🥺

Trusts • Transfer of Interests

TRUSTS#015

Legal Definition

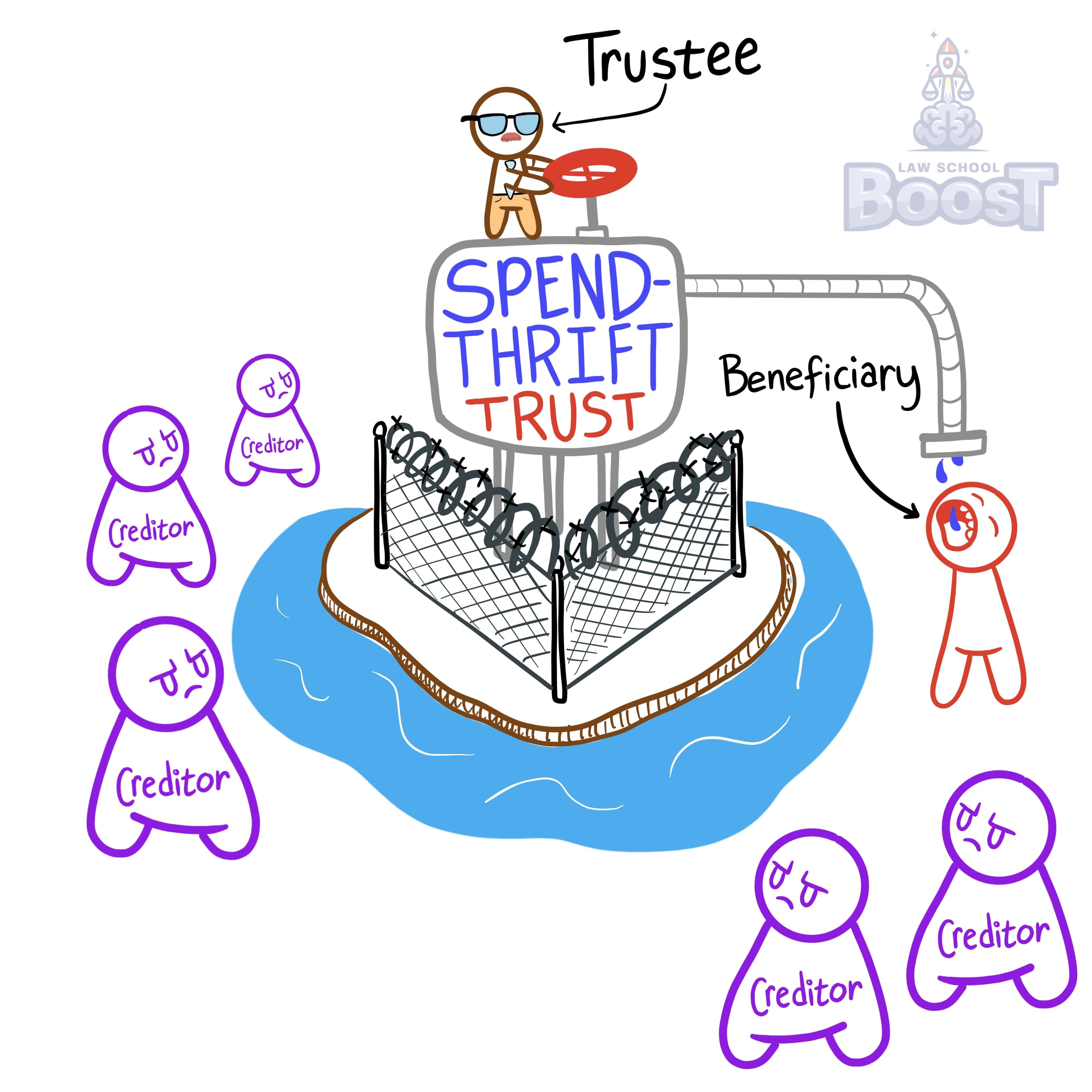

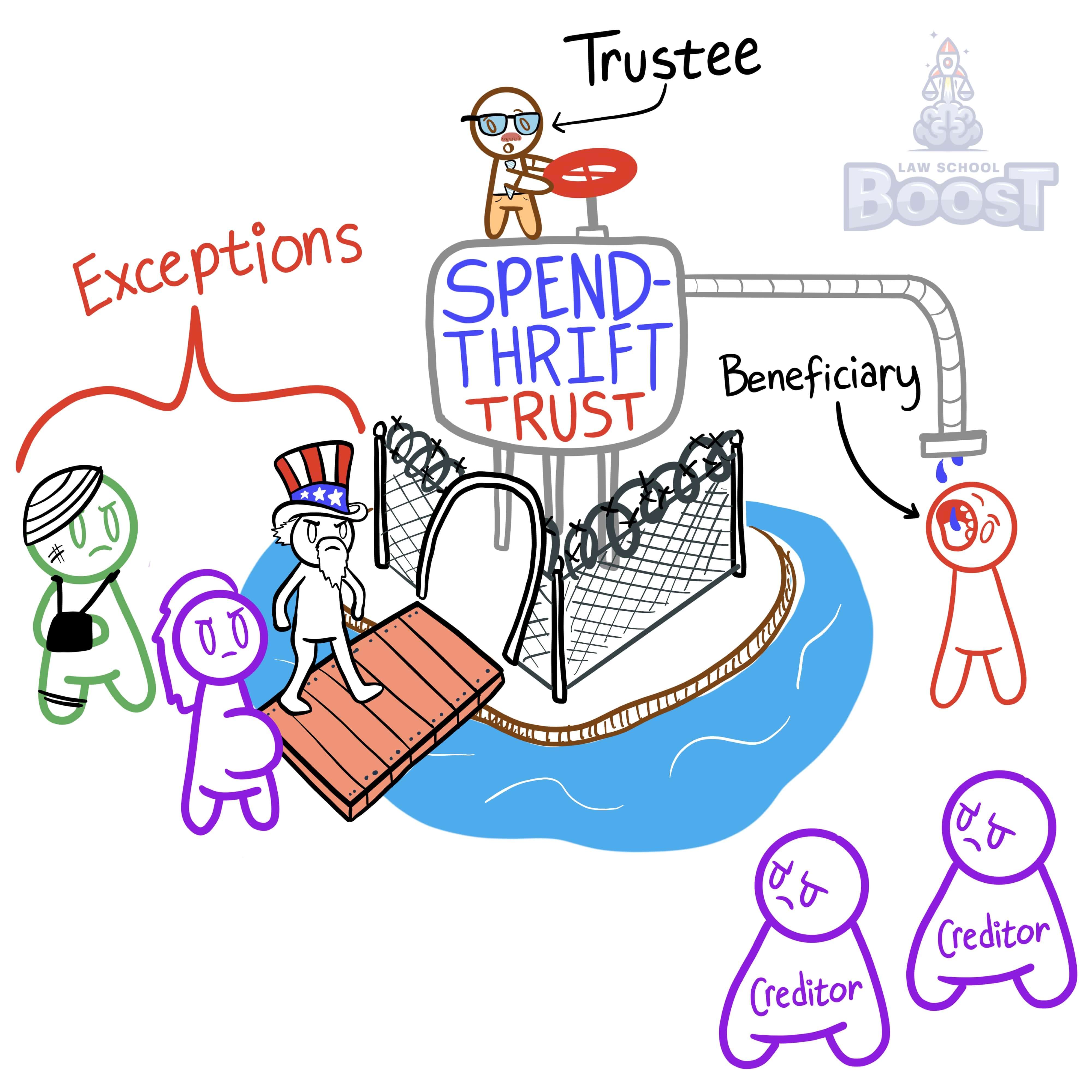

A spendthrift trust is a trust that is created for the benefit of a person (often unable to control his/her spending) that gives an independent trustee full authority to make decisions as to how the trust funds may be spent for the benefit of the beneficiary.

In a spendthrift trust, the beneficiary cannot transfer their right to future payments of income or principal and creditors cannot attach the beneficiary's rights to future payments of income or principal.

In a spendthrift trust, the beneficiary cannot transfer their right to future payments of income or principal and creditors cannot attach the beneficiary's rights to future payments of income or principal.

Plain English Explanation

Spendthrift trusts are the type of trusts rich people would set up for their spoiled children who have no concept of the value of money. They completely remove any and all authority from the beneficiary to control or influence the trust. It's sort of like the beneficiary just receives an envelope of cash in the mail periodically, from someone who has been keeping an eye on the beneficiary and deciding how much money is necessary to benefit their life in a positive way. This is important because other types of trusts can sometimes be attacked by creditors, which is something you don't want to happen when the beneficiary is financially incompetent.

Another way to think about it is imagine if today you decided to send me, the creator of this app, $100 from time to time when you thought I needed it (which, by the way, if you want to do, I am happy to make this hypothetical real ;)). In this scenario, I have no power over asking you to send me more money, and you have full discretion on when to send me money. If I get into debt, a creditor can't force you to pay them $100 because I have no right to force you to pay me money, which means neither would a creditor. A spendthrift trust is a way to mimic this level of insulation, keeping a beneficiary from having any control over the person giving money, or the payments themselves.

Another way to think about it is imagine if today you decided to send me, the creator of this app, $100 from time to time when you thought I needed it (which, by the way, if you want to do, I am happy to make this hypothetical real ;)). In this scenario, I have no power over asking you to send me more money, and you have full discretion on when to send me money. If I get into debt, a creditor can't force you to pay them $100 because I have no right to force you to pay me money, which means neither would a creditor. A spendthrift trust is a way to mimic this level of insulation, keeping a beneficiary from having any control over the person giving money, or the payments themselves.

Hypothetical

Hypo 1: Bob, known for his reckless spending habits, will inherit a large sum of money from his aunt. Concerned about his financial stability, his aunt sets up a spendthrift trust with Sam as the trustee. Bob wants to buy a luxury car with the trust money, but Sam decides that it's not a necessary expense and denies the request. Result: This is a classic example of how a spendthrift trust works. Bob cannot directly control the funds and cannot use them for extravagant purchases, as determined by the trustee, Sam.

Hypo 2: Bob has accumulated a significant amount of debt. His creditors discover that he is the beneficiary of a spendthrift trust set up by his late grandfather. The creditors attempt to claim the trust funds to pay off Bob's debts. Result: The spendthrift trust shields the assets from Bob's creditors. They cannot access the trust funds to settle Bob's debts because the trust legally protects these funds from claims of creditors.

Hypo 3: Bob, a beneficiary of a spendthrift trust, tries to sell his future payments from the trust to a third party for a lump sum of money. The third party agrees, expecting to receive the future payments. Result: The sale is invalid because the terms of a spendthrift trust prevent the beneficiary from transferring his rights to future payments. The third party cannot claim these payments.

Hypo 4: Bob's friend, Sam, is in financial trouble. Bob promises to give Sam some of the money from his spendthrift trust. However, when he asks the trustee to give money to Sam, the trustee refuses, stating the trust's purpose is solely for Bob's benefit. Result: The trustee's decision is in line with the spendthrift trust rules. The trust is intended for Bob's benefit alone and cannot be directed to others, even at Bob's request.

Hypo 5: Bob receives a large inheritance directly from his late aunt, with no trust or conditions attached. He immediately starts spending lavishly and accumulates significant debt. Result: Since this situation involves a direct inheritance without a spendthrift trust, Bob has full control over the money. Creditors can claim against Bob's assets, including the inheritance, to settle debts.

Hypo 2: Bob has accumulated a significant amount of debt. His creditors discover that he is the beneficiary of a spendthrift trust set up by his late grandfather. The creditors attempt to claim the trust funds to pay off Bob's debts. Result: The spendthrift trust shields the assets from Bob's creditors. They cannot access the trust funds to settle Bob's debts because the trust legally protects these funds from claims of creditors.

Hypo 3: Bob, a beneficiary of a spendthrift trust, tries to sell his future payments from the trust to a third party for a lump sum of money. The third party agrees, expecting to receive the future payments. Result: The sale is invalid because the terms of a spendthrift trust prevent the beneficiary from transferring his rights to future payments. The third party cannot claim these payments.

Hypo 4: Bob's friend, Sam, is in financial trouble. Bob promises to give Sam some of the money from his spendthrift trust. However, when he asks the trustee to give money to Sam, the trustee refuses, stating the trust's purpose is solely for Bob's benefit. Result: The trustee's decision is in line with the spendthrift trust rules. The trust is intended for Bob's benefit alone and cannot be directed to others, even at Bob's request.

Hypo 5: Bob receives a large inheritance directly from his late aunt, with no trust or conditions attached. He immediately starts spending lavishly and accumulates significant debt. Result: Since this situation involves a direct inheritance without a spendthrift trust, Bob has full control over the money. Creditors can claim against Bob's assets, including the inheritance, to settle debts.

Visual Aids

Related Concepts

Are discretionary trusts involuntarily alienable?

Are discretionary trusts voluntarily alienable?

Are spendthrift trusts involuntarily alienable?

Are spendthrift trusts voluntarily alienable?

Are support trusts involuntarily alienable?

Are support trusts voluntarily alienable?

What is a discretionary trust?

What is a self-settled spendthrift trust and how do most jurisdictions deal with them?

What is a support trust