🥺

Trusts • Transfer of Interests

TRUSTS#017

Legal Definition

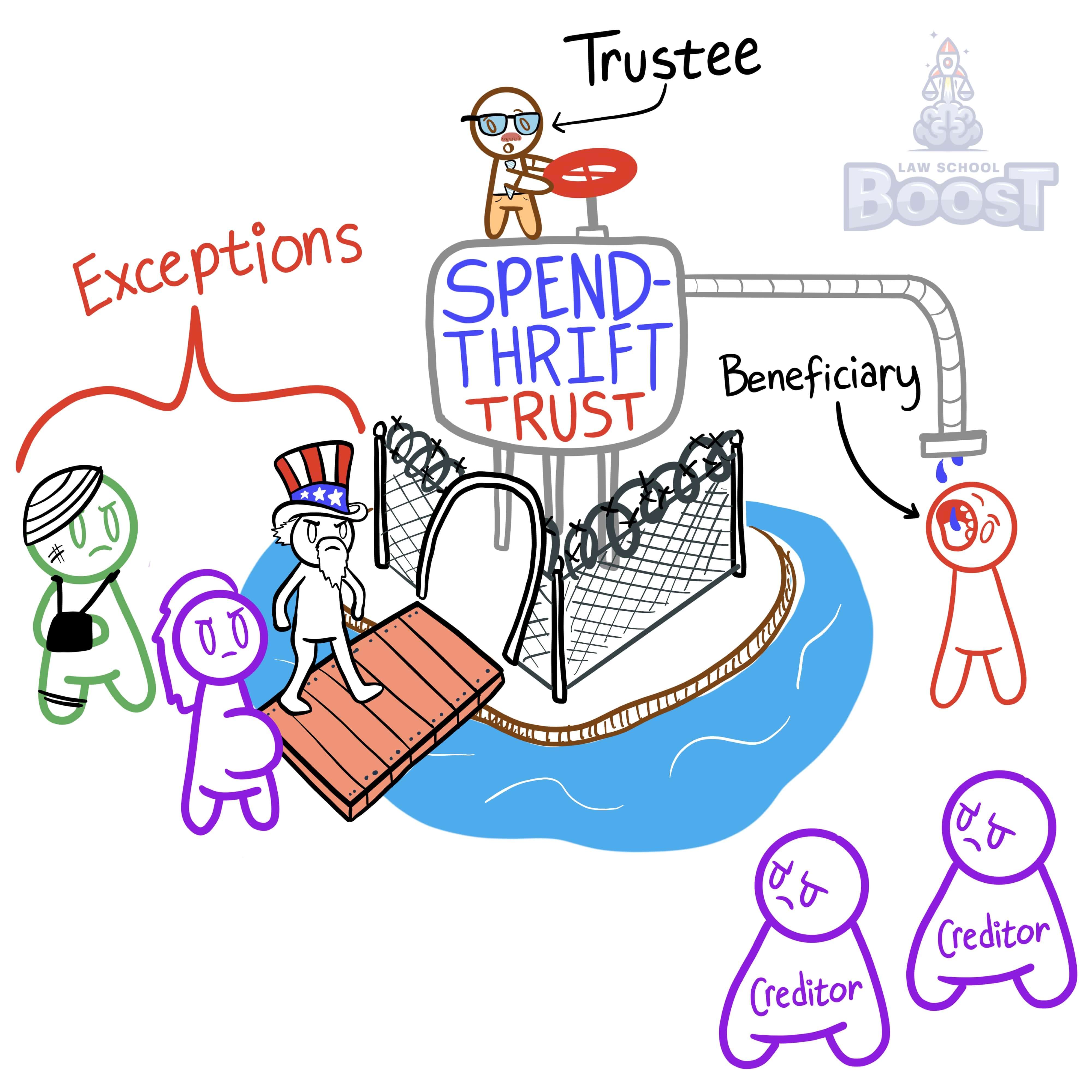

Generally, creditors cannot attach the beneficiary's right to future payments, with an exception that certain preferred creditors can (e.g., the government, those that provide necessities of life, child support, spousal support, alimony, tort judgment creditor, etc.), and some jurisdictions allow creditors to attach a surplus as measured by the beneficiary's station in life.

Plain English Explanation

As discussed in other cards, the whole point of a spendthrift trust is to provide support to a beneficiary who is not financially competent enough to be in charge of their own finances. In other words, it's likely that the beneficiary is the type of person who would not only spend all the money they have, but spend more money than they have, putting themselves into debt to creditors. For that reason, spendthrift trusts generally cannot be touched by most creditors.

However, there are some "preferred creditors who can sometimes go after a spendthrift trust:

(1) The government is the most aggressive form of creditor (think about how much power the IRS has) and will generally always get paid if you owe it money.

(2) People that provide necessities of life will generally get paid. For example, if a beneficiary of a spendthrift trust does something that requires emergency care or some sort of assistance to stay alive, fed, or sheltered, it wouldn't be fair to not compensate those who provide such assistance.

(3) If a beneficiary of a spendthrift trust owes money to support their children or their former spouse, courts may allow such creditors to go after the trust.

(4) If the beneficiary of a spendthrift trust hurts someone, they may need to use their trust to compensate them. For example, if Bob's only source of income is a spendthrift trust and Bob chooses to drive drunk and hurt Sam, it wouldn't be right to deny Sam the ability to recover from Bob simply because of the spendthrift's protections against creditors.

(5) Finally, in some jurisdictions, a judge may allow creditors to go after the "surplus" of a beneficiary's spendthrift trust. In other words, imagine if Bob had a spendthrift trust worth $100,000,000 and lives a lifestyle that costs $200,000 per year to maintain. If Bob is 40, you could imagine that, at most, he may live another 50 years. 50 years at $200k per year would require $10,000,000 to maintain, which means the $90,000,000 surplus available in the spendthrift trust may be accessible by creditors.

However, there are some "preferred creditors who can sometimes go after a spendthrift trust:

(1) The government is the most aggressive form of creditor (think about how much power the IRS has) and will generally always get paid if you owe it money.

(2) People that provide necessities of life will generally get paid. For example, if a beneficiary of a spendthrift trust does something that requires emergency care or some sort of assistance to stay alive, fed, or sheltered, it wouldn't be fair to not compensate those who provide such assistance.

(3) If a beneficiary of a spendthrift trust owes money to support their children or their former spouse, courts may allow such creditors to go after the trust.

(4) If the beneficiary of a spendthrift trust hurts someone, they may need to use their trust to compensate them. For example, if Bob's only source of income is a spendthrift trust and Bob chooses to drive drunk and hurt Sam, it wouldn't be right to deny Sam the ability to recover from Bob simply because of the spendthrift's protections against creditors.

(5) Finally, in some jurisdictions, a judge may allow creditors to go after the "surplus" of a beneficiary's spendthrift trust. In other words, imagine if Bob had a spendthrift trust worth $100,000,000 and lives a lifestyle that costs $200,000 per year to maintain. If Bob is 40, you could imagine that, at most, he may live another 50 years. 50 years at $200k per year would require $10,000,000 to maintain, which means the $90,000,000 surplus available in the spendthrift trust may be accessible by creditors.

Hypothetical

Hypo 1: Sam receives $5,000 per month from a spendthrift trust set up by his wealthy father. Sam fails to pay income taxes for several years. The IRS obtains a judgment against Sam for $50,000 in unpaid taxes and seeks to garnish his trust distributions. Result: As a government creditor, the IRS would likely be able to garnish Sam's trust distributions to satisfy the tax judgment despite the spendthrift clause. The government is typically considered an exception creditor.

Hypo 2: Bob is the beneficiary of a spendthrift trust that provides him $10,000 per month. Bob fails to make credit card payments for years and racks up $100,000 in credit card debt. When the credit card company sues Bob and wins a judgment, they seek to garnish Bob's trust distributions. Result: Here, the credit card company would not be able to garnish Bob's trust distributions because they are not an exception creditor like the government or provider of necessities.

Hypo 3: Sam receives $2,000 per month from a spendthrift trust, which he uses to pay for food, housing, transportation, and discretionary spending. Sam owes his ex-wife Amy $50,000 in unpaid alimony over several years. Amy obtains a judgment against Sam for the past-due alimony and seeks to garnish Sam's trust distributions. Result: As Sam's ex-wife owed alimony, Amy would likely be able to garnish some of Sam's trust distributions despite the spendthrift clause because alimony is another common exception. However, she may only be able to take the amount over what Sam reasonably needs for basic necessities.

Hypo 2: Bob is the beneficiary of a spendthrift trust that provides him $10,000 per month. Bob fails to make credit card payments for years and racks up $100,000 in credit card debt. When the credit card company sues Bob and wins a judgment, they seek to garnish Bob's trust distributions. Result: Here, the credit card company would not be able to garnish Bob's trust distributions because they are not an exception creditor like the government or provider of necessities.

Hypo 3: Sam receives $2,000 per month from a spendthrift trust, which he uses to pay for food, housing, transportation, and discretionary spending. Sam owes his ex-wife Amy $50,000 in unpaid alimony over several years. Amy obtains a judgment against Sam for the past-due alimony and seeks to garnish Sam's trust distributions. Result: As Sam's ex-wife owed alimony, Amy would likely be able to garnish some of Sam's trust distributions despite the spendthrift clause because alimony is another common exception. However, she may only be able to take the amount over what Sam reasonably needs for basic necessities.

Visual Aids

Related Concepts

Are discretionary trusts involuntarily alienable?

Are discretionary trusts voluntarily alienable?

Are spendthrift trusts voluntarily alienable?

Are support trusts involuntarily alienable?

Are support trusts voluntarily alienable?

What is a discretionary trust?

What is a self-settled spendthrift trust and how do most jurisdictions deal with them?

What is a spendthrift trust?

What is a support trust