😀

Real Property • Present Possessory Estates

PROP#003

Legal Definition

A defeasible fee is a fee simple estate that can be terminated when a stated event occurs.

Plain English Explanation

A defeasible fee is a fee simple that is vulnerable to being defeated (or terminated) at a later point, upon the happening of some condition. In other words, it's a fee simple with strings attached.

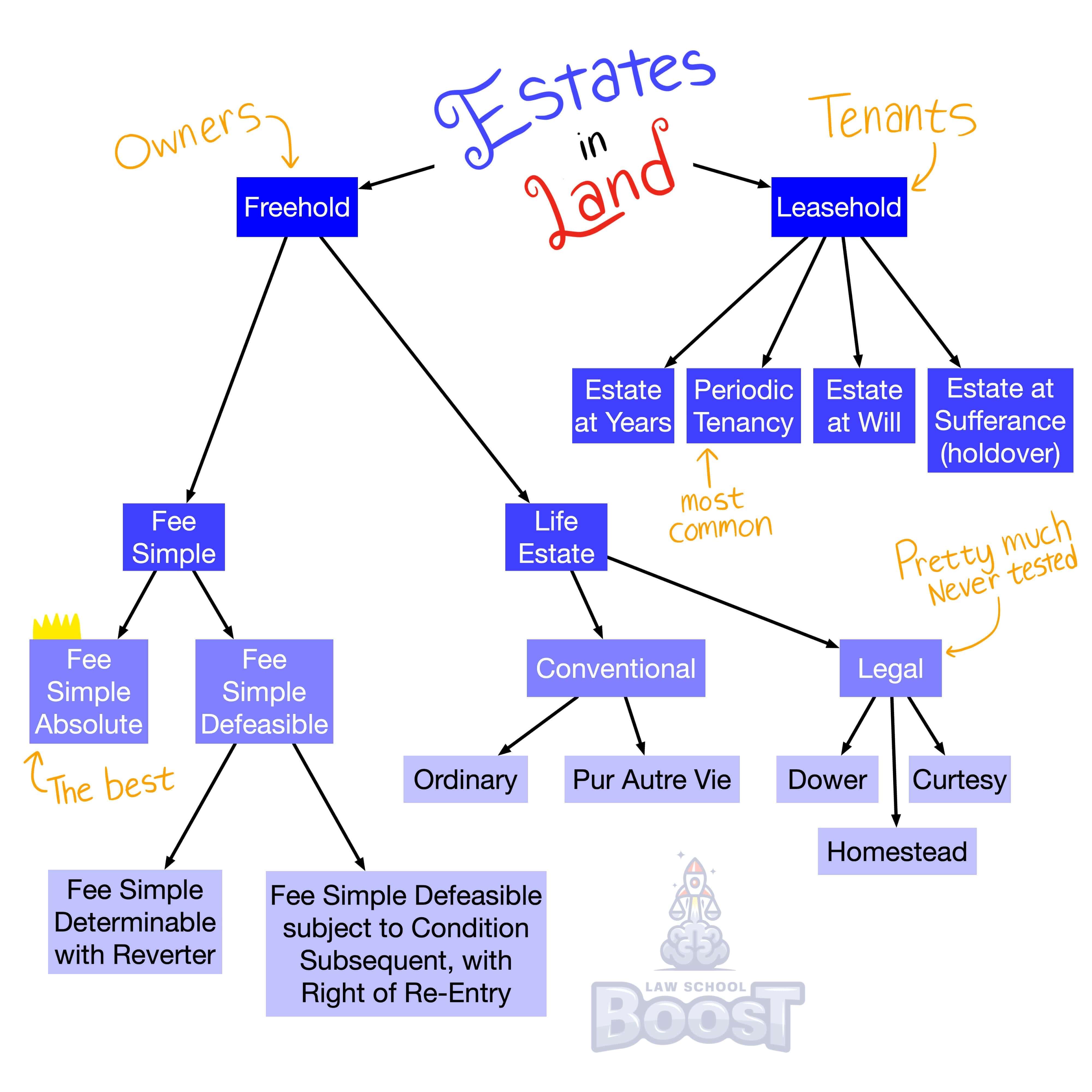

Note that "defeasible fees" are a class of rights, meaning that there are multiple types of "defeasible fees" (which we will cover in other cards). Those types are:

(1) Fee Simple Determinable

(2) Fee Simple Subject to Condition Subsequent

(3) Fee Simple Subject to an Executory Interest

Note that "defeasible fees" are a class of rights, meaning that there are multiple types of "defeasible fees" (which we will cover in other cards). Those types are:

(1) Fee Simple Determinable

(2) Fee Simple Subject to Condition Subsequent

(3) Fee Simple Subject to an Executory Interest

Visual Aids

Related Concepts

How is a fee simple determinable created?

How is a fee simple subject to condition subsequent created?

In assessing a present possessory estate, what is affirmative waste?

In assessing a present possessory estate, what is ameliorative waste?

In assessing a present possessory estate, what is permissive waste?

What are the 3 types of waste a life estate holder may commit?

What are the present possessory estates?

What happens when a life estate holder renounces his interest?

What is a fee simple absolute?

What is a fee simple subject to executory interest?

What is a fee tail, how is it created, and what is the result of its creation in most jurisdictions today?

What is a life estate?

What is a life estate pur autre vie and how is it created?

What rights and duties do the holder of a life estate have?

What will a court do if it is not clear whether someone intended to create a fee simple determinable or subject to condition subsequent?