🤧

Community Property • Pensions, Stock Bonuses, and Options

CPROP#016

Legal Definition

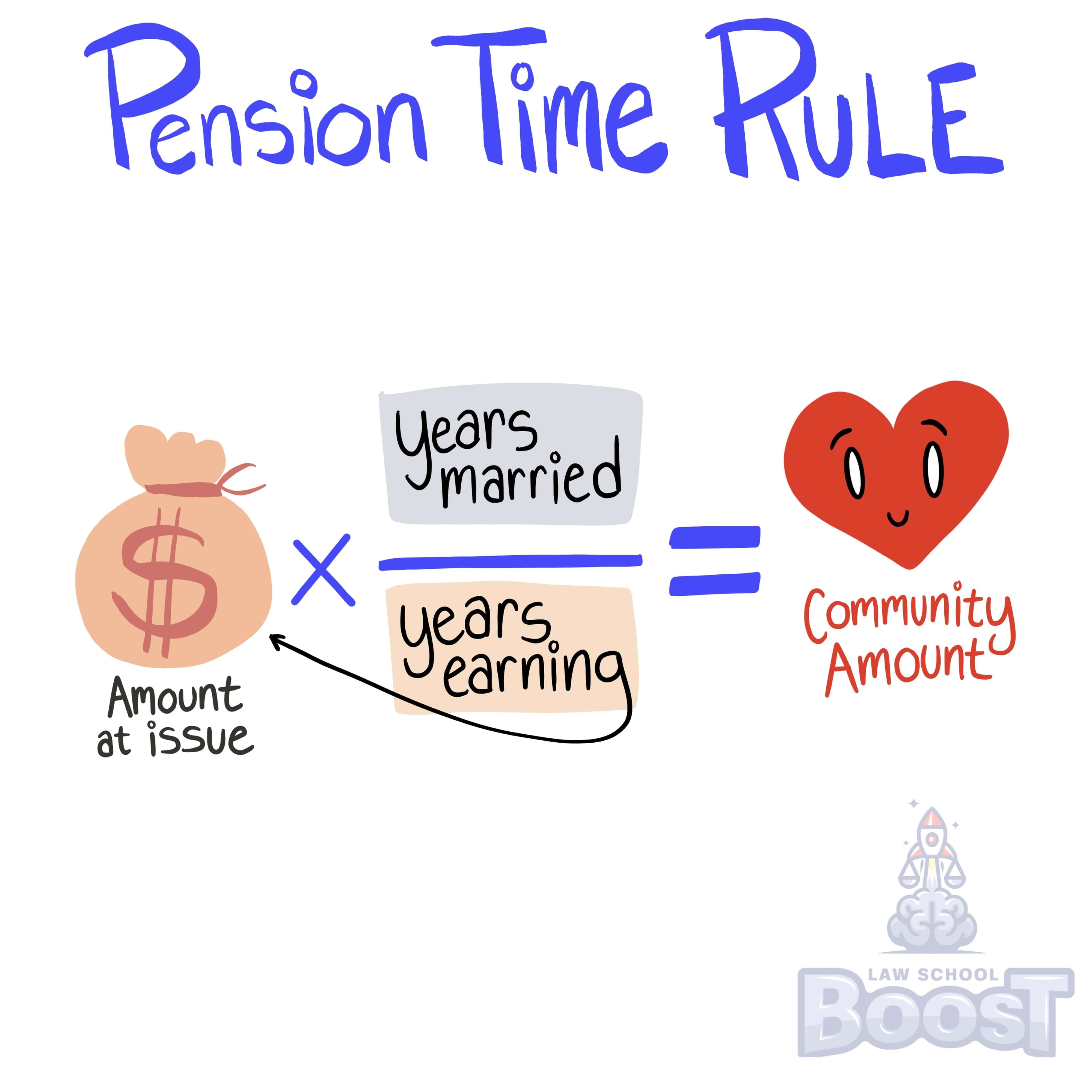

Bonuses are treated as wages, and any such bonuses earned during the marriage are presumptively community property. In determining the character of stock bonuses and stock options acquired in part during the marriage and in part outside the marriage, the court applies the pension time rule, in which the total amount of stock is multiplied by a fraction to determine the community interest. The numerator is the total number of years of marriage in which the stock is earned, and the denominator is the total number of years in which the stock is earned.

Plain English Explanation

Stock options are a form of compensation, so they can be considered community property if earned during the marriage. However, it's complex if the stock accumulates over many years, including before and after the marriage. The pension time rule creates a fair formula - it divides the total stock proportionally based on the years married versus total years worked. This honors both the community contribution during the marriage and the separate property interest from before/after. The formula multiplies the total stock by a fraction, using the years married as the numerator and total years earning the stock in the denominator. This determines a percentage that represents the community interest in the stock options.

Hypothetical

Hypo 1: Bob works at a tech company and receives stock options over a period of 10 years. He has been married to Amy for the last 6 of those years. Result: The total stock value is multiplied by 6/10, representing the 6 years of marriage out of the 10 years earning the stock. This fraction determines the portion of the stock that is community property.

Hypo 2: Amy is awarded a stock bonus by her employer for her exceptional work. She has been married to Bob for the entire period she worked towards this bonus. Result: Since Amy earned the stock bonus entirely during her marriage, the entire bonus is considered community property.

Hypo 3: Bob receives stock options from his employer. He starts earning these options two years before marrying Amy, and continues to earn them for three years after marriage. Result: The community interest in the stock options is calculated as the total value multiplied by 3/5, as they were married for 3 out of the 5 years the stocks were earned.

Hypo 4: Amy receives a stock bonus from her employer a year after her divorce from Bob. Result: Since the stock bonus was earned entirely after the end of the marriage, it is considered Amy's separate property and not subject to community property division.

Hypo 5: Bob receives stock options before his marriage to Amy and sells them off before getting married. Result: Since the stock options were both earned and disposed of before the marriage, the rule does not apply, and the proceeds are considered Bob's separate property.

Hypo 2: Amy is awarded a stock bonus by her employer for her exceptional work. She has been married to Bob for the entire period she worked towards this bonus. Result: Since Amy earned the stock bonus entirely during her marriage, the entire bonus is considered community property.

Hypo 3: Bob receives stock options from his employer. He starts earning these options two years before marrying Amy, and continues to earn them for three years after marriage. Result: The community interest in the stock options is calculated as the total value multiplied by 3/5, as they were married for 3 out of the 5 years the stocks were earned.

Hypo 4: Amy receives a stock bonus from her employer a year after her divorce from Bob. Result: Since the stock bonus was earned entirely after the end of the marriage, it is considered Amy's separate property and not subject to community property division.

Hypo 5: Bob receives stock options before his marriage to Amy and sells them off before getting married. Result: Since the stock options were both earned and disposed of before the marriage, the rule does not apply, and the proceeds are considered Bob's separate property.

Visual Aids