‼️

Prof Responsibility • Financial Duties

PR#014

Legal Definition

A contingent fee offer must warn the client that they must still pay costs even if they lose the case. According to Rule 1.5(c), the contingent fee agreement must be in writing, signed by the client, and must state: (1) how the fee is to be calculated; (2) what expenses are to be deducted from the recovery; (3) whether the contingency fee is on the gross or net recovery; and (4) what expenses the client must pay, whether or not they win the case.

Plain English Explanation

When lawyers offer to work on a contingency basis, it might sound like a risk-free deal for the client. But there's more to it than "no win, no fee."

First off, the agreement has to be crystal clear and in black and white. No handshake deals here – it needs to be written down and signed by the client. This protects both the lawyer and the client from misunderstandings down the road.

The agreement needs to spell out exactly how the lawyer will be paid if the case is successful. Will they get a flat percentage of the winnings? Does that percentage change if the case goes to trial? The client needs to know precisely what to expect.

It's also crucial for clients to understand what expenses will be deducted from any money they win. Court filing fees, expert witness costs, and other expenses can add up, and clients need to know how these will impact their potential payout.

The agreement must clarify whether the lawyer's percentage comes out of the total amount won (the gross recovery) or what's left after expenses are paid (the net recovery). This seemingly small detail can make a big difference in how much the client ultimately receives.

Perhaps most importantly, the agreement must warn clients that some costs will be their responsibility even if they lose the case. While the lawyer might not get paid if the case is unsuccessful, certain expenses – like court filing fees or expert witness costs – still need to be covered by the client.

First off, the agreement has to be crystal clear and in black and white. No handshake deals here – it needs to be written down and signed by the client. This protects both the lawyer and the client from misunderstandings down the road.

The agreement needs to spell out exactly how the lawyer will be paid if the case is successful. Will they get a flat percentage of the winnings? Does that percentage change if the case goes to trial? The client needs to know precisely what to expect.

It's also crucial for clients to understand what expenses will be deducted from any money they win. Court filing fees, expert witness costs, and other expenses can add up, and clients need to know how these will impact their potential payout.

The agreement must clarify whether the lawyer's percentage comes out of the total amount won (the gross recovery) or what's left after expenses are paid (the net recovery). This seemingly small detail can make a big difference in how much the client ultimately receives.

Perhaps most importantly, the agreement must warn clients that some costs will be their responsibility even if they lose the case. While the lawyer might not get paid if the case is unsuccessful, certain expenses – like court filing fees or expert witness costs – still need to be covered by the client.

Hypothetical

Hypo 1: Sam is injured in a slip-and-fall accident at a grocery store. He approaches Bob, a personal injury lawyer, who offers to take the case on a contingency basis. Bob presents Sam with a written agreement stating he'll receive 33% of any recovery, calculated on the gross amount before expenses are deducted. The agreement lists potential expenses like court fees and expert witness costs, clearly stating that Sam is responsible for these regardless of the case outcome. Sam signs the agreement after carefully reading it. Result: This scenario illustrates a proper contingency fee agreement. Bob has complied with all requirements: the agreement is in writing, signed by Sam, explains how the fee is calculated (33% of gross recovery), lists expenses, and clearly warns Sam about his responsibility for costs even if they lose. This transparency allows Sam to make an informed decision about pursuing the case.

Hypo 2: Sam, a small business owner, wants to sue a supplier for breach of contract. He meets with Bob, a business litigation attorney, who agrees to take the case on contingency. Bob verbally explains that he'll take 40% of any recovery and that Sam will be responsible for court costs. He doesn't provide a written agreement, saying they can "keep it simple." Result: In this case, Bob has failed to comply with the requirements for a contingent fee agreement. Even though he explained some aspects verbally, the lack of a written agreement signed by Sam violates the rule. Additionally, Bob didn't clearly outline all the required elements, particularly the warning about Sam's responsibility for costs even if they lose. This verbal agreement would not be enforceable, and Bob could face ethical violations.

Hypo 3: Sam is pursuing a medical malpractice claim. Bob, a specialized attorney, presents a written contingency fee agreement. The agreement states Bob will receive 40% of the net recovery (after expenses are deducted) and lists potential expenses. However, it doesn't mention that Sam must pay these expenses even if they lose the case. Sam signs the agreement. Result: While Bob has met most of the requirements – the agreement is in writing, signed by Sam, and explains how the fee is calculated – he has crucially omitted the warning that Sam must pay expenses even if they lose. This omission violates the rule and could lead to disputes if the case is unsuccessful. Bob should have explicitly included this warning to fully comply with the requirements.

Hypo 4: Sam approaches Bob about a potential class action lawsuit against a pharmaceutical company. Bob provides a detailed, written contingency fee agreement. It clearly states his fee will be 30% of the gross recovery, lists all potential expenses, and explicitly warns that class members may be responsible for certain costs even if the suit is unsuccessful. However, Bob forgets to have Sam sign the agreement before beginning work on the case. Result: The agreement is comprehensive and meets all the content requirements, including the warning about expenses in case of a loss. However, the lack of Sam's signature means it doesn't fully comply with the rule.

Hypo 2: Sam, a small business owner, wants to sue a supplier for breach of contract. He meets with Bob, a business litigation attorney, who agrees to take the case on contingency. Bob verbally explains that he'll take 40% of any recovery and that Sam will be responsible for court costs. He doesn't provide a written agreement, saying they can "keep it simple." Result: In this case, Bob has failed to comply with the requirements for a contingent fee agreement. Even though he explained some aspects verbally, the lack of a written agreement signed by Sam violates the rule. Additionally, Bob didn't clearly outline all the required elements, particularly the warning about Sam's responsibility for costs even if they lose. This verbal agreement would not be enforceable, and Bob could face ethical violations.

Hypo 3: Sam is pursuing a medical malpractice claim. Bob, a specialized attorney, presents a written contingency fee agreement. The agreement states Bob will receive 40% of the net recovery (after expenses are deducted) and lists potential expenses. However, it doesn't mention that Sam must pay these expenses even if they lose the case. Sam signs the agreement. Result: While Bob has met most of the requirements – the agreement is in writing, signed by Sam, and explains how the fee is calculated – he has crucially omitted the warning that Sam must pay expenses even if they lose. This omission violates the rule and could lead to disputes if the case is unsuccessful. Bob should have explicitly included this warning to fully comply with the requirements.

Hypo 4: Sam approaches Bob about a potential class action lawsuit against a pharmaceutical company. Bob provides a detailed, written contingency fee agreement. It clearly states his fee will be 30% of the gross recovery, lists all potential expenses, and explicitly warns that class members may be responsible for certain costs even if the suit is unsuccessful. However, Bob forgets to have Sam sign the agreement before beginning work on the case. Result: The agreement is comprehensive and meets all the content requirements, including the warning about expenses in case of a loss. However, the lack of Sam's signature means it doesn't fully comply with the rule.

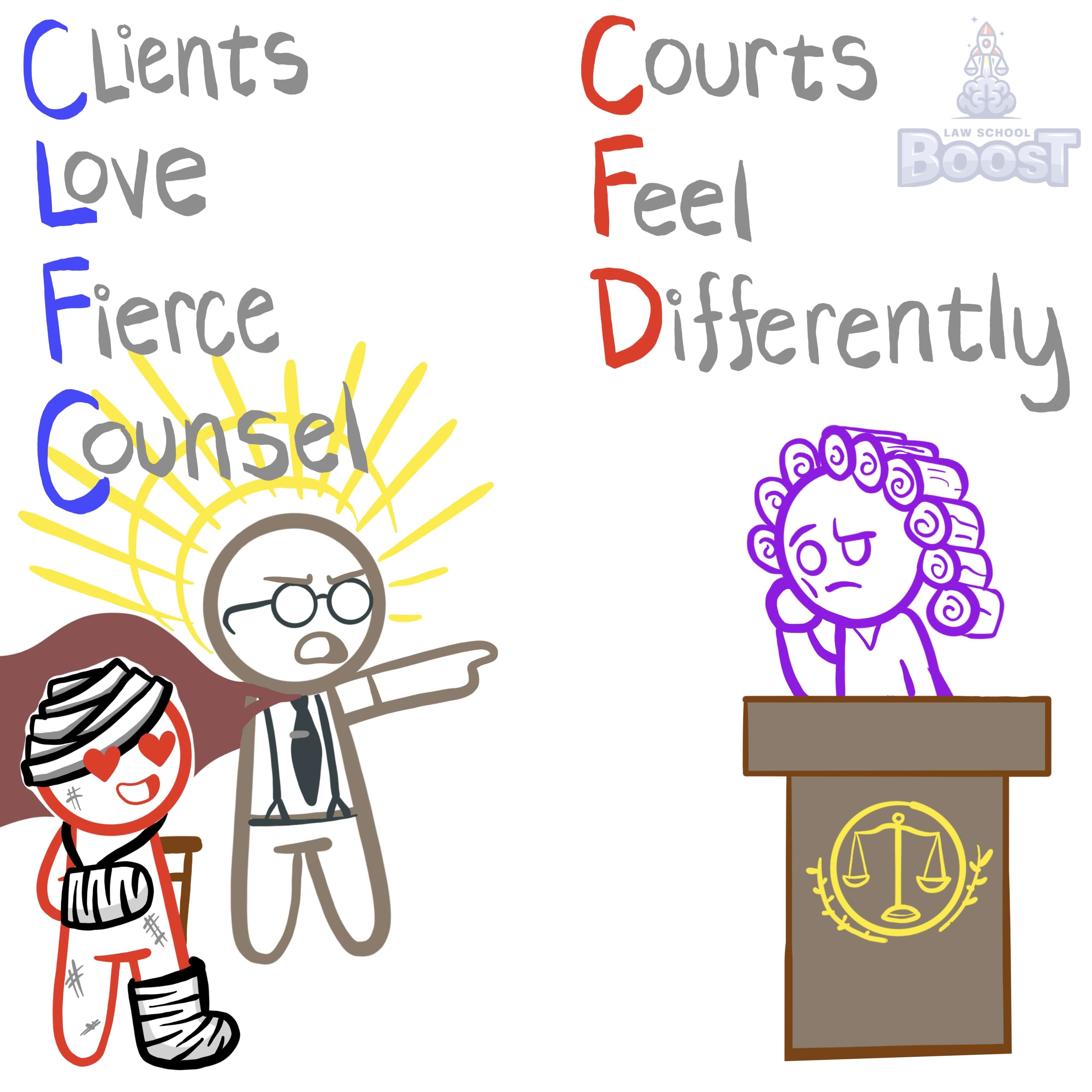

Visual Aids

Related Concepts

How and when must a lawyer determine fee arrangements with a new client?

How does California rule on fee splitting differ from the ABA?

How may a contingent fee be calculated?

In California, how and when must a lawyer determine fee arrangements with a new client?

In California, what constitutes "reasonable fees"?

Under the ABA, which types of cases are prohibited from contingent fee arrangements?

What constitutes "reasonable fees"?

What is a contingency fee?

What is required to fee split with another lawyer not in their firm?