🤧

Community Property • Pensions, Stock Bonuses, and Options

CPROP#018

Legal Definition

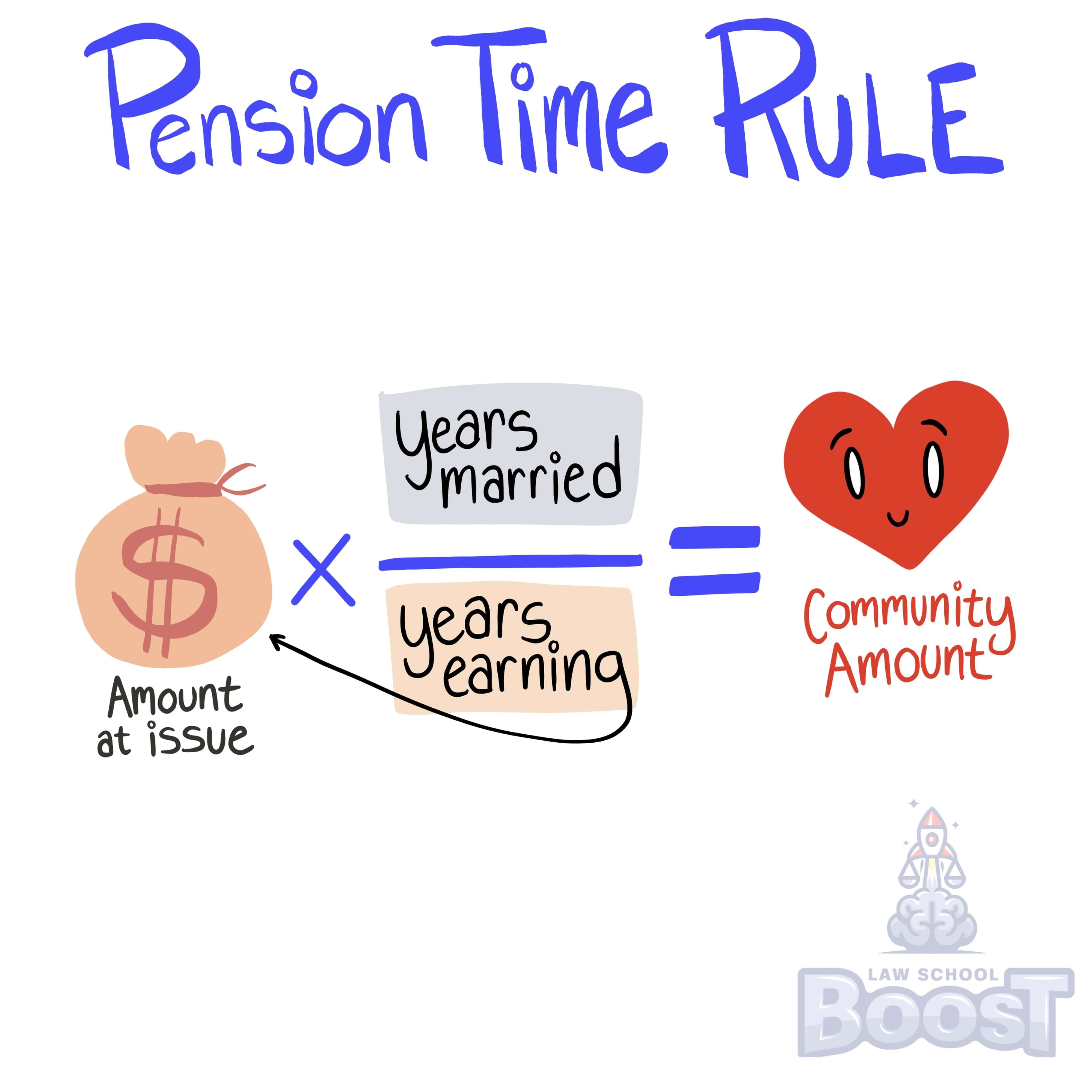

If not yet eligible for retirement, the other spouse can (1) wait and request the funds if and when received, or (2) ask to be cashed out now. If the spouse cashes out now, the numerator remains the total years of service while married, while the denominator is the total years employed until the time of divorce, multiplied by the present value of the pension (i.e., the value at the time of divorce).

Plain English Explanation

Retirement benefits are earned over time through years of employment. If a worker gets divorced before being eligible to retire, their ex-spouse is still entitled to a portion of those benefits. The portion is based on how long they were married compared to the total time worked. For example, if they were married for 10 of the 20 years the person worked, only 10/20 or half of the pension would be considered community property. The ex-spouse then has a choice: wait until the worker retires and collect their share later, or cash out now at the current value. This rule lets the ex-spouse get their fair share without waiting indefinitely.

Hypothetical

Hypo 1: Bob has been contributing to his retirement fund for 30 years, 20 of which he was married to Amy. They decide to get a divorce when Bob is 60, five years away from retirement. Amy decides to wait for her share of Bob's retirement benefits until he retires. Result: When Bob retires at 65, Amy is entitled to a portion of his retirement benefits, calculated based on the 20 years they were married out of his 35 years of total employment.

Hypo 2: Bob, a 50-year-old, has a retirement fund he's been adding to for 15 years, 10 of which he was married to Amy. They decide to divorce, and Amy wants her share of the retirement benefits immediately. Result: The court calculates Amy's share based on the 10 years of Bob's employment during their marriage, out of his total 15 years of employment up to the divorce. Amy receives a lump sum payment, representing her share of the retirement fund's current value.

Hypo 2: Bob, a 50-year-old, has a retirement fund he's been adding to for 15 years, 10 of which he was married to Amy. They decide to divorce, and Amy wants her share of the retirement benefits immediately. Result: The court calculates Amy's share based on the 10 years of Bob's employment during their marriage, out of his total 15 years of employment up to the divorce. Amy receives a lump sum payment, representing her share of the retirement fund's current value.

Visual Aids