🌕

Corporations • Federal Securities Laws

CORP#070

Legal Definition

A tippee is liable where the (1) the tipper breached their fiduciary duty, (2) the tippee knew or had reason to know of the breach, and (3) the tippee used the information by trading or tipping for a personal benefit.

Plain English Explanation

Usually when you see the letters "ee" at the end of a legal word, it means the person is receiving something from someone else. Thus, a tippee is someone who receives a tip from a tipper. You may remember a hypo from another card where the Director of HypoCorp discovered that a recently purchased parcel of land had a bunch of oil underneath it and after they told their brother, the brother purchased shares of HypoCorp. In this example, the Director is liable as a tipper the moment their brother, the tippee, used the information to purchase shares of HypoCorp. But is the brother liable? After all, people buy and sell stock all the time after they learn new information, so when does a tippee become liable?

There are two ways that a tippee can be liable.

The first way is the most common. Put simply, when a tippee either knows or should know that the information they've received is non-public insider information that should not be used to buy or sell stock, but they do buy or sell stock, then they are guilty. In other words, if a tippee doesn't realize what they just learned is sensitive information, then making a trade isn't wrong or illegal. But if a little voice in their head says, "This feels like information I shouldn't know about..." then its probably illegal.

The second way a tippee can be liable is if they become a tipper. In other words, if a tippee receives information, knows that it is sensitive non-public insider information, and then gives that information to someone else in exchange for some benefit, they are liable. In this instance, your analysis is the same as you learned under the tipper liability card.

There are two ways that a tippee can be liable.

The first way is the most common. Put simply, when a tippee either knows or should know that the information they've received is non-public insider information that should not be used to buy or sell stock, but they do buy or sell stock, then they are guilty. In other words, if a tippee doesn't realize what they just learned is sensitive information, then making a trade isn't wrong or illegal. But if a little voice in their head says, "This feels like information I shouldn't know about..." then its probably illegal.

The second way a tippee can be liable is if they become a tipper. In other words, if a tippee receives information, knows that it is sensitive non-public insider information, and then gives that information to someone else in exchange for some benefit, they are liable. In this instance, your analysis is the same as you learned under the tipper liability card.

Hypothetical

Hypo 1: Bob and Sam are directors at HypoCorp. HypoCorp just purchased a new parcel of land to build an office and is having it inspected by Amy, a geologist. Amy discovers that there is a large amount of oil under the land. Bob and Sam decide they will announce this news at their next shareholder meeting in 1 month. After work, Sam decides to grab dinner with his brother. While they eat their burritos, Sam tells his brother, "Oh man, what a crazy day. You remember how HypoCorp bought that new parcel of land? Turns out there is a ton of oil under the land. It's gotta be worth a fortune." Later that night, Sam's brother buys HypoCorp stock. Result: Sam is a tipper and can be held liable for providing the information to his brother. But what about the brother? On an exam, this would be a hard one to argue, but you should try your best. One argument is that a reasonable person would know that the sudden discovery of oil would mean the company is worth a lot more, and the fact that the discovery had been made merely hours before being told would signal that it wasn't something public yet. A more obvious example of liability would be if Sam said something like, "Don't tell anyone, but..." or "We're not going to announce this publicly for a month, but..."

Hypo 2: Same facts as above, but Sam's brother doesn't buy any stock. Instead, he goes home and tells his neighbor, a stock trader, in exchange for forgiving a loan the brother took from his neighbor. The neighbor uses the information to purchase HypoCorp stock. Result: Here, Sam's brother has become a tipper and is liable for giving the information to the neighbor.

Hypo 2: Same facts as above, but Sam's brother doesn't buy any stock. Instead, he goes home and tells his neighbor, a stock trader, in exchange for forgiving a loan the brother took from his neighbor. The neighbor uses the information to purchase HypoCorp stock. Result: Here, Sam's brother has become a tipper and is liable for giving the information to the neighbor.

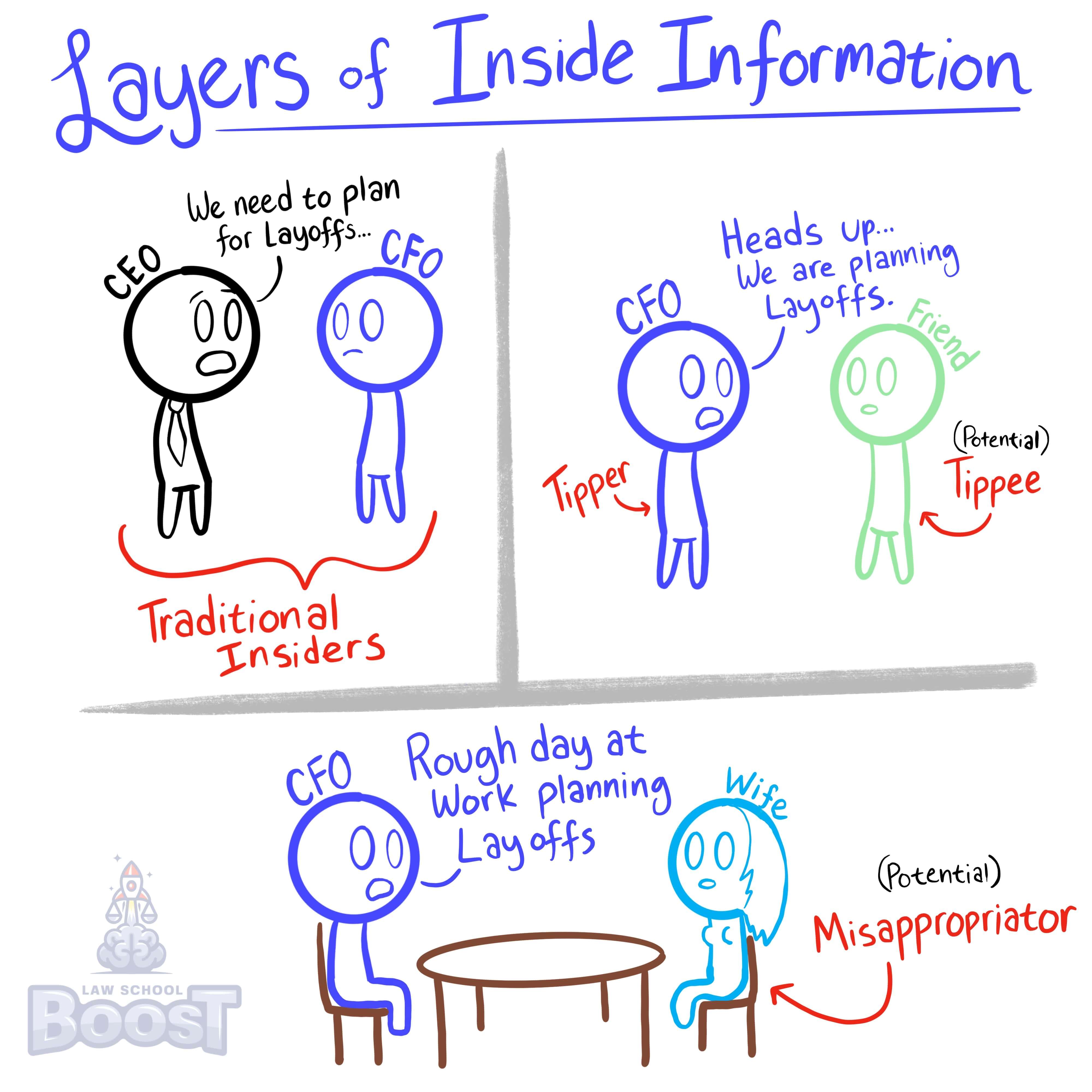

Visual Aids

Related Concepts

Under Rule 10b-5, when does someone commit insider trading?

What is a misappropriator?

What is a tipper?

What is a traditional insider?

What is Rule 10b-5 (regarding Anti-Fraud) and its elements?

What is the Sarbanes-Oxley (SOX) Act and when does it apply?

When does Section 16(b) (regarding Short Swing Profits) apply?