‼️

Prof Responsibility • Loyalty

PR#038

Legal Definition

A lawyer may not promise to pay a prospective client's debts, but may make loans to a client in all matters for any purpose with a written loan agreement.

Plain English Explanation

In California, lawyers can't dangle financial carrots to lure in new business. But once you've crossed the threshold from potential client to actual client, the rules do a complete 180. Suddenly, it's as if your lawyer has transformed into a friendly neighborhood bank, able to lend you money for just about anything. Need cash for groceries? Check. Want to fund your dream of opening a pickle-flavored ice cream shop? Oddly specific, but also check.

The catch? It's all got to be in black and white. No handshake deals or pinky promises here. The loan agreement needs to be written down, signed, and probably stored somewhere fireproof for good measure. This written requirement is like a safety net, ensuring both lawyer and client don't end up in a "he said, she said" situation down the line.

This rule is California's way of saying, "We trust our lawyers to help their clients, but let's keep everything above board." It's a balancing act between allowing lawyers to be supportive and ensuring they don't cross ethical lines.

The catch? It's all got to be in black and white. No handshake deals or pinky promises here. The loan agreement needs to be written down, signed, and probably stored somewhere fireproof for good measure. This written requirement is like a safety net, ensuring both lawyer and client don't end up in a "he said, she said" situation down the line.

This rule is California's way of saying, "We trust our lawyers to help their clients, but let's keep everything above board." It's a balancing act between allowing lawyers to be supportive and ensuring they don't cross ethical lines.

Hypothetical

Hypo 1: Sam, facing a potential lawsuit, approaches Bob for legal representation. Sam mentions he's struggling financially. Bob, hoping to secure Sam as a client, offers to pay off Sam's $5,000 credit card debt if Sam hires him. Result: This violates California's rule. Bob is promising to pay a prospective client's debts, which is explicitly prohibited. This could be seen as Bob trying to "buy" Sam as a client, which is unethical. Bob should refrain from making such offers and instead focus on his legal qualifications and strategy for Sam's case.

Hypo 2: Bob has been representing Sam in a personal injury case for several months. The case is taking longer than expected, and Sam is struggling to pay rent. Sam asks Bob if he can lend him $2,000 for rent. Bob agrees and draws up a written loan agreement, specifying the amount, interest (if any), and repayment terms. Result: This is permissible under California's rule. Sam is an existing client, not a prospective one. Bob is allowed to make a loan to Sam for any purpose, including personal expenses like rent. The key is that Bob has properly documented the loan with a written agreement. This follows the letter and spirit of the rule, allowing Bob to help his client while maintaining proper documentation.

Hypo 3: Sam, a potential client, meets with Bob to discuss representation in a complex corporate lawsuit. Sam mentions that taking on the lawsuit might require him to shut down his business temporarily. Bob, seeing a lucrative case, offers to loan Sam money to keep his business afloat if Sam hires him, promising to put the loan in writing after Sam officially becomes a client. Result: This scenario violates California's rule. Even though Bob is promising to document the loan in writing later, he is still essentially promising to pay a prospective client's debts (in this case, business expenses) to secure representation. This falls under the prohibited behavior of the rule. Bob should not make such offers to prospective clients, regardless of his intentions to formalize it later. Instead, Bob should focus on his legal strategy and skills, and only discuss potential loans after Sam has become a client without such incentives.

Hypo 2: Bob has been representing Sam in a personal injury case for several months. The case is taking longer than expected, and Sam is struggling to pay rent. Sam asks Bob if he can lend him $2,000 for rent. Bob agrees and draws up a written loan agreement, specifying the amount, interest (if any), and repayment terms. Result: This is permissible under California's rule. Sam is an existing client, not a prospective one. Bob is allowed to make a loan to Sam for any purpose, including personal expenses like rent. The key is that Bob has properly documented the loan with a written agreement. This follows the letter and spirit of the rule, allowing Bob to help his client while maintaining proper documentation.

Hypo 3: Sam, a potential client, meets with Bob to discuss representation in a complex corporate lawsuit. Sam mentions that taking on the lawsuit might require him to shut down his business temporarily. Bob, seeing a lucrative case, offers to loan Sam money to keep his business afloat if Sam hires him, promising to put the loan in writing after Sam officially becomes a client. Result: This scenario violates California's rule. Even though Bob is promising to document the loan in writing later, he is still essentially promising to pay a prospective client's debts (in this case, business expenses) to secure representation. This falls under the prohibited behavior of the rule. Bob should not make such offers to prospective clients, regardless of his intentions to formalize it later. Instead, Bob should focus on his legal strategy and skills, and only discuss potential loans after Sam has become a client without such incentives.

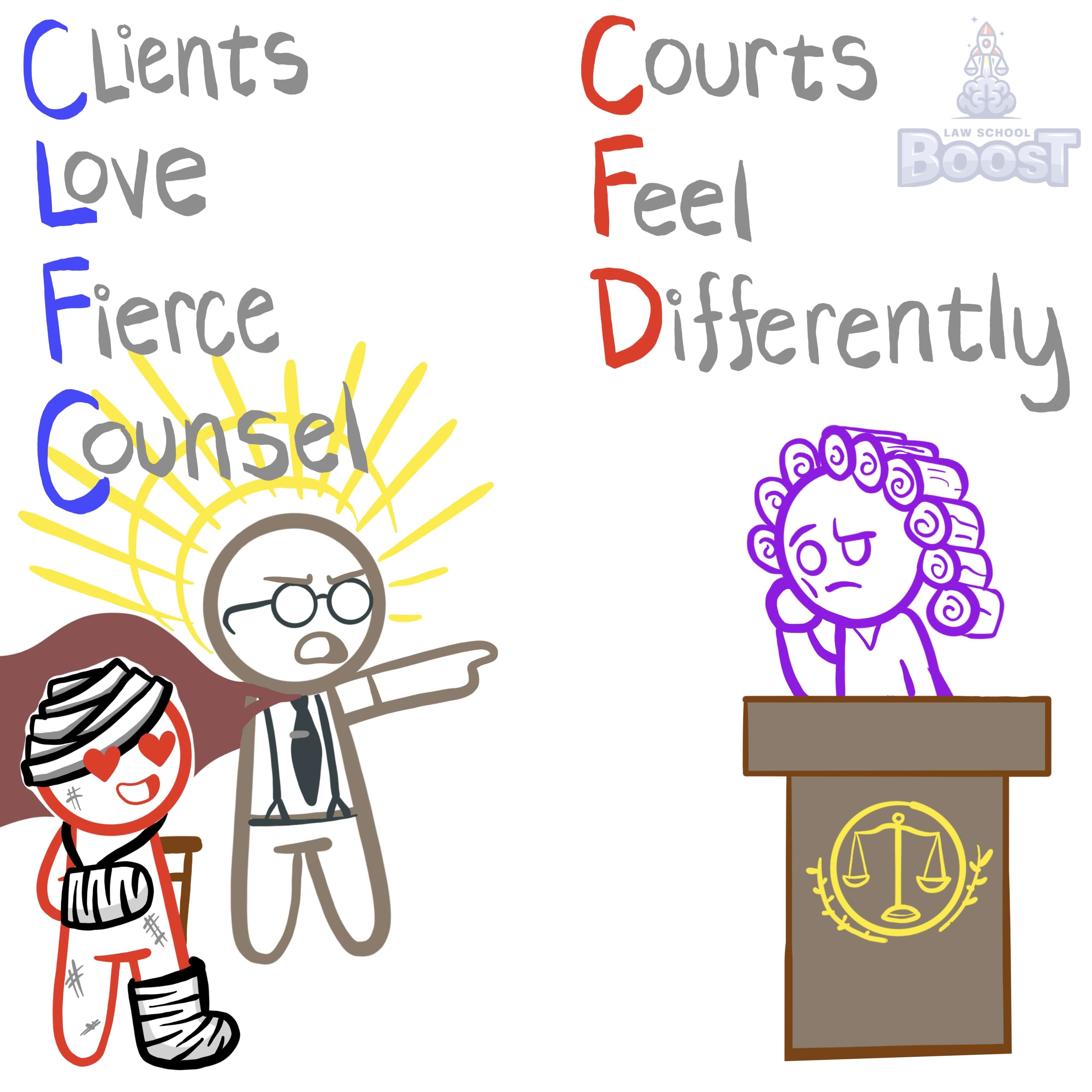

Visual Aids

Related Concepts

Are lawyers allowed to have sex with their clients?

Can an attorney continue to represent a client if a conflict exists?

Does representing clients with inconsistent positions violate the lawyer's Duty of Loyalty?

How can a lawyer limit their malpractice liability with a client?

How can screening avoid imputed conflicts?

How do the California rules differ from the ABA when it comes to a lawyer accepting compensation from a party other than their client?

In assessing a conflict of interest, what is a concurrent conflict?

In assessing the Duty of Loyalty, what's the difference between an actual conflict and a potential conflict?

In California, are lawyer's allowed to have sex with their clients?

In California, how can a lawyer limit their malpractice liability with a client?

In California, how must a lawyer advise their client to seek independent counsel when dealing with potential financial conflicts?

In California, may a lawyer represent an insurance company and its policyholder as joint clients?

In California, what are the restrictions related to lawyers acquiring the media rights of their clients?

In California, what are the restrictions related to lawyers receiving gifts from their clients?

What are some common issues that occur when a lawyer represents multiple clients in the same matter?

What are the most common types of conflicts of interest that involve a lawyer's own interest?

What are the restrictions related to lawyers acquiring the media rights of their clients?

What are the restrictions related to lawyers receiving gifts from their clients?

What is an imputed conflict and how can it be resolved?

What is required in order for a lawyer to accept compensation from a party other than their client?

What is required in order for a lawyer to avoid a financial conflict with a client?

What is the Duty of Loyalty?

When does the general rule of imputed conflicts NOT apply?

When may a lawyer appear as a witness in a matter where they represent a party?

When may a lawyer loan money to a client?

When may there be a conflict of interest with a former client?