🤔

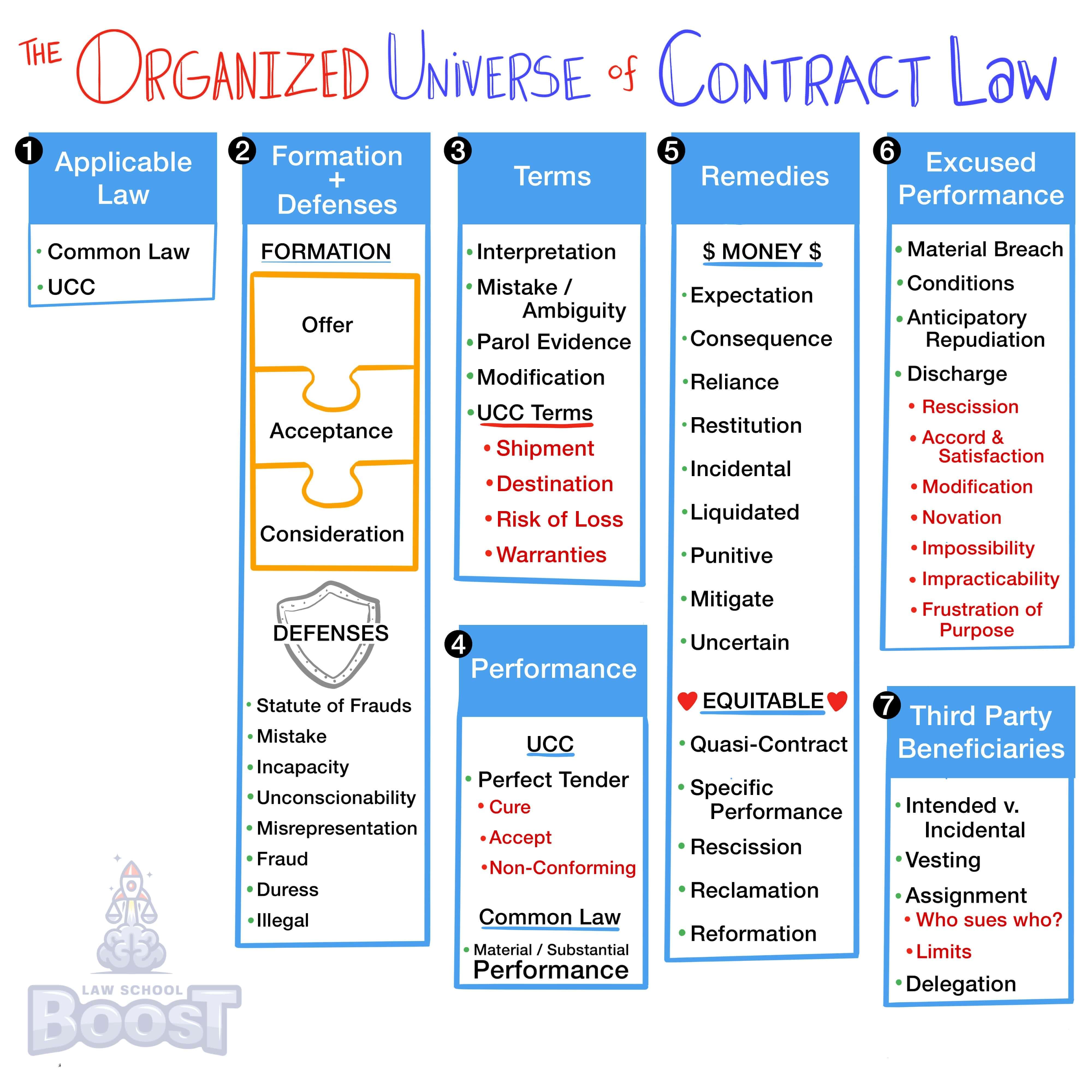

Contracts • Terms of the Contract

K#096

Legal Definition

If the risk of loss is on the buyer, he must pay the full contract price. If the risk of loss is on the seller, the buyer is not liable and the seller may be liable for failing to deliver. To determine the risk of loss, assess the following:

(1) Agreement: The agreement of the parties will control if it identifies who assumes the risk of loss.

(2) Breach: A breaching party is liable for an uninsured loss even where the breach is unrelated to the problem (e.g., late delivery of goods, and then they are destroyed).

(3) Common Carrier Delivery: The risk of loss shifts from the seller to the buyer at the time the seller completes its delivery obligations (look to whether its a shipment or destination contract).

(4) Catch-All: If the seller is a merchant, the risk of loss shifts to the buyer on buyer's "receipt" of the goods. If the seller is not a merchant, the risk of loss shifts to the buyer when the seller "tenders" the goods.

(1) Agreement: The agreement of the parties will control if it identifies who assumes the risk of loss.

(2) Breach: A breaching party is liable for an uninsured loss even where the breach is unrelated to the problem (e.g., late delivery of goods, and then they are destroyed).

(3) Common Carrier Delivery: The risk of loss shifts from the seller to the buyer at the time the seller completes its delivery obligations (look to whether its a shipment or destination contract).

(4) Catch-All: If the seller is a merchant, the risk of loss shifts to the buyer on buyer's "receipt" of the goods. If the seller is not a merchant, the risk of loss shifts to the buyer when the seller "tenders" the goods.

Plain English Explanation

When it comes to figuring out who’s responsible for the risk of loss (basically, who gets stuck paying if something happens to the goods), here’s how to break it down. If the buyer holds the risk, they still have to pay, even if the goods are lost or destroyed. If the seller holds the risk, the buyer doesn’t have to pay, and the seller might have to cover any loss.

Here’s how you figure it out:

(1) Agreement: Check the contract first! If it says who’s responsible for the risk, that’s the rule. The agreement always comes first.

(2) Breach: If someone breaches the contract (even for something small, like late delivery), that party takes on the risk. So, if the goods get lost or damaged after the breach, the breaching party is liable.

(3) Common Carrier Delivery: If a third-party delivery service is used, the risk shifts depending on the type of contract. In a shipment contract, the risk moves to the buyer when the seller hands the goods to the carrier. In a destination contract, the risk stays with the seller until the goods arrive at the buyer’s location.

(4) Catch-All: If the seller is a merchant, the risk shifts to the buyer when the buyer actually takes possession of the goods. If the seller is not a merchant, the risk shifts when the seller just makes the goods available, or "tenders" them.

Here’s how you figure it out:

(1) Agreement: Check the contract first! If it says who’s responsible for the risk, that’s the rule. The agreement always comes first.

(2) Breach: If someone breaches the contract (even for something small, like late delivery), that party takes on the risk. So, if the goods get lost or damaged after the breach, the breaching party is liable.

(3) Common Carrier Delivery: If a third-party delivery service is used, the risk shifts depending on the type of contract. In a shipment contract, the risk moves to the buyer when the seller hands the goods to the carrier. In a destination contract, the risk stays with the seller until the goods arrive at the buyer’s location.

(4) Catch-All: If the seller is a merchant, the risk shifts to the buyer when the buyer actually takes possession of the goods. If the seller is not a merchant, the risk shifts when the seller just makes the goods available, or "tenders" them.

Visual Aids

Related Concepts

Does the Parol Evidence Rule allow evidence of defenses to enforcement?

How does a limitation on remedies affect warranties?

How do you identify express warranties?

How is the Parol Evidence Rule handled under UCC?

Under the Parol Evidence Rule, is parol evidence admissible to clarify ambiguities?

Under the Parol Evidence Rule, what is the effect of a clerical mistake in integration?

Under the Parol Evidence Rule, what is the effect of changing or contradicting terms in a written deal?

Under the Parol Evidence Rule, when are conditions precedent admissible?

Under the Parol Evidence Rule, when will a court allow terms to be added to a written deal?

Under the UCC, how is privity a limitation on warranty liability?

Under the UCC, in determining the seller's delivery obligations while using a common carrier, what is FOB (Free on Board)?

Under the UCC, in determining the seller's delivery obligations while using a common carrier, what is FAS (Free Alongside)?

Under the UCC, in determining the seller's delivery obligations while using a common carrier, what is CIF (Cost, Insurance, and Freight) and CF (Cost and Freight)?

Under the UCC, what is the effect of a buyer examining goods before acceptance?

Under the UCC, what is the statute of limitations on warranties of quality?

Under the UCC, when does risk of loss pass to which party when using a non-common carrier?

Under the UCC, which warranties can be disclaimed?

What are destination contracts?

What are shipment contracts?

What are the default warranties of quality available under the UCC?

What is a merger clause?

What is an implied warranty of fitness for a particular purpose?

What is an implied warranty of merchantability?

What is an integration?

What is a partial integration?

What is parol evidence?

What is the Parol Evidence Rule?

When may conduct be a source of contract terms?