‼️

Prof Responsibility • Confidentiality

PR#062

Legal Definition

Under California's strict Duty of Confidentiality, there is no explicit rule permitting the disclosure of client information, even if the client is violating securities law. However, this duty can conflict with the lawyer's obligations under federal law, specifically the Sarbanes-Oxley Act.

If a securities lawyer becomes aware of credible evidence that their client is materially violating federal or state securities law, they must report the evidence to the client's chief legal officer (CLO). The CLO is then required to investigate the situation. If the CLO determines that a violation has occurred, they must take all reasonable steps to ensure that the client makes an "appropriate response," which includes stopping the violation and ensuring it does not recur. The CLO must then report the results to the securities lawyer. If the securities lawyer believes the CLO's response is inadequate, they must escalate the issue to the client's board of directors, an audit committee, or a committee of outside, independent directors.

Additionally, under federal law, a securities lawyer may reveal confidential information to the SEC if it is reasonably necessary to:

(1) Stop the client from committing a violation that will cause substantial financial injury to the client or its investors;

(2) Rectify such a financial injury if the lawyer's services were used to further the violation; or

(3) Prevent the client from committing or suborning perjury in an SEC matter or lying in any matter within the jurisdiction of any branch of the federal government.

If a securities lawyer becomes aware of credible evidence that their client is materially violating federal or state securities law, they must report the evidence to the client's chief legal officer (CLO). The CLO is then required to investigate the situation. If the CLO determines that a violation has occurred, they must take all reasonable steps to ensure that the client makes an "appropriate response," which includes stopping the violation and ensuring it does not recur. The CLO must then report the results to the securities lawyer. If the securities lawyer believes the CLO's response is inadequate, they must escalate the issue to the client's board of directors, an audit committee, or a committee of outside, independent directors.

Additionally, under federal law, a securities lawyer may reveal confidential information to the SEC if it is reasonably necessary to:

(1) Stop the client from committing a violation that will cause substantial financial injury to the client or its investors;

(2) Rectify such a financial injury if the lawyer's services were used to further the violation; or

(3) Prevent the client from committing or suborning perjury in an SEC matter or lying in any matter within the jurisdiction of any branch of the federal government.

Plain English Explanation

In California, lawyers have a strict duty to keep their clients' information confidential. However, this duty can conflict with federal laws, like the Sarbanes-Oxley Act, which is designed to prevent and address corporate fraud. When a lawyer working in the securities field discovers credible evidence that their client is breaking securities laws, they must act. First, they have to report what they found to the company’s Chief Legal Officer (CLO). The CLO must then investigate and take steps to fix the problem. If the CLO doesn’t take appropriate action, the lawyer is required to escalate the matter to higher authorities within the company, such as the board of directors or a special committee. Additionally, federal law allows the lawyer to break confidentiality and report to the Securities and Exchange Commission (SEC) if it’s necessary to prevent significant financial harm, correct a past wrong where the lawyer’s help was involved, or prevent the client from lying under oath. This is a special exception to the usual confidentiality rules and is meant to protect investors and the public from serious corporate misconduct.

Hypothetical

Hypo 1: Bob is a lawyer representing Sam's tech company, which is about to release a new product. Bob discovers that Sam is misleading investors about the product's capabilities to inflate stock prices. Bob reports this to the company's CLO, who does nothing. Bob then informs the company's board of directors. Result: Bob acted correctly by escalating the issue after the CLO failed to address it. If the board also does nothing, Bob may report the situation to the SEC to prevent investor harm.

Hypo 2: Sam's real estate firm is involved in fraudulent land deals, and Bob, the company’s lawyer, uncovers the scam. He reports it to the CLO, but the CLO tells him to stay quiet. Bob then brings the issue to the board of directors, who also ignore the problem. Result: Bob should report the issue to the SEC because the company's leadership failed to take appropriate action, and investors could suffer significant financial harm.

Hypo 3: Bob, an attorney, finds out that Sam’s firm is committing minor regulatory infractions that do not pose any financial risk to investors or the company. Bob considers reporting this, but the infractions are neither significant nor related to securities law. Result: The rule does not require Bob to report this issue, as it does not involve a material violation of securities law or a situation that would cause substantial financial harm.

Hypo 2: Sam's real estate firm is involved in fraudulent land deals, and Bob, the company’s lawyer, uncovers the scam. He reports it to the CLO, but the CLO tells him to stay quiet. Bob then brings the issue to the board of directors, who also ignore the problem. Result: Bob should report the issue to the SEC because the company's leadership failed to take appropriate action, and investors could suffer significant financial harm.

Hypo 3: Bob, an attorney, finds out that Sam’s firm is committing minor regulatory infractions that do not pose any financial risk to investors or the company. Bob considers reporting this, but the infractions are neither significant nor related to securities law. Result: The rule does not require Bob to report this issue, as it does not involve a material violation of securities law or a situation that would cause substantial financial harm.

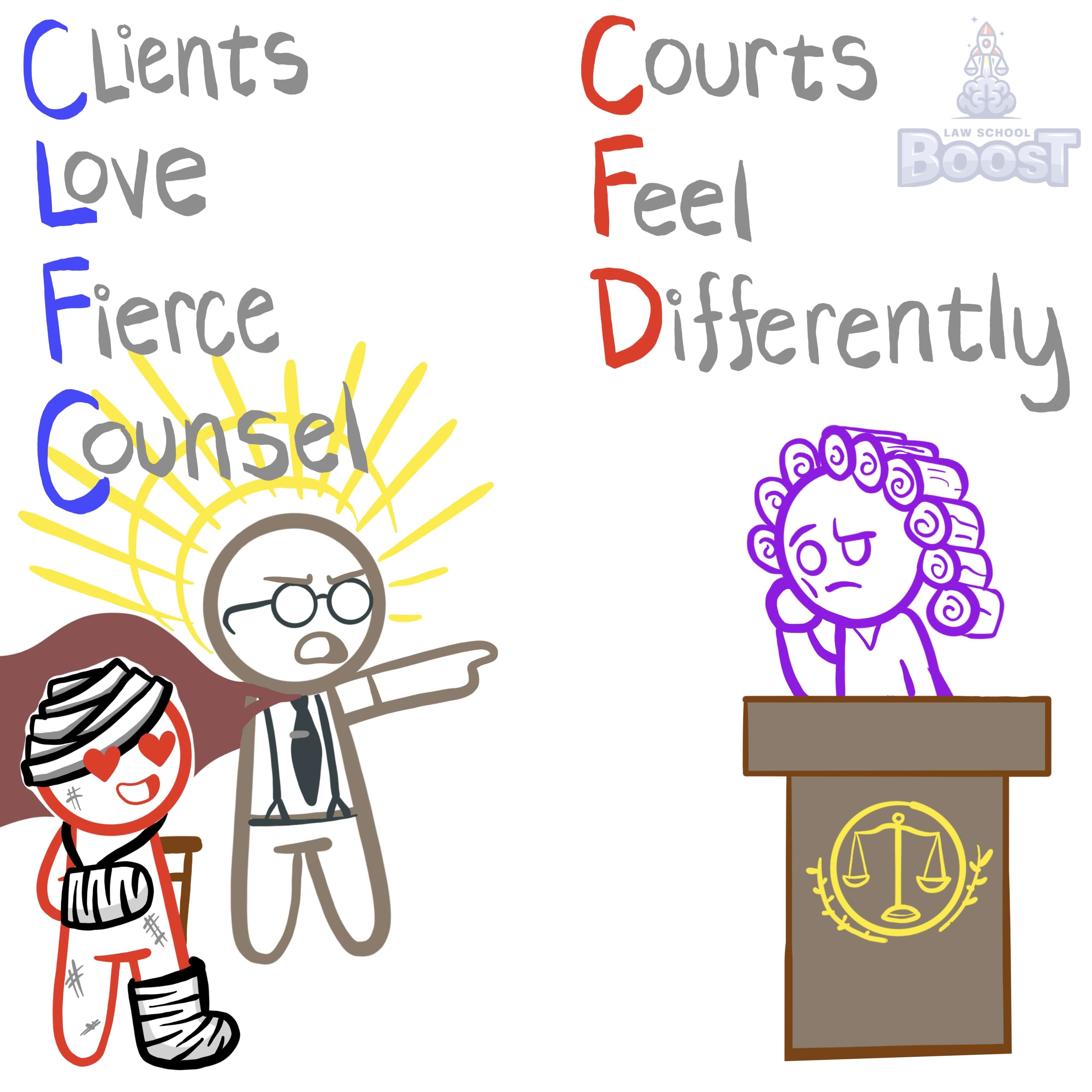

Visual Aids

Related Concepts

How does California's Rule 1.13 regarding Organizations as Clients differ from the ABA rules?

If a lawyer for an organization becomes aware that someone from the organization intends to break the law, how must the lawyer respond?

In California, what are the three exceptions to the Duty of Confidentiality?

What are the seven permissive exceptions, under the ABA, to the Duty of Confidentiality?

What is the Duty of Confidentiality?