🌕

Corporations • Formation Requirements

CORP#014

Legal Definition

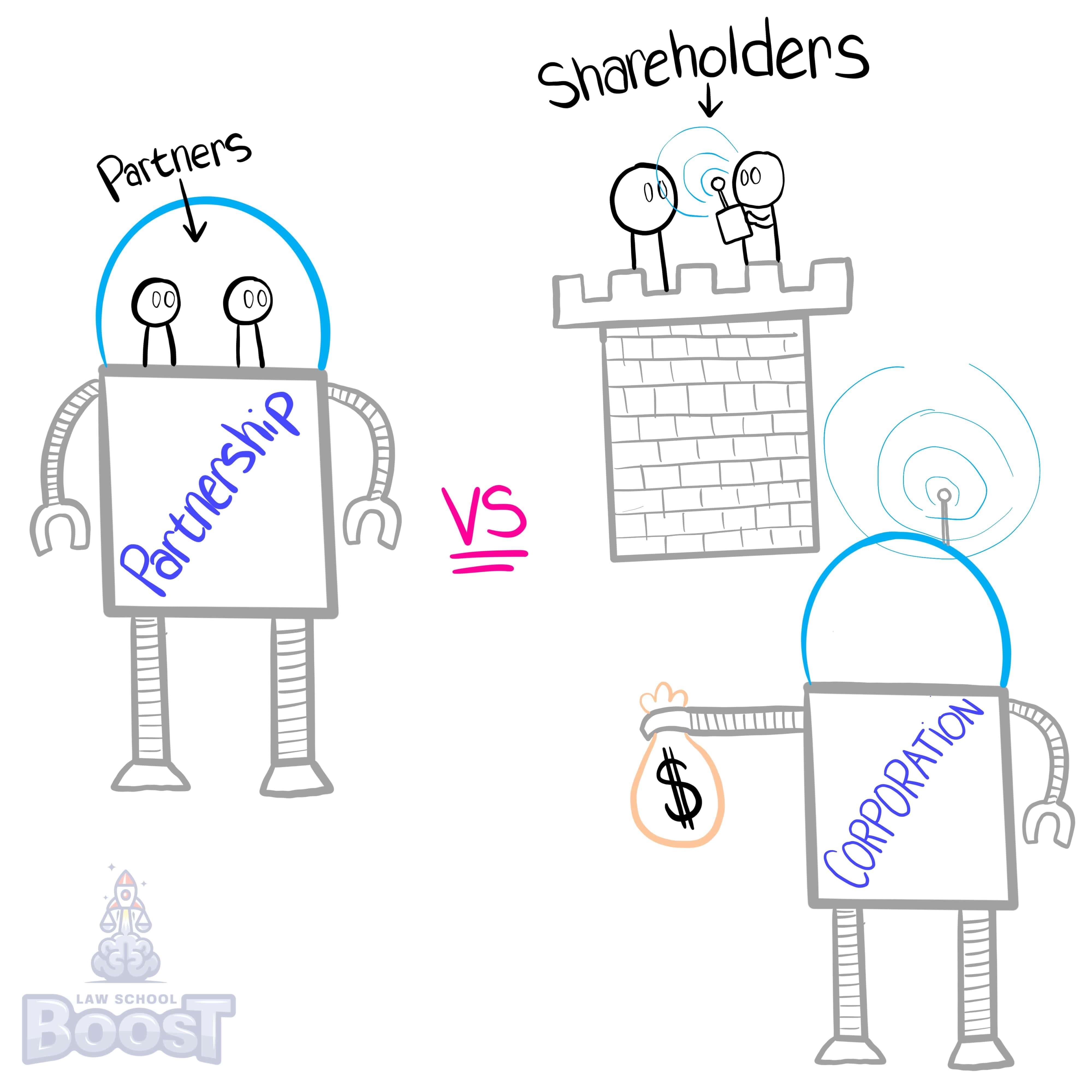

The corporation itself is a separate legal person. Once the corporation is formed, the shareholders generally are not personally liable for the debts of the corporation. Rather, they have limited liability, meaning they are liable only to the extent of the price of the stock owned.

Plain English Explanation

If you're struggling with the concept of what a corporation is, you've come to the right place. The first step is to take a moment to stop and appreciate the fact that every corporation you're aware of, from McDonalds to Amazon, is legally a person... sort of. More specifically, they have something called "corporate personhood," which means as far as the law is concerned they have many of the same rights and abilities as living, breathing human beings. The most common right is the ability to enter into contracts with others, as well as be held to obligations by others. Put simply: corporations can sue others and they can be sued by others.

Corporate personhood is nice and all, but the primary benefit of a corporation is how well it insulates its owners from liability. A corporation's ownership is represented by its shares, and each individual share is sort of like a puzzle piece that, together with the other pieces, adds up to complete ownership. In other words, the more puzzle pieces you own, the more of the corporation you control. Depending on how well the corporation does, the value of your puzzle piece share will increase or decrease (i.e., a share you purchase for $10 may later be worth $20 or $0 depending on various factors outside of your control). As an owner, that's pretty much all you have to worry about: "Will my shares become worth less than what I paid for them?"

In other words, the biggest liability a shareholder faces in relation to their ownership of a corporation is possibly losing whatever money they invested into the shares they own.

Corporate personhood is nice and all, but the primary benefit of a corporation is how well it insulates its owners from liability. A corporation's ownership is represented by its shares, and each individual share is sort of like a puzzle piece that, together with the other pieces, adds up to complete ownership. In other words, the more puzzle pieces you own, the more of the corporation you control. Depending on how well the corporation does, the value of your puzzle piece share will increase or decrease (i.e., a share you purchase for $10 may later be worth $20 or $0 depending on various factors outside of your control). As an owner, that's pretty much all you have to worry about: "Will my shares become worth less than what I paid for them?"

In other words, the biggest liability a shareholder faces in relation to their ownership of a corporation is possibly losing whatever money they invested into the shares they own.

Visual Aids

Related Concepts

Are bylaws required to form a corporation, and who is allowed to create and modify them?

How broad can a statement of business purpose be?

In what instances will courts pierce the corporate veil?

What are the requirements for articles of incorporation?

What are ultra vires activities and their consequences?

What is a corporation by estoppel and when does it apply?

What is a de facto corporation?

What is a de jure corporation and how is it formed?

What is a foreign corporation and how does it gain the ability to operate?

What is "piercing the corporate veil"?

Why are courts more willing to pierce corporate veils for tort victims?