🇺🇸

Constitutional Law • Equal Protection

CONLAW#115

Legal Definition

Classifications involving age, disability, wealth, economic regulations, sexual orientation, and anything else are subject to rational basis scrutiny.

Plain English Explanation

For classifications based on age, disability, wealth, economic regulations, sexual orientation, and most other characteristics, the courts use the lowest level of scrutiny, called "rational basis" scrutiny. Under this standard, as long as the government has a reasonable goal for the law and the law is rationally related to that goal, the courts will usually allow it. The government doesn't need an extremely important reason - just a rational one.

The rational basis test exists because the courts recognize that the government often needs to draw lines and treat groups differently for practical reasons, like saving money or addressing specific societal issues. As long as those reasons are based on rational goals and not arbitrary discrimination, some differential treatment is permissible and even necessary for effective governance.

The rational basis test exists because the courts recognize that the government often needs to draw lines and treat groups differently for practical reasons, like saving money or addressing specific societal issues. As long as those reasons are based on rational goals and not arbitrary discrimination, some differential treatment is permissible and even necessary for effective governance.

Hypothetical

Hypo 1: Hypofornia passes a law increasing the minimum age to purchase alcohol from 21 to 25, citing data showing that the 21-25 age group has the highest rates of drunk driving fatalities. A group of 23-year-olds sue, arguing the law violates their equal protection rights. Result: Since age is subject to rational basis review, the court would likely uphold Hypofornia's law. The state has a legitimate interest in reducing drunk driving deaths and data supports targeting the 21-25 demographic. The law is rationally related to that purpose. The fact that it doesn't apply to those over 25 doesn't make it unconstitutional under this lenient standard.

Hypo 2: New Hypoland enacts a law banning people with physical disabilities from working as police officers, arguing that mobility issues could interfere with essential job duties. Sam, who uses a wheelchair but is otherwise qualified, sues after his application to the police academy is rejected based on his disability. Result: Disability classifications receive rational basis scrutiny. Here, the state would argue it has a rational interest in ensuring police can physically perform necessary tasks to protect public safety. However, Sam could potentially prevail by showing the blanket ban is not rationally related to that interest since many disabled individuals may be fully capable of being effective officers. A more tailored policy assessing individual capabilities would be better suited.

Hypo 3: Hypofornia raises income taxes only on residents making over $500,000 per year, in order to fund social welfare programs. Wealthy taxpayers sue, claiming it violates equal protection compared to lower-income residents. Result: Economic regulations like tax laws are subject to rational basis review. Hypofornia has a legitimate interest in funding government aid programs and it is rational to tax higher earners more to do so. Wealth classifications do not receive heightened scrutiny, so this type of tax scheme does not violate equal protection even though it draws distinctions based on income level.

Hypo 4: Hypofornia passes a law imposing a 90% income tax rate on all residents of Chinese ancestry. Bob, a 4th generation Chinese-American, sues, arguing the law violates equal protection. Result: This law would not be subject to mere rational basis review. It creates a suspect classification based on race/national origin, which receives strict scrutiny. Under that standard, Hypofornia would have to show a compelling government interest and that the law is narrowly tailored to serve that interest. Blatant racial discrimination in tax policy would not meet this high burden. The court would find it unconstitutional. Rational basis is inapplicable to racial classifications.

Hypo 2: New Hypoland enacts a law banning people with physical disabilities from working as police officers, arguing that mobility issues could interfere with essential job duties. Sam, who uses a wheelchair but is otherwise qualified, sues after his application to the police academy is rejected based on his disability. Result: Disability classifications receive rational basis scrutiny. Here, the state would argue it has a rational interest in ensuring police can physically perform necessary tasks to protect public safety. However, Sam could potentially prevail by showing the blanket ban is not rationally related to that interest since many disabled individuals may be fully capable of being effective officers. A more tailored policy assessing individual capabilities would be better suited.

Hypo 3: Hypofornia raises income taxes only on residents making over $500,000 per year, in order to fund social welfare programs. Wealthy taxpayers sue, claiming it violates equal protection compared to lower-income residents. Result: Economic regulations like tax laws are subject to rational basis review. Hypofornia has a legitimate interest in funding government aid programs and it is rational to tax higher earners more to do so. Wealth classifications do not receive heightened scrutiny, so this type of tax scheme does not violate equal protection even though it draws distinctions based on income level.

Hypo 4: Hypofornia passes a law imposing a 90% income tax rate on all residents of Chinese ancestry. Bob, a 4th generation Chinese-American, sues, arguing the law violates equal protection. Result: This law would not be subject to mere rational basis review. It creates a suspect classification based on race/national origin, which receives strict scrutiny. Under that standard, Hypofornia would have to show a compelling government interest and that the law is narrowly tailored to serve that interest. Blatant racial discrimination in tax policy would not meet this high burden. The court would find it unconstitutional. Rational basis is inapplicable to racial classifications.

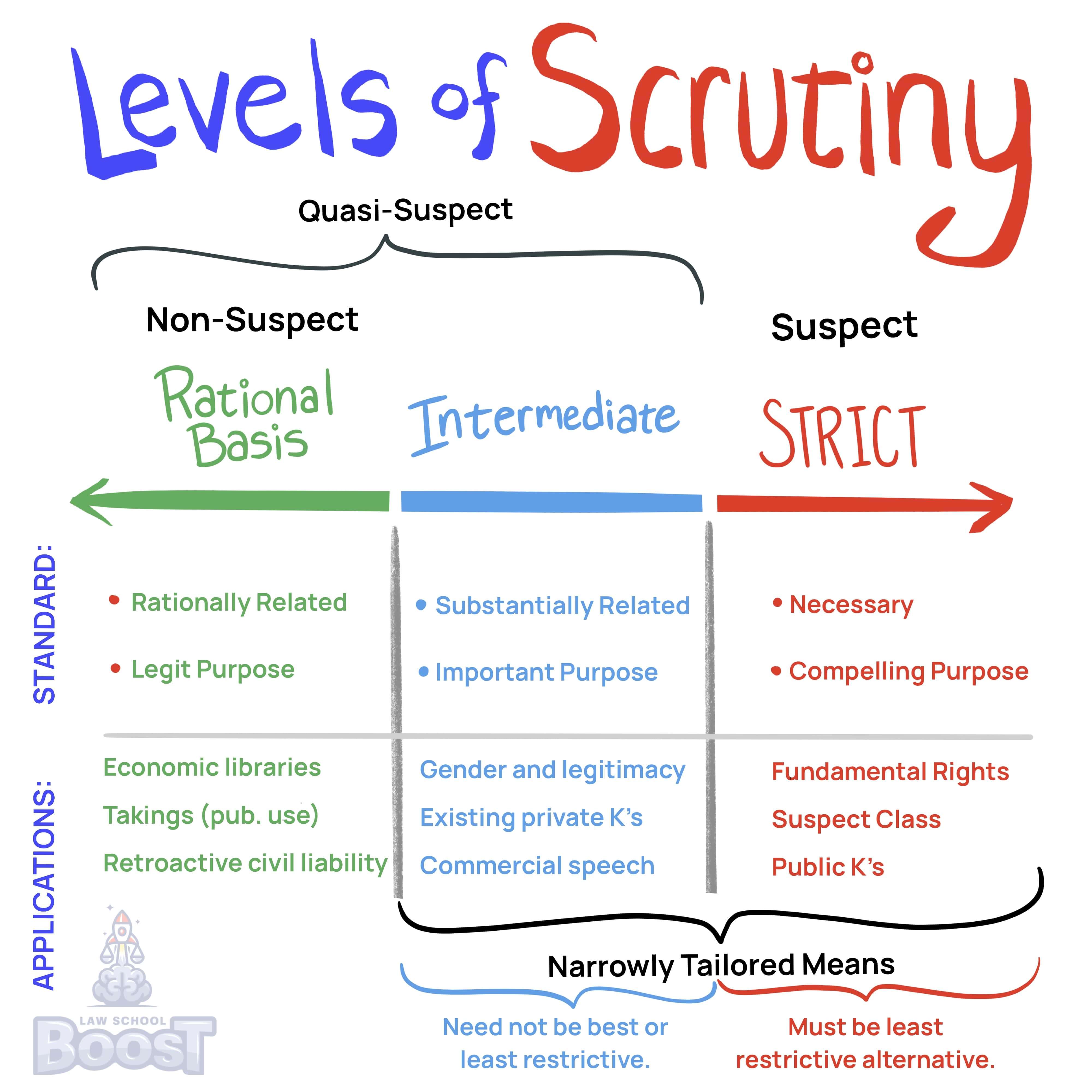

Visual Aids

Related Concepts

The Equal Protection Clause applies to which actions?

Under the Equal Protection Clause, what level of scrutiny is applied to alienage?

Under the Equal Protection Clause, what level of scrutiny is applied to all other classifications beside fundamental right, suspect, and quasi-suspect?

Under the Equal Protection Clause, what level of scrutiny is applied to fundamental rights or suspect classifications?

Under the Equal Protection Clause, what level of scrutiny is applied to gender and legitimacy?

Under the Equal Protection Clause, what level of scrutiny is applied to laws benefitting women?

Under the Equal Protection Clause, what level of scrutiny is applied to quasi-suspect classification?

Under the Equal Protection Clause, what level of scrutiny is applied to race or national origin?

Under the Equal Protection Clause, what level of scrutiny is applied to undocumented alien children?

Under the Equal Protection Clause, what level of scrutiny is applied to undocumented aliens?

What is the Equal Protection Clause?