🌕

Corporations • Rights of Shareholders

CORP#052

Legal Definition

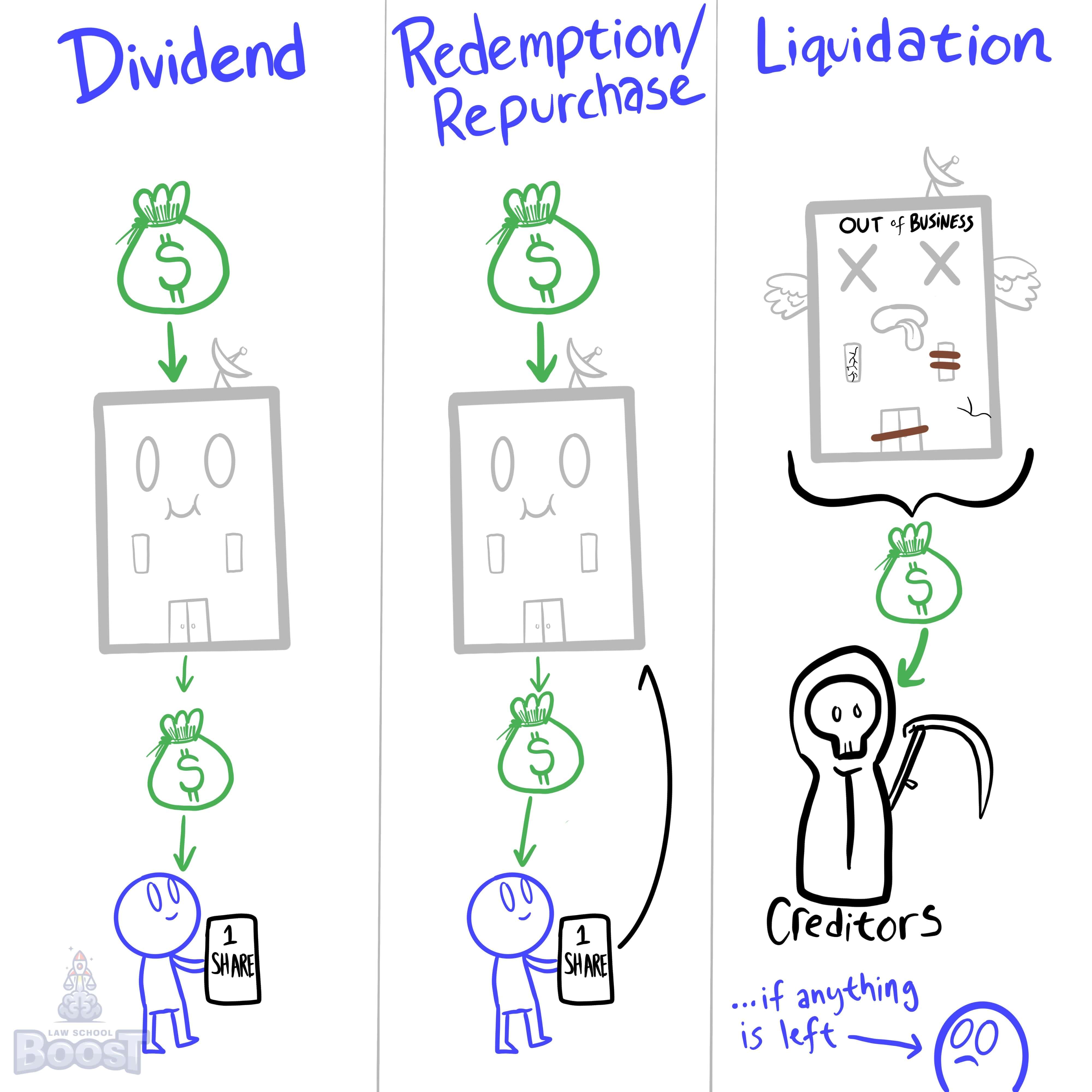

The three most common forms of distributions are: (1) dividends paid to shareholders, (2) redemption of shareholder stock (where the corporation has a redemption right) or repurchase of shareholder stock (where the shareholder voluntarily sells), and (3) liquidating distributions when the corporation is dissolved.

Plain English Explanation

A "distribution" is when a corporation gives cash or property to its shareholders. There are 3 common types of distributions:

(1) The most popular one that most folks know about is a dividend, which is usually a cash payment to shareholders. For example, HypoCorp may declare a dividend of "$1 per share." If you owned 100 shares of HypoCorp, you would receive a check for $100.

(2) Another common type of distribution involves a stock buyback, where the corporation takes some of its profits and uses them to buy shares of stock from its shareholders. There are two scenarios to do this. In the first scenario, some corporations issue stock with a redemption right, which means the corporation has the right to purchase the shares back at a later point. In this scenario, shareholders would have no choice but to sell their shares back to the corporation. In the second scenario, a corporation basically just makes an offer to its shareholders to repurchase their shares at a specific price and allow shareholders to choose whether or not they want to accept the offer.

(3) The last common type of distribution occurs when a corporation is dissolved. In other words, when a corporation is going out of business and winding up its operations, it can basically divide up any remaining money it has left over (after paying off its other creditors and obligations) and give that to shareholders.

(1) The most popular one that most folks know about is a dividend, which is usually a cash payment to shareholders. For example, HypoCorp may declare a dividend of "$1 per share." If you owned 100 shares of HypoCorp, you would receive a check for $100.

(2) Another common type of distribution involves a stock buyback, where the corporation takes some of its profits and uses them to buy shares of stock from its shareholders. There are two scenarios to do this. In the first scenario, some corporations issue stock with a redemption right, which means the corporation has the right to purchase the shares back at a later point. In this scenario, shareholders would have no choice but to sell their shares back to the corporation. In the second scenario, a corporation basically just makes an offer to its shareholders to repurchase their shares at a specific price and allow shareholders to choose whether or not they want to accept the offer.

(3) The last common type of distribution occurs when a corporation is dissolved. In other words, when a corporation is going out of business and winding up its operations, it can basically divide up any remaining money it has left over (after paying off its other creditors and obligations) and give that to shareholders.

Visual Aids

Related Concepts

Are shareholder proxies revocable?

How is an action approved at a shareholder meeting?

In regards to shareholder suits, what are derivative action?

In regards to shareholder suits, what are direct actions?

In what form may dividends be paid?

What are the liabilities of shareholders and controlling shareholders?

What are the minimum meeting requirements for a corporation?

What are the requirements for a shareholder to examine books and records?

What are the requirements for calling a special shareholder meeting?

What are the traditional limitations on distributions?

What are the ways in which a corporation may restrict the transfer of shares?

What is a professional corporation and how does it form?

What is a redemption right?

What is pooled or block voting?

What is the difference between traditional voting and cumulative voting?

What is the priority of distribution for dividends?

What is the procedure for a shareholder to bring a derivative action?

What is the procedure for a shareholder to vote by proxy?

When and how may shareholders eliminate corporate formalities?

When can or can't a board of directors declare a distribution?

Who has the right to vote at a shareholder meeting?