😭

Wills • Capacity

WILLS#011

Legal Definition

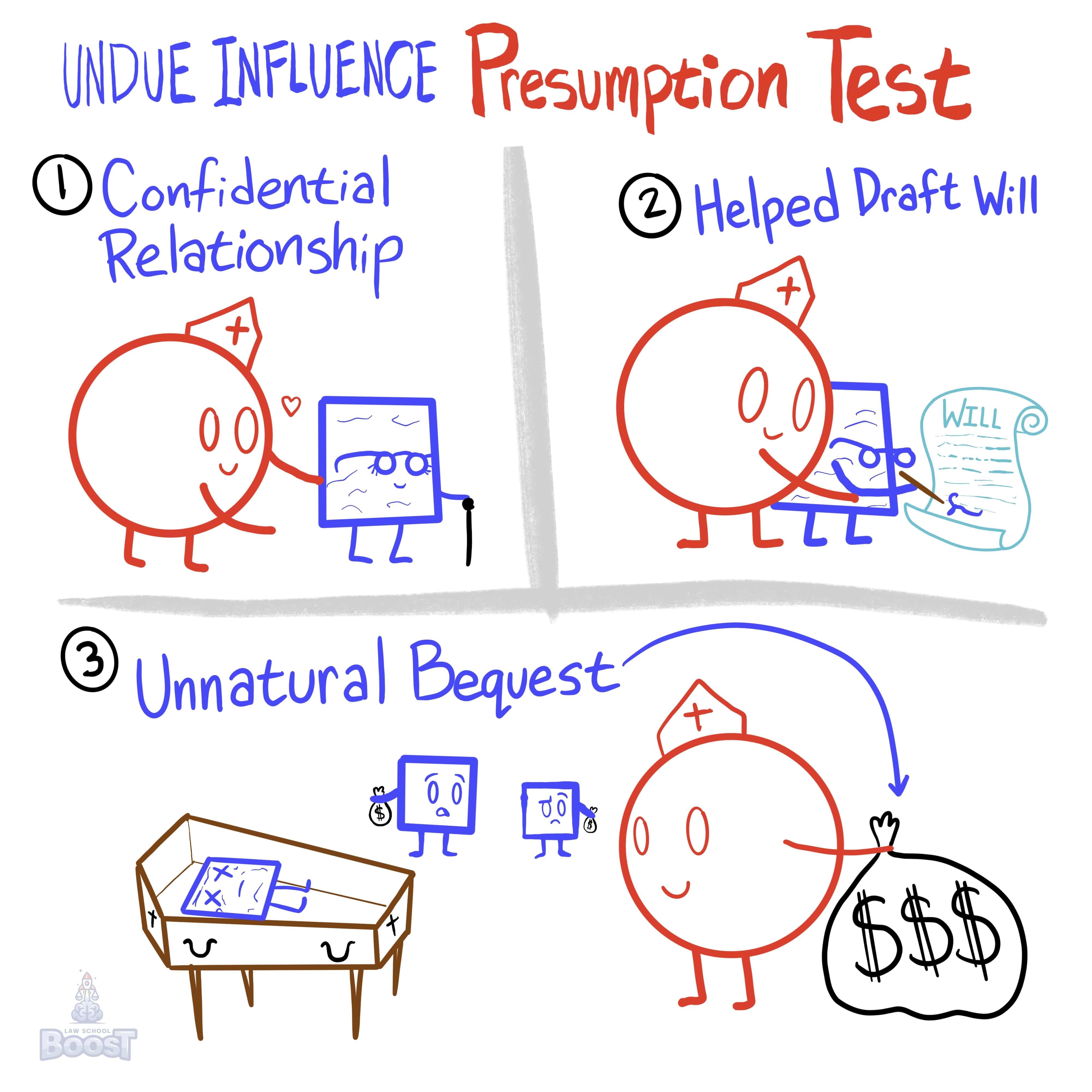

There is a presumption of undue influence where (1) a beneficiary enjoys a confidential relationship with the testator, (2) a beneficiary participates in drafting or executing the will, and (3) the gift is an unnatural bequest that favors the beneficiary. If not rebutted, the gift is invalidated.

Plain English Explanation

This rule allows a gift in a will to be automatically canceled if it seems like someone used improper influence over the person making the will to get that gift. The gift will be canceled if (1) the person getting the gift had a very close relationship with the will-maker where they could have unfairly pressured them, (2) the person getting the gift was involved in making or signing the will, and (3) the gift seems really unusual and more than the person would normally give them.

The purpose is to protect people from being manipulated or coerced into leaving money or gifts to someone who has power over them. It aims to prevent abuse and make sure the gifts in a will are what the person really wanted.

The purpose is to protect people from being manipulated or coerced into leaving money or gifts to someone who has power over them. It aims to prevent abuse and make sure the gifts in a will are what the person really wanted.

Hypothetical

Hypo 1: Bob was Sam's caretaker. Bob drove Sam to the lawyer's office and sat with him while he signed a new will leaving Bob a large sum of money. Result: The gift to Bob would be presumed invalid due to undue influence.

Hypo 2: Bob was Sam's spiritual advisor. Sam added a gift in his will leaving Bob a valuable family heirloom. Bob did not participate in making the will. Result: The gift would likely be valid because Bob did not participate in making the will, even though he had a confidential relationship with Sam.

Hypo 3: Bob was Sam's business partner. Sam left Bob a disproportionately large share of business profits in his will. Bob helped Sam draft the new will. Result: The gift would be presumed invalid because Bob participated in drafting the will and received an unnatural gift favoring him over others.

Hypo 4: Bob was Sam's neighbor. Sam left Bob $20,000 in his will because Bob had helped Sam with yardwork. Bob was not involved in making the will. Result: The gift would likely be valid because Bob did not have a confidential relationship with Sam nor participate in making the will.

Hypo 2: Bob was Sam's spiritual advisor. Sam added a gift in his will leaving Bob a valuable family heirloom. Bob did not participate in making the will. Result: The gift would likely be valid because Bob did not participate in making the will, even though he had a confidential relationship with Sam.

Hypo 3: Bob was Sam's business partner. Sam left Bob a disproportionately large share of business profits in his will. Bob helped Sam draft the new will. Result: The gift would be presumed invalid because Bob participated in drafting the will and received an unnatural gift favoring him over others.

Hypo 4: Bob was Sam's neighbor. Sam left Bob $20,000 in his will because Bob had helped Sam with yardwork. Bob was not involved in making the will. Result: The gift would likely be valid because Bob did not have a confidential relationship with Sam nor participate in making the will.

Visual Aids

Related Concepts

How do you make a prima facie case for undue influence?

In California, can an attorney who drafts a will for their client be a beneficiary?

In California, when is there a statutory presumption of undue influence?

In California, when is there no presumption of undue influence for a donative transfer?

What happens if someone fraudulently prevents someone from creating a will?

What is an insane delusion?

What is fraud in the execution?

What is fraud in the inducement?

What is required for valid testamentary capacity?

What is required to establish fraud?

What is undue influence?

What relief is available if mistake in the inducement occurs?

When does a mistake in the execution occur and what is the result?