🌕

Corporations • Federal Securities Laws

CORP#068

Legal Definition

A misappropriator is a person who steals or converts material non-public information in violation of a confidential relationship (e.g., parent-child, principal-agent) and uses it to purchase or sell securities.

Plain English Explanation

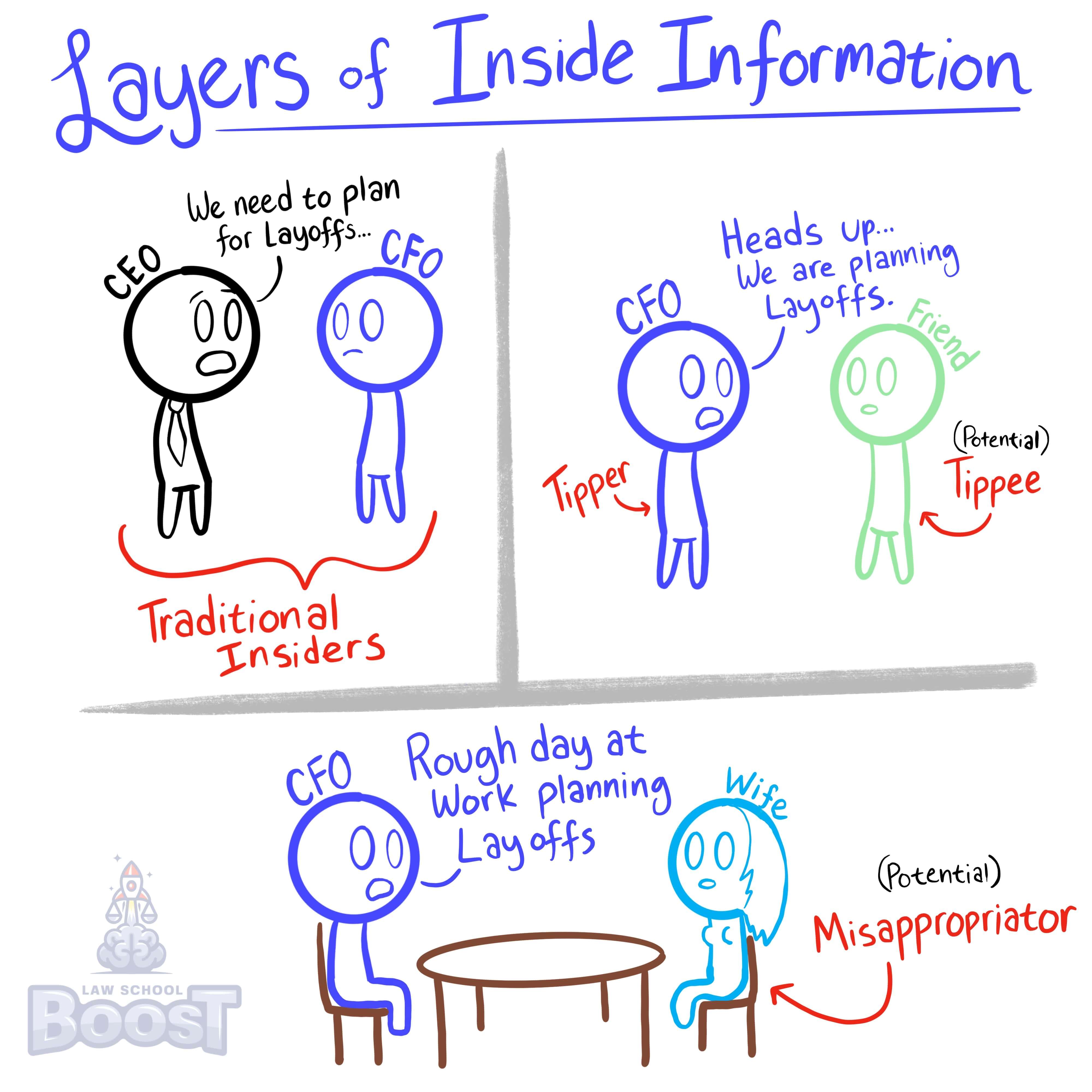

There are three main types of "insider", one of which is the misappropriator.

To "misappropriate" something means to dishonestly or unfairly take something that belongs to someone else and selfishly use it for your own personal gain. With that in mind, think of misappropriation as insider trading opportunists. Directors and officers of a company (who would be considered traditional insiders) cannot operate the company on their own. They have employees and assistants who take notes for them, empty their garbage, make copies of sensitive documents, etc. Additionally, they may have spouses who they vent to when they get home from work. So what happens if an employee or spouse wrongfully uses non-public information they find out as a result of their confidential relationship and decide to use that information to purchase or sell stock? They become a misappropriator.

In other words, to successfully identify a misappropriator, you want to look for someone who basically took advantage of their relationship with a traditional insider in order to get access to non-public information.

To "misappropriate" something means to dishonestly or unfairly take something that belongs to someone else and selfishly use it for your own personal gain. With that in mind, think of misappropriation as insider trading opportunists. Directors and officers of a company (who would be considered traditional insiders) cannot operate the company on their own. They have employees and assistants who take notes for them, empty their garbage, make copies of sensitive documents, etc. Additionally, they may have spouses who they vent to when they get home from work. So what happens if an employee or spouse wrongfully uses non-public information they find out as a result of their confidential relationship and decide to use that information to purchase or sell stock? They become a misappropriator.

In other words, to successfully identify a misappropriator, you want to look for someone who basically took advantage of their relationship with a traditional insider in order to get access to non-public information.

Hypothetical

Hypo 1: Sam is a summer associate at BigLaw who works only on criminal defense. BigLaw handles many types of legal issues. One of BigLaw's main clients is HypoCorp. HypoCorp is getting ready to acquire TinyCorp and is asking BigLaw to prepare the acquisition documents. One day, Sam goes to make copies of files for his boss and sees paperwork left in the copier from an attorney he's never worked with. The documents provide details about HypoCorp's upcoming offer. Sam reads the documents. Later, on Sam's lunch break, he uses his phone to purchase 1,000 shares of TinyCorp knowing that when HypoCorp announces its acquisition, the shares will become much more valuable. Result: Sam is a misappropriator. Sam has a confidential, trusted relationship with BigLaw, which is why he's allowed to walk around the office and have access to potentially confidential information. He breached this trust when he used the information found on the copier to purchase shares of TinyCorp. Sam would be found guilty under a Rule 10b-5 action.

Visual Aids

Related Concepts

Under Rule 10b-5, when does someone commit insider trading?

What is a tipper?

What is a traditional insider?

What is Rule 10b-5 (regarding Anti-Fraud) and its elements?

What is the Sarbanes-Oxley (SOX) Act and when does it apply?

When does Section 16(b) (regarding Short Swing Profits) apply?

When is a tippee liable?