🤧

Community Property • Pensions, Stock Bonuses, and Options

CPROP#017

Legal Definition

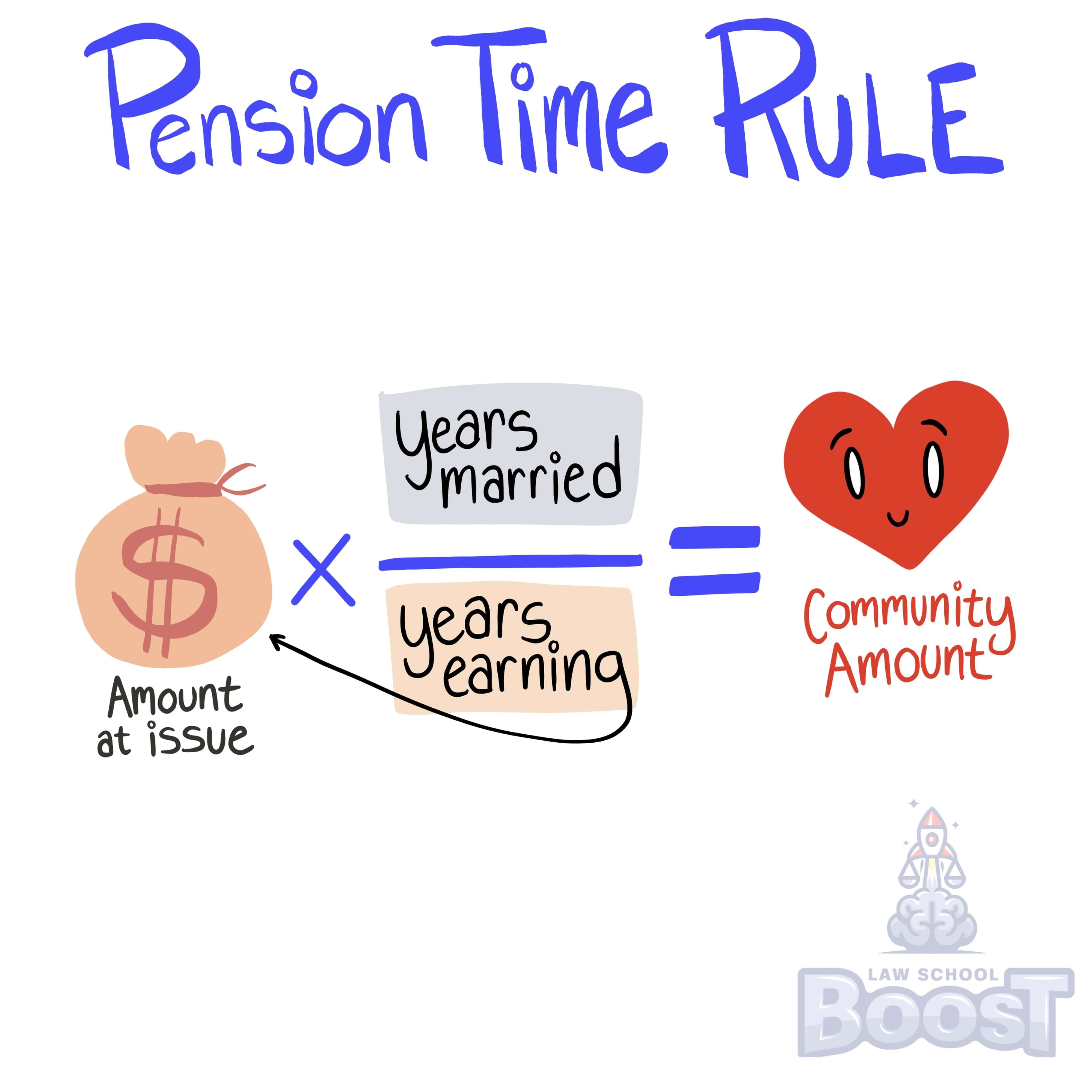

Employee retirement benefits (i.e., pensions) accumulated during marriage, whether or not vested at the time of divorce, are community property. To determine the character of pension benefits acquired in part during the marriage and in part outside the marriage, the court applies the pension time rule, in which the total value of the pension is multiplied by a fraction to determine the community interest. The numerator is the total years of service while married, and the denominator is the total years employed to retirement.

Plain English Explanation

Getting divorced can feel like your life savings is being divided with a butcher knife. Retirement funds, though earned partly through long hours at boring desk jobs, often become the subject of bitter battles. The pension time rule tries to fairly split this nest egg. The logic is simple - whatever portion was saved during the bliss of matrimony gets split down the middle. The rest stays with the egg's original owner. This keeps divorce from being a total wealth wipeout while recognizing marriage as an economic partnership, for better and worse. Of course humans are imperfect estimators. To figure out how much of the pension is shared, you use a special calculation: Take the total value of the pension, then multiply it by a fraction. The top number of the fraction is the number of years you were married while earning the pension, and the bottom number is the total number of years you worked to earn the pension.

Hypothetical

Hypo 1: Bob works for a company for 30 years, and he is married to Amy for 20 of those years. When he retires, he starts receiving his pension. Result: Under the pension time rule, 2/3 of Bob's pension is considered community property because he was married to Amy for 20 out of the 30 years he worked.

Hypo 2: Amy works and earns a pension over 25 years. She is married to Bob for the last 10 years before she retires. Result: In this scenario, 10/25 or 40% of Amy's pension is community property, as that's the proportion of her pension-earning years that she was married to Bob.

Hypo 3: Bob is married to Amy for 15 years during which he is not employed and does not contribute to a pension. After their divorce, he works for 20 years and earns a pension. Result: None of Bob's pension is considered community property because he did not contribute to it during his marriage to Amy.

Hypo 4: Amy and Bob are married for 10 years. During this time, Amy contributes to a pension. They get divorced, and Amy continues working for another 15 years, contributing to the same pension. Result: 40% of Amy's pension (10 out of 25 total years) is community property because she contributed to it for 10 years while married to Bob.

Hypo 5: Bob inherits a pension from his late uncle. He is married to Amy at the time of the inheritance. Result: The inherited pension is not considered community property because it was an inheritance received by Bob alone, not earned through employment during the marriage.

Hypo 2: Amy works and earns a pension over 25 years. She is married to Bob for the last 10 years before she retires. Result: In this scenario, 10/25 or 40% of Amy's pension is community property, as that's the proportion of her pension-earning years that she was married to Bob.

Hypo 3: Bob is married to Amy for 15 years during which he is not employed and does not contribute to a pension. After their divorce, he works for 20 years and earns a pension. Result: None of Bob's pension is considered community property because he did not contribute to it during his marriage to Amy.

Hypo 4: Amy and Bob are married for 10 years. During this time, Amy contributes to a pension. They get divorced, and Amy continues working for another 15 years, contributing to the same pension. Result: 40% of Amy's pension (10 out of 25 total years) is community property because she contributed to it for 10 years while married to Bob.

Hypo 5: Bob inherits a pension from his late uncle. He is married to Amy at the time of the inheritance. Result: The inherited pension is not considered community property because it was an inheritance received by Bob alone, not earned through employment during the marriage.

Visual Aids