🇺🇸

Constitutional Law • Congressional Authority to Act

CONLAW#019

Legal Definition

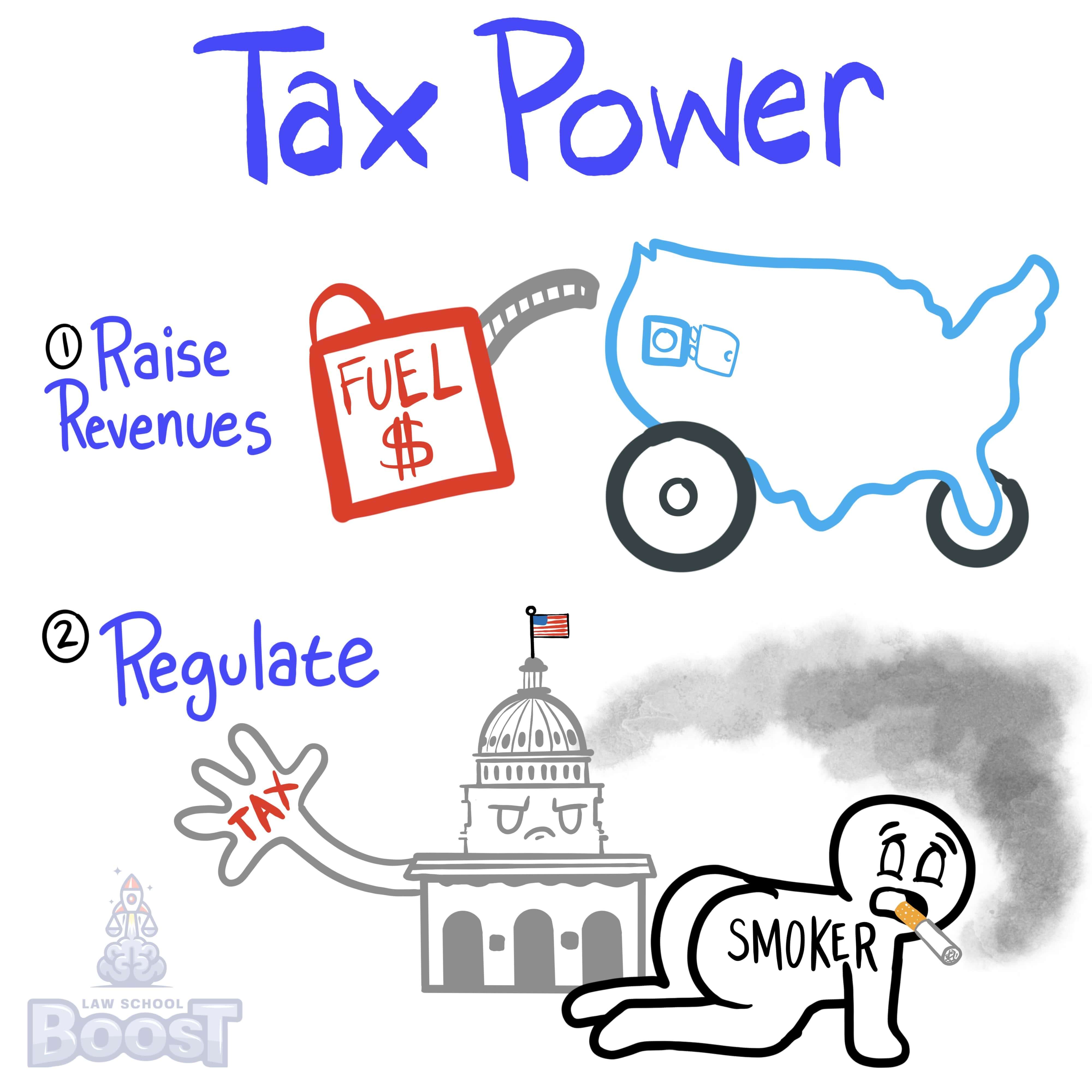

Congress may use its Taxing Power to levy any tax (1) reasonably related to raising revenue, or (2) where Congress has the power to regulate the activity taxed.

Plain English Explanation

The Constitution gives Congress the power to tax. Congress can use taxation for two main purposes:

(1) To raise revenue - Congress can impose any tax that is reasonably designed to raise money to fund the government. For example, income taxes, corporate taxes, estate taxes, etc.

(2) To regulate - Congress can tax things it has the power to regulate under the Constitution even if the tax doesn't raise much money. For instance, Congress can tax cigarettes very heavily to discourage smoking, or tax environmental polluters. The tax is being used more as a "stick" for regulation.

The rule allows taxation for money but prevents Congress from imposing unfair or arbitrary taxes. Congress cannot tax simply to punish people or groups it doesn't like. Any tax must be reasonably related to raising funds for government operations or regulating an area Congress has power over like interstate commerce. This restricts abusive taxation while giving Congress flexibility to tailor taxes for regulatory goals.

(1) To raise revenue - Congress can impose any tax that is reasonably designed to raise money to fund the government. For example, income taxes, corporate taxes, estate taxes, etc.

(2) To regulate - Congress can tax things it has the power to regulate under the Constitution even if the tax doesn't raise much money. For instance, Congress can tax cigarettes very heavily to discourage smoking, or tax environmental polluters. The tax is being used more as a "stick" for regulation.

The rule allows taxation for money but prevents Congress from imposing unfair or arbitrary taxes. Congress cannot tax simply to punish people or groups it doesn't like. Any tax must be reasonably related to raising funds for government operations or regulating an area Congress has power over like interstate commerce. This restricts abusive taxation while giving Congress flexibility to tailor taxes for regulatory goals.

Hypothetical

Hypo 1: Bob runs a company that makes sugary drinks. To encourage healthier eating habits, Congress passes a law that places a tax on all sugary drinks. Bob's company now has to pay extra taxes because of the sugar in their drinks. Result: This is an example of Congress using its taxing power to regulate an activity, sugary drink consumption, by making it more expensive, which could lead people to choose healthier options.

Hypo 2: Congress decides it needs more money to improve the country's schools. It passes a new tax that everyone pays when they file their annual taxes. Sam, a teacher, notices a slight increase in the taxes he pays, but he also sees improvements in the school where he works. Result: Here, Congress used its taxing power properly to raise revenue that directly contributes to funding education.

Hypo 3: Bob starts a business that sells products made from recycled materials. To promote recycling, Congress passes a law that reduces taxes for businesses like Bob's. Result: This scenario shows Congress indirectly regulating activities by properly offering tax incentives for positive actions, like recycling, to encourage more businesses to follow suit.

Hypo 4: Sam decides to buy a fuel-efficient electric vehicle. Congress has passed a law that offers tax credits to electric vehicle buyers to promote greener transportation options. Result: This is another example of Congress using its taxing power to regulate behavior, this time by encouraging the purchase of electric vehicles through tax benefits.

Hypo 2: Congress decides it needs more money to improve the country's schools. It passes a new tax that everyone pays when they file their annual taxes. Sam, a teacher, notices a slight increase in the taxes he pays, but he also sees improvements in the school where he works. Result: Here, Congress used its taxing power properly to raise revenue that directly contributes to funding education.

Hypo 3: Bob starts a business that sells products made from recycled materials. To promote recycling, Congress passes a law that reduces taxes for businesses like Bob's. Result: This scenario shows Congress indirectly regulating activities by properly offering tax incentives for positive actions, like recycling, to encourage more businesses to follow suit.

Hypo 4: Sam decides to buy a fuel-efficient electric vehicle. Congress has passed a law that offers tax credits to electric vehicle buyers to promote greener transportation options. Result: This is another example of Congress using its taxing power to regulate behavior, this time by encouraging the purchase of electric vehicles through tax benefits.

Visual Aids

Related Concepts

May Congress prohibit harmful commercial activities?

Under Lopez, when may Congress regulate commerce?

What are the Constitutional limitations on Congress' authority to act?

What are the Constitutional limitations on federal police power?

What is the effect of the 10th Amendment on Congress?

What is the effect of the Anti-Commandeering Doctrine of the 10th Amendment?

What is the impact of the necessary and proper clause?

What is the importance of Section 5 of the 14th Amendment?

When may Congress use its spending power?