🌕

Corporations • Federal Securities Laws

CORP#069

Legal Definition

A tipper is a person who, in breach of his fiduciary duty, wrongfully tips inside information for a personal benefit to another who trades on it (a "tippee").

Plain English Explanation

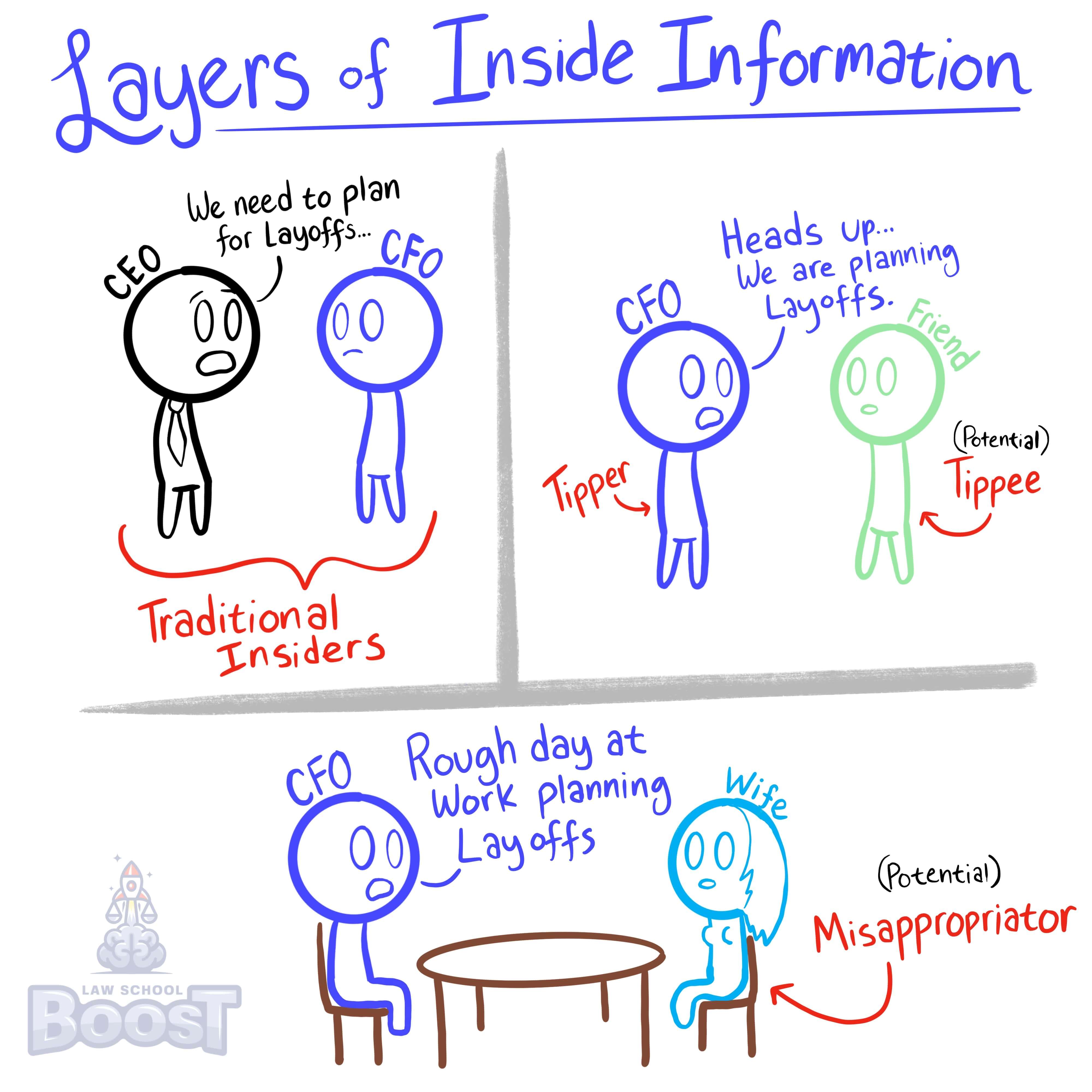

There are three main types of "insider", one of which is the tipper.

Generally speaking, a "tipper" is someone who has access to non-public information and gives it to someone else in return for some sort of benefit. That benefit may be as obvious as money (e.g., if someone sells insider information to someone else), but the benefit doesn't have to be money. Some other examples of a tipper receiving a benefit in exchange for giving someone insider information include: (a) Giving information in exchange for a beer; (b) giving information to a family member simply because it makes the tipper feel like a good person; (c) giving information to someone because the tipper wants to impress people with how much information they have. The benefit can be intangible, and just about anything can arguably be a benefit — and, on an exam, you will have to argue.

In other words, to successfully identify a tipper, you want to look for someone who didn't personally trade on non-public information, but gave it to someone else who did. Once you identify that, look for any benefit the tipper may have received from providing that information, ranging from a bag of cash to a high-five and praise.

Generally speaking, a "tipper" is someone who has access to non-public information and gives it to someone else in return for some sort of benefit. That benefit may be as obvious as money (e.g., if someone sells insider information to someone else), but the benefit doesn't have to be money. Some other examples of a tipper receiving a benefit in exchange for giving someone insider information include: (a) Giving information in exchange for a beer; (b) giving information to a family member simply because it makes the tipper feel like a good person; (c) giving information to someone because the tipper wants to impress people with how much information they have. The benefit can be intangible, and just about anything can arguably be a benefit — and, on an exam, you will have to argue.

In other words, to successfully identify a tipper, you want to look for someone who didn't personally trade on non-public information, but gave it to someone else who did. Once you identify that, look for any benefit the tipper may have received from providing that information, ranging from a bag of cash to a high-five and praise.

Hypothetical

Hypo 1: Bob and Sam are directors at HypoCorp. HypoCorp just purchased a new parcel of land to build an office and is having it inspected by Amy, a geologist. Amy discovers that there is a large amount of oil under the land. Bob and Sam decide they will announce this news at their next shareholder meeting in 1 month. After work, Sam decides to grab dinner with his brother. While they eat their burritos, Sam tells his brother, "Oh man, what a crazy day. You remember how HypoCorp bought that new parcel of land? Turns out there is a ton of oil under the land. It's gotta be worth a fortune." Later that night, Sam's brother buys HypoCorp stock. Additionally, Sam's waitress overheard Sam talking to his brother and also purchased stock in HypoCorp. Result: Sam is a tipper and can be held liable for providing the information to his brother. You may be wondering, "But what benefit did Sam get from telling his brother? His brother didn't pay, nor did Sam do it to try to help him out." The benefit is merely the enjoyment and entertainment of sharing gossip. Sam has an obligation to not share such information, and he breached that duty. However, Sam did not intend to share with the waitress, which means he wouldn't be liable for her decision to purchase shares with the information.

Visual Aids

Related Concepts

Under Rule 10b-5, when does someone commit insider trading?

What is a misappropriator?

What is a traditional insider?

What is Rule 10b-5 (regarding Anti-Fraud) and its elements?

What is the Sarbanes-Oxley (SOX) Act and when does it apply?

When does Section 16(b) (regarding Short Swing Profits) apply?

When is a tippee liable?