😭

Wills • Capacity

WILLS#015

Legal Definition

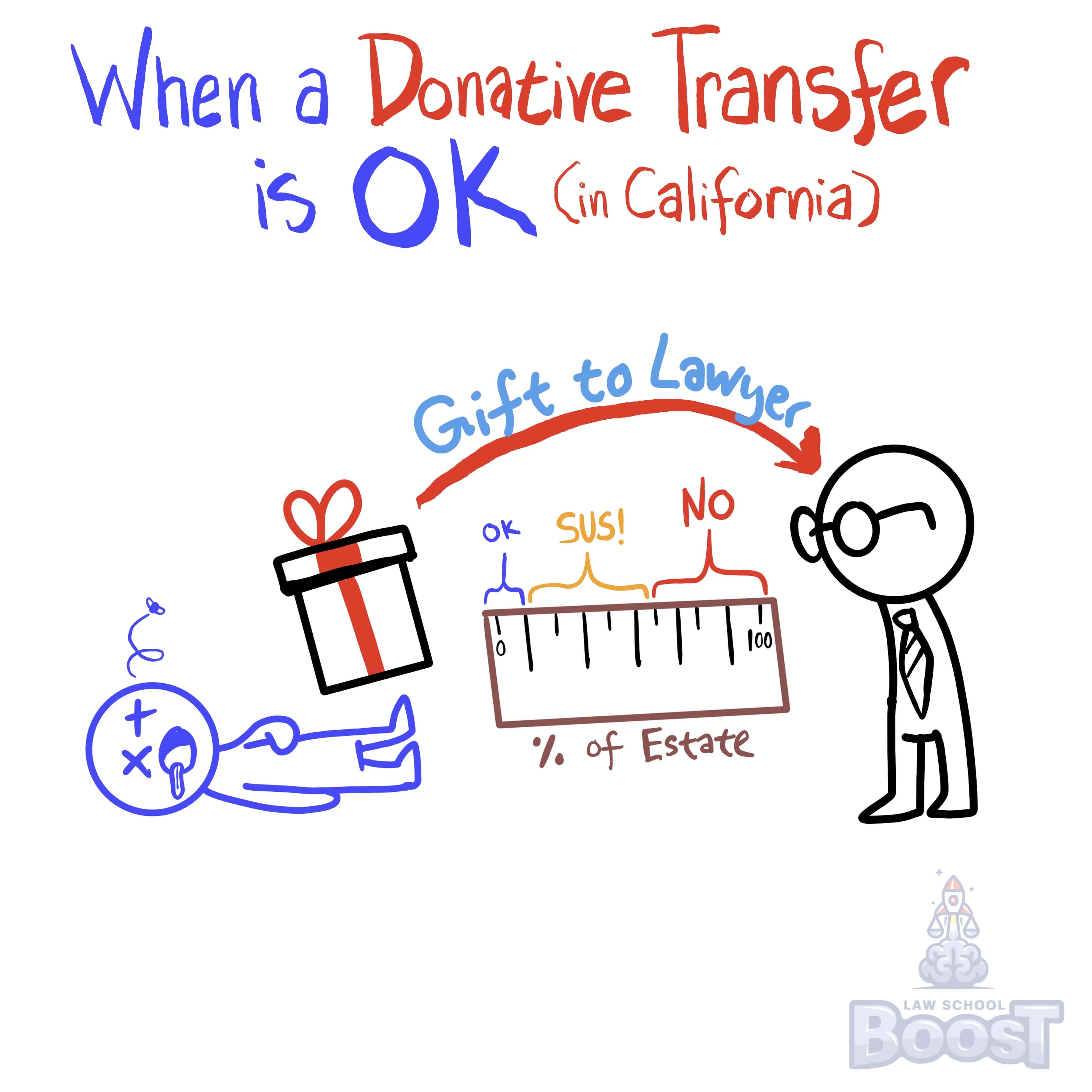

A donative transfer is okay where reviewed by an independent attorney or where it constitutes a small gift in a big estate.

Plain English Explanation

Though some gifts can be super suspicious and appear like undue influence, they are permissible if the will was reviewed and approved by an independent attorney or if the gift is relatively small compared to the total size of the estate. For example, if a billionaire hires an attorney to write their will and opts to leave the attorney a $100 bottle of wine, it likely won't rise to the level of undue influence even though, on its face, the relationship would make it appear inappropriate.

Hypothetical

Hypo 1: Bob, a wealthy businessman, writes a will leaving a $500 watch to his lawyer, Sam. The will was reviewed and approved by an independent attorney. Result: This is okay under California law because the gift was checked by another lawyer, ensuring it's fair.

Hypo 2: Bob is a millionaire and decides to leave Sam, his gardener, $1,000 in his will. The total value of Bob's estate is $5 million. Result: This is fine because the gift is small compared to Bob's large estate.

Hypo 3: Sam is Bob's caretaker. Bob writes a will leaving his house to Sam, but this will wasn't reviewed by an independent attorney. Result: This might not be okay because the gift is large and wasn't checked by a neutral lawyer.

Hypo 5: Bob, a business owner, leaves 50% of his company to Sam, his only child, without the will being reviewed by an independent attorney. Result: This rule doesn't apply here because Sam is a direct family member, and such transfers are usually treated differently in inheritance scenarios.

Hypo 2: Bob is a millionaire and decides to leave Sam, his gardener, $1,000 in his will. The total value of Bob's estate is $5 million. Result: This is fine because the gift is small compared to Bob's large estate.

Hypo 3: Sam is Bob's caretaker. Bob writes a will leaving his house to Sam, but this will wasn't reviewed by an independent attorney. Result: This might not be okay because the gift is large and wasn't checked by a neutral lawyer.

Hypo 5: Bob, a business owner, leaves 50% of his company to Sam, his only child, without the will being reviewed by an independent attorney. Result: This rule doesn't apply here because Sam is a direct family member, and such transfers are usually treated differently in inheritance scenarios.

Visual Aids

Related Concepts

How do you make a prima facie case for undue influence?

In California, can an attorney who drafts a will for their client be a beneficiary?

In California, when is there a statutory presumption of undue influence?

What happens if someone fraudulently prevents someone from creating a will?

What is an insane delusion?

What is fraud in the execution?

What is fraud in the inducement?

What is required for valid testamentary capacity?

What is required to establish fraud?

What is undue influence?

What relief is available if mistake in the inducement occurs?

When assessing undue influence, what is the presumption test?

When does a mistake in the execution occur and what is the result?