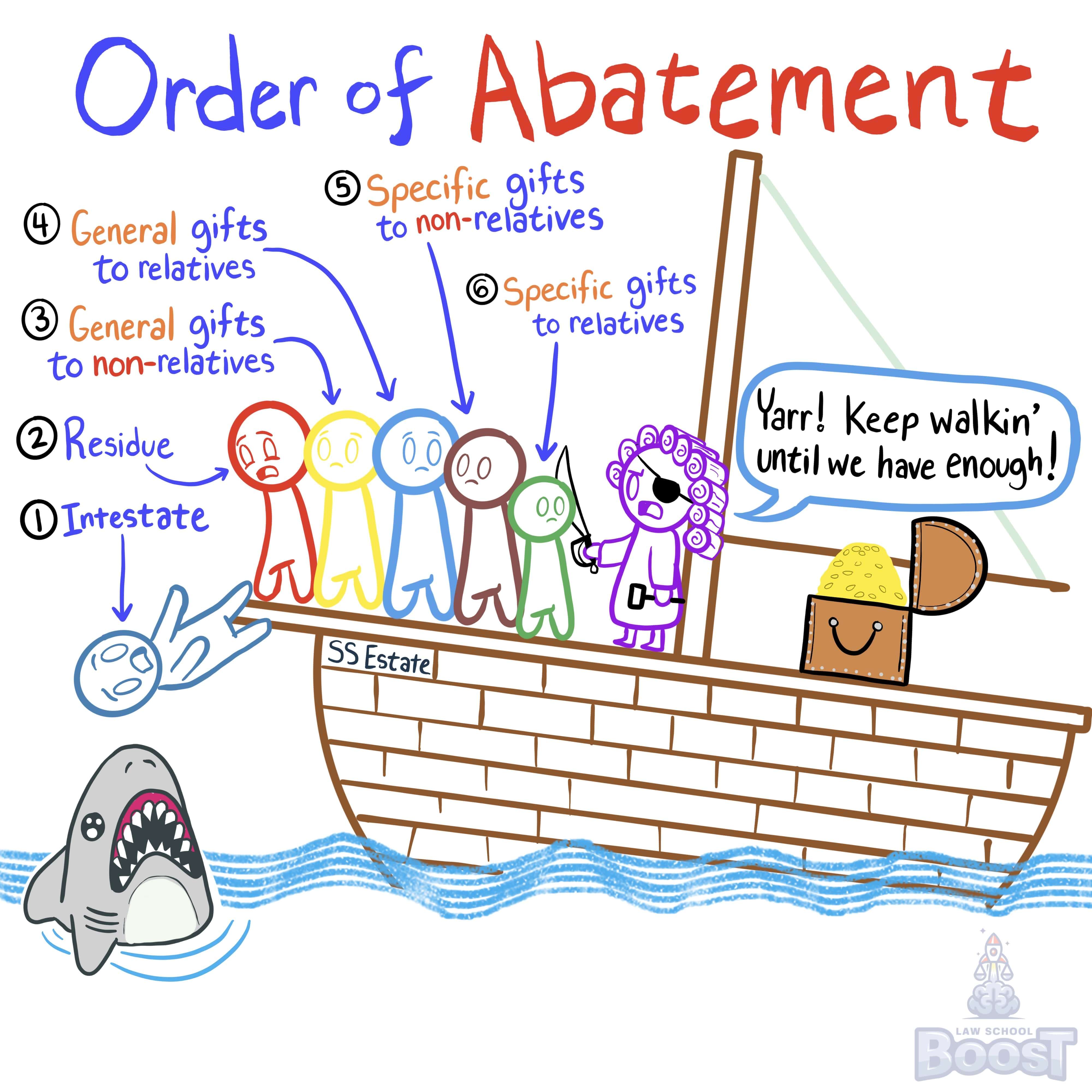

Abatement is the process by which certain gifts are decreased if there is a need to pay an additional share (e.g., to a pretermitted child) or where estate assets are not sufficient to pay all claims against the estate. The abatement order is as follows:

(1) intestate, (2) residue, (3) general gifts to non-relatives; (4) general gifts to relatives; (5) specific gifts to non-relatives; (6) specific gifts to relatives.

(1) intestate, (2) residue, (3) general gifts to non-relatives; (4) general gifts to relatives; (5) specific gifts to non-relatives; (6) specific gifts to relatives.

Plain English Explanation

A dead person's estate can not distribute more assets than what the dead person actually owned when they died. In other words, if someone creates a will that tries to distribute $1,000,000 worth of stuff to friends and family, but, upon death, they only have $1,000 in assets available, the court will have to figure out who actually gets what. To do this, they follow an "abatement order," which is sort of like a list of people and gifts that are less important and, thus, more likely to be ignored.

In other words, it's like you were trying to plan a vacation and budgeted every dollar of your trip then, before you start your vacation, you realize that you lost $100. Suddenly you have $100 less dollars, so how do you decide which part of your budget to pull it from? There are likely less important things than others. For example, you definitely need your airline tickets, so you can't really cut back there. However, if you budgeted $300 for eating out, then perhaps you only spend $200 on eating out now. In this example, "eating out" has been abated.

The court acts similarly when an estate has budgeted more for gifts than it actually has to fund them. It has to figure out which gifts to which people are less important than others, then reduce them (or deny them) to make sure that the most important gifts can be made. Let's walk through that order:

(1) The least important level are gifts that would have gone to people through intestacy. This should make sense because intestacy is basically the default option for when people weren't planned for, thus, they should be the first to get nothing (or less) if there isn't enough in the estate.

(2) Next, if there aren't enough assets after denying intestacy gifts, then we look at people who were getting gifts via the "residue." The "residue" is the leftovers of an estate. For example, sometimes a dead person will say "I leave $10,000 to Bob, $1,000 to Sam, and the rest to Amy." In this example, Amy is receiving a residuary gift.

(3) Next, if there aren't enough assets after denying residuary gifts, then we look for general gifts that were made to non-relatives.

(4) If that isn't enough still, we look for general gifts made to relatives.

(5) If we still don't have enough assets, we may have to liquidate or sell off some specific gifts made to non-relatives.

(6) Finally, if there still isn't enough, then the court will look to sell specific gifts made to relatives.

In other words, it's like you were trying to plan a vacation and budgeted every dollar of your trip then, before you start your vacation, you realize that you lost $100. Suddenly you have $100 less dollars, so how do you decide which part of your budget to pull it from? There are likely less important things than others. For example, you definitely need your airline tickets, so you can't really cut back there. However, if you budgeted $300 for eating out, then perhaps you only spend $200 on eating out now. In this example, "eating out" has been abated.

The court acts similarly when an estate has budgeted more for gifts than it actually has to fund them. It has to figure out which gifts to which people are less important than others, then reduce them (or deny them) to make sure that the most important gifts can be made. Let's walk through that order:

(1) The least important level are gifts that would have gone to people through intestacy. This should make sense because intestacy is basically the default option for when people weren't planned for, thus, they should be the first to get nothing (or less) if there isn't enough in the estate.

(2) Next, if there aren't enough assets after denying intestacy gifts, then we look at people who were getting gifts via the "residue." The "residue" is the leftovers of an estate. For example, sometimes a dead person will say "I leave $10,000 to Bob, $1,000 to Sam, and the rest to Amy." In this example, Amy is receiving a residuary gift.

(3) Next, if there aren't enough assets after denying residuary gifts, then we look for general gifts that were made to non-relatives.

(4) If that isn't enough still, we look for general gifts made to relatives.

(5) If we still don't have enough assets, we may have to liquidate or sell off some specific gifts made to non-relatives.

(6) Finally, if there still isn't enough, then the court will look to sell specific gifts made to relatives.

Hypothetical

Hypo 1: Bob has two sons named Timmy and Junior. Bob creates a will that provides the following gifts: Timmy gets Bob's antique Rolex watch; Sam, Bob's friend, get's Bob's motorcycle; Amy, Bob's friend, gets $10,000; Junior gets $10,000; and Carl, Bob's friend, gets "the rest." One day, Bob decides to get super drunk and drives a rental car the wrong way on the highway, smashing into an oncoming car, killing himself and severely injuring the other driver. The injured driver wins a lawsuit against Bob's estate and receives $200,000 in damages. When Bob died, his estate was worth $210,000. Result: Carl received a "residuary gift," which would have been worth quite a lot. Now, however, Carl gets nothing since the money is needed to pay off the lawsuit. However, even after you take away Carl's gift, there still isn't quite enough to pay $200,000 in damages. Next, the court will take Amy's $10,000 gift, since she received a general gift and is not related to Bob. After that, if more money is required to pay off the lawsuit, the court will go after the $10,000 gift to Junior. If more money is required to cover the lawsuit and attorneys fees and such, next up in the crosshairs is the motorcycle Bob left to Sam. The motorcycle will be liquidated (sold for cash). Lastly, if there is still a need for money, the court will liquidate Bob's antique Rolex watch.

Visual Aids