‼️

Prof Responsibility • Loyalty

PR#037

Legal Definition

Under Rule 1.8(e) lawyer may not financially assist a client, except for: (1) litigation expenses for an *indigent* client; or (2) where the advance of litigation expenses occurs in contingent fee cases.

Plain English Explanation

The legal system can be expensive, and clients often face significant costs when pursuing a case. It might seem natural for a lawyer to want to help their client by lending them money, especially if the client is struggling financially. However, the rules of professional conduct generally forbid lawyers from providing financial assistance to their clients.

If lawyers could freely lend money to clients, it might create conflicts of interest. A lawyer might be tempted to give advice based on their own financial stake in the case rather than what's best for the client. It could also give lawyers an unfair advantage in attracting clients, turning the practice of law into a competition of who can offer the most financial incentives.

However, the rule recognizes two important exceptions. First, lawyers can advance the costs of litigation (like court filing fees or expert witness fees) for clients who are truly poor or indigent. This helps ensure that lack of money doesn't completely bar people from accessing the justice system.

Second, in contingent fee cases (where the lawyer only gets paid if the client wins), the lawyer can advance litigation costs for any client, not just indigent ones. This makes sense because in these cases, the lawyer is already taking on financial risk by only getting paid if they win. Allowing them to advance costs can help cases move forward that might otherwise stall due to the client's inability to pay upfront expenses.

It's important to note that in both exceptions, we're talking about advancing costs directly related to the litigation, not personal loans or living expenses. The lawyer is still expected to seek repayment of these costs, usually from any recovery obtained for the client.

If lawyers could freely lend money to clients, it might create conflicts of interest. A lawyer might be tempted to give advice based on their own financial stake in the case rather than what's best for the client. It could also give lawyers an unfair advantage in attracting clients, turning the practice of law into a competition of who can offer the most financial incentives.

However, the rule recognizes two important exceptions. First, lawyers can advance the costs of litigation (like court filing fees or expert witness fees) for clients who are truly poor or indigent. This helps ensure that lack of money doesn't completely bar people from accessing the justice system.

Second, in contingent fee cases (where the lawyer only gets paid if the client wins), the lawyer can advance litigation costs for any client, not just indigent ones. This makes sense because in these cases, the lawyer is already taking on financial risk by only getting paid if they win. Allowing them to advance costs can help cases move forward that might otherwise stall due to the client's inability to pay upfront expenses.

It's important to note that in both exceptions, we're talking about advancing costs directly related to the litigation, not personal loans or living expenses. The lawyer is still expected to seek repayment of these costs, usually from any recovery obtained for the client.

Hypothetical

Hypo 1: Bob represents Amy in a personal injury case on a contingency fee basis. Amy can't afford the $5,000 fee for an expert witness crucial to her case. Bob advances this fee, with the understanding it will be repaid from any settlement or judgment. Result: This is permissible under Rule 1.8(e). As this is a contingency fee case, Bob is allowed to advance litigation expenses, including expert witness fees.

Hypo 2: Bob is representing Amy pro bono in a landlord-tenant dispute. Amy is unemployed and can't afford the $500 court filing fee. Bob pays this fee for Amy. Result: This is permissible under Rule 1.8(e). Amy qualifies as an indigent client, and court filing fees are a litigation expense that Bob is allowed to advance for her.

Hypo 3: While representing Amy in a divorce case, Bob learns that Amy is struggling to pay her rent due to the ongoing legal proceedings. Bob offers to loan Amy $2,000 for her rent until the case is settled. Result: This violates Rule 1.8(e). The rent payment is not a litigation expense, and the rule does not allow lawyers to provide financial assistance for personal expenses, even in difficult circumstances.

Hypo 4: Bob is representing Amy in a contingency fee employment discrimination case. Amy mentions she's having trouble paying for transportation to attend depositions and court hearings. Bob gives Amy a $200 prepaid gas card. Result: This likely violates Rule 1.8(e). While Bob can advance litigation costs in a contingency fee case, personal transportation costs are generally not considered litigation expenses under this rule.

Hypo 5: Bob represents Amy, a low-income client, in a small claims court case. The court requires parties to pay for their own interpreters. Amy needs an interpreter but can't afford the $100 fee. Bob pays for the interpreter. Result: This is permissible under Rule 1.8(e). Amy likely qualifies as an indigent client, and the interpreter fee is directly related to the litigation. Therefore, Bob can advance this cost for Amy.

Hypo 2: Bob is representing Amy pro bono in a landlord-tenant dispute. Amy is unemployed and can't afford the $500 court filing fee. Bob pays this fee for Amy. Result: This is permissible under Rule 1.8(e). Amy qualifies as an indigent client, and court filing fees are a litigation expense that Bob is allowed to advance for her.

Hypo 3: While representing Amy in a divorce case, Bob learns that Amy is struggling to pay her rent due to the ongoing legal proceedings. Bob offers to loan Amy $2,000 for her rent until the case is settled. Result: This violates Rule 1.8(e). The rent payment is not a litigation expense, and the rule does not allow lawyers to provide financial assistance for personal expenses, even in difficult circumstances.

Hypo 4: Bob is representing Amy in a contingency fee employment discrimination case. Amy mentions she's having trouble paying for transportation to attend depositions and court hearings. Bob gives Amy a $200 prepaid gas card. Result: This likely violates Rule 1.8(e). While Bob can advance litigation costs in a contingency fee case, personal transportation costs are generally not considered litigation expenses under this rule.

Hypo 5: Bob represents Amy, a low-income client, in a small claims court case. The court requires parties to pay for their own interpreters. Amy needs an interpreter but can't afford the $100 fee. Bob pays for the interpreter. Result: This is permissible under Rule 1.8(e). Amy likely qualifies as an indigent client, and the interpreter fee is directly related to the litigation. Therefore, Bob can advance this cost for Amy.

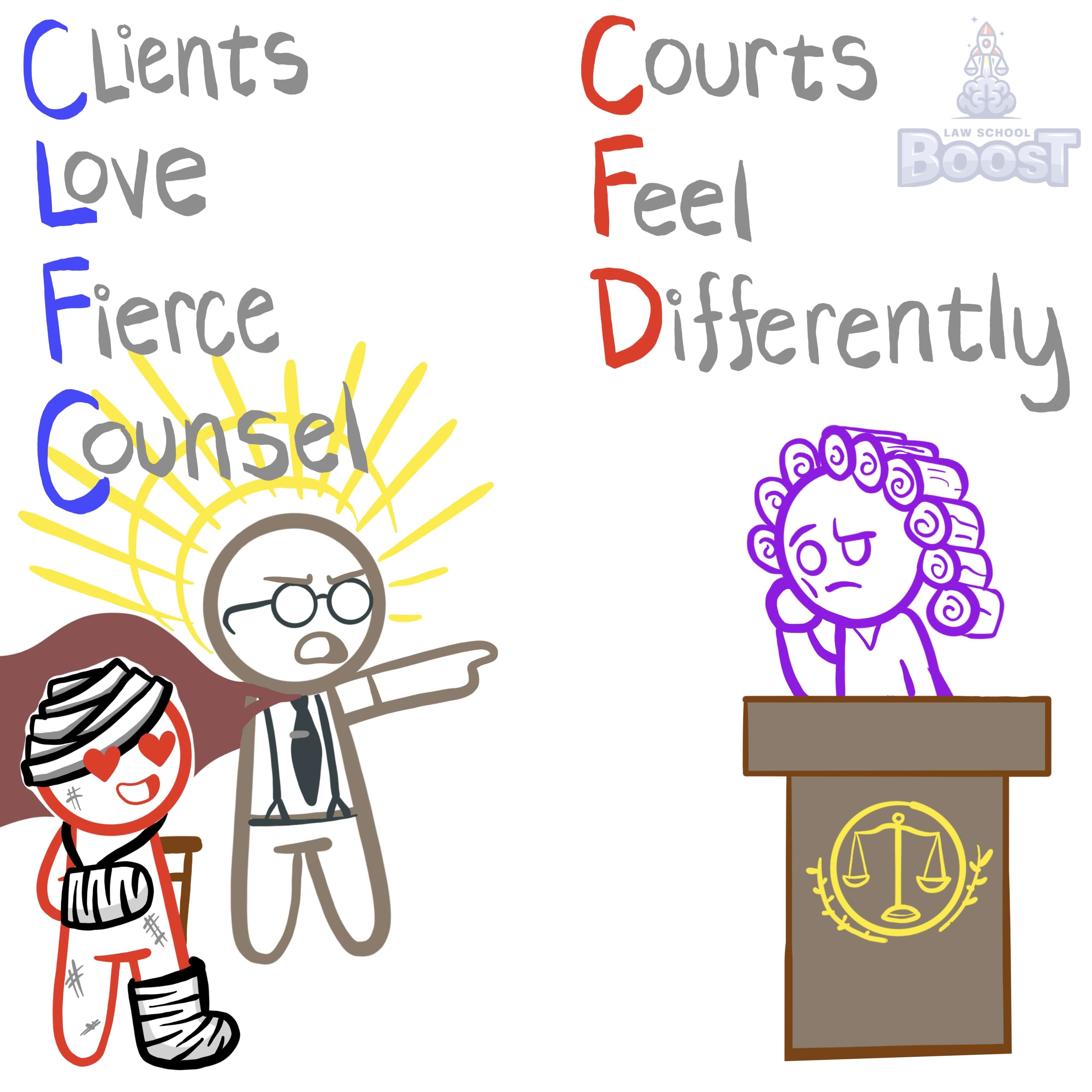

Visual Aids

Related Concepts

Are lawyers allowed to have sex with their clients?

Can an attorney continue to represent a client if a conflict exists?

Does representing clients with inconsistent positions violate the lawyer's Duty of Loyalty?

How can a lawyer limit their malpractice liability with a client?

How can screening avoid imputed conflicts?

How do the California rules differ from the ABA when it comes to a lawyer accepting compensation from a party other than their client?

In assessing a conflict of interest, what is a concurrent conflict?

In assessing the Duty of Loyalty, what's the difference between an actual conflict and a potential conflict?

In California, are lawyer's allowed to have sex with their clients?

In California, how can a lawyer limit their malpractice liability with a client?

In California, how must a lawyer advise their client to seek independent counsel when dealing with potential financial conflicts?

In California, may a lawyer represent an insurance company and its policyholder as joint clients?

In California, what are the restrictions related to lawyers acquiring the media rights of their clients?

In California, what are the restrictions related to lawyers receiving gifts from their clients?

In California, when may a lawyer loan money to a client?

What are some common issues that occur when a lawyer represents multiple clients in the same matter?

What are the most common types of conflicts of interest that involve a lawyer's own interest?

What are the restrictions related to lawyers acquiring the media rights of their clients?

What are the restrictions related to lawyers receiving gifts from their clients?

What is an imputed conflict and how can it be resolved?

What is required in order for a lawyer to accept compensation from a party other than their client?

What is required in order for a lawyer to avoid a financial conflict with a client?

What is the Duty of Loyalty?

When does the general rule of imputed conflicts NOT apply?

When may a lawyer appear as a witness in a matter where they represent a party?

When may there be a conflict of interest with a former client?