🌕

Corporations • Rights of Shareholders

CORP#057

Legal Definition

In a closely held corporation, shareholders may eliminate corporate formalities so long as there is a unanimous shareholder election as evidenced by the articles of incorporation, bylaws, or a filed agreement. As a result, one cannot pierce the corporate veil of such a corporation even if they fail to maintain formalities.

Plain English Explanation

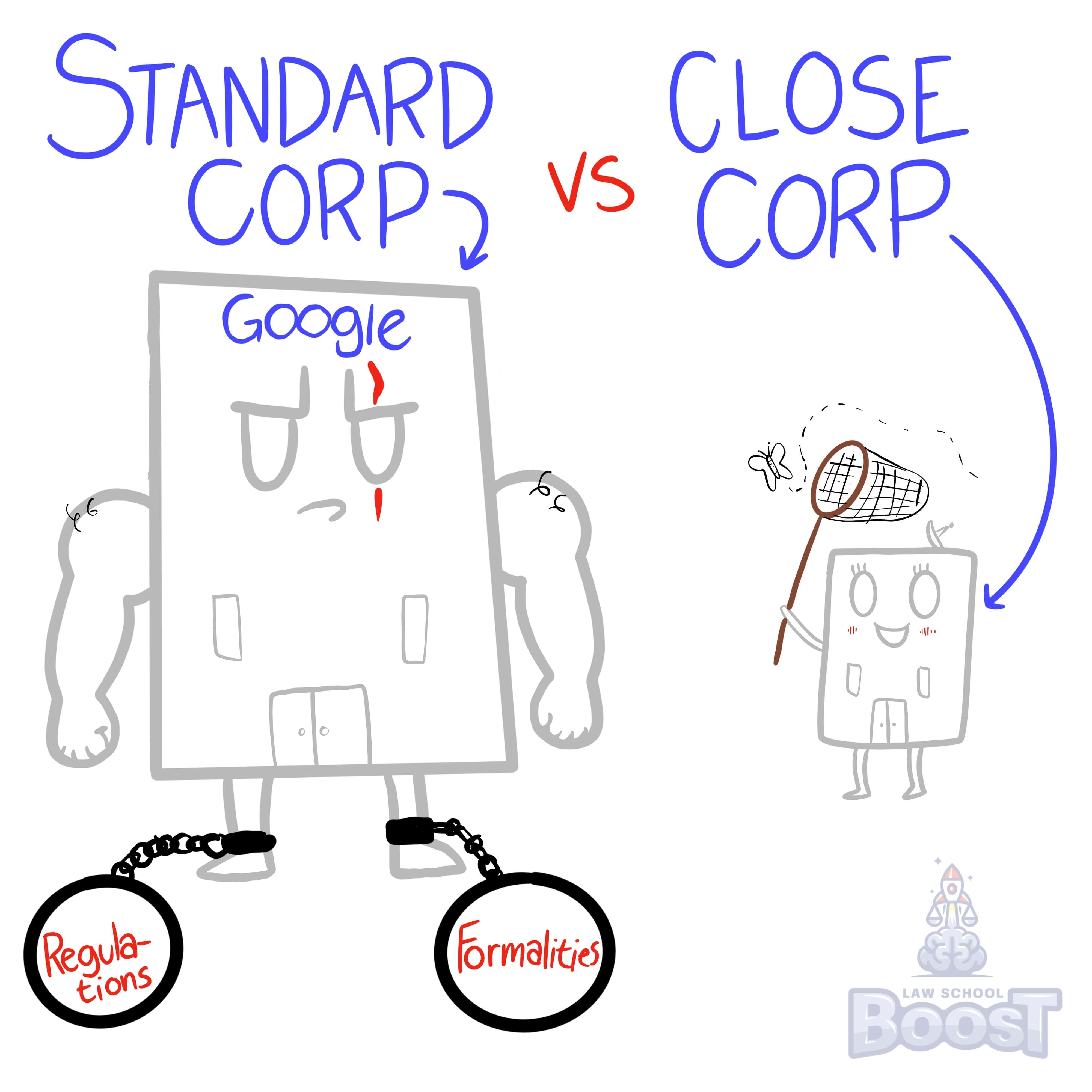

When people think of corporations, they often think of large, publicly traded, business titans like Microsoft, Google, and Amazon. These are good examples of public corporations. Many of the formality requirements you've learned about in these cards exist to help prevent rampant abuse by large, public corporations. After all, large public corporations usually deal with large amounts of money and large numbers of shareholders from all parts of the world. Because of that, a large corporation has the ability to cause a larger harm and, thus, is more regulated.

But what if you want all the benefits of a corporation (like limited liability protections), but have no intention or goal of "going public"? Such corporations are called close corporations (also known as closely held private corporations or closely held corporations). Close corporations are generally made up of fewer than 75 shareholders who are usually family members or former partners.

As you've learned in other cards, though the limited liability protections are one of the primary reasons people form corporations, it is possible for creditors to pierce the corporate veil and try to hold a corporation's shareholders personally liable. In other words, in some circumstances, a person who is owed money from a corporation may be able to personally sue the corporation's shareholders instead. One of those circumstances is when a corporation fails to abide by corporate formalities (like keeping notes of business meetings, following company bylaws, and maintaining separate financial accounts).

However, if the shareholders of a close company unanimously vote to eliminate the burden of corporate formalities, then failure to abide by them is no longer a valid reason to pierce the corporate veil. In other words, the shareholders can form an agreement, change their bylaws, or modify the corporation's articles of incorporation to say they do not follow specific (or various) corporate formalities, which then enables the shareholders to be a bit more casual without worrying about being held personally liable for the corporation's debts.

This option is only available to closely held corporations.

But what if you want all the benefits of a corporation (like limited liability protections), but have no intention or goal of "going public"? Such corporations are called close corporations (also known as closely held private corporations or closely held corporations). Close corporations are generally made up of fewer than 75 shareholders who are usually family members or former partners.

As you've learned in other cards, though the limited liability protections are one of the primary reasons people form corporations, it is possible for creditors to pierce the corporate veil and try to hold a corporation's shareholders personally liable. In other words, in some circumstances, a person who is owed money from a corporation may be able to personally sue the corporation's shareholders instead. One of those circumstances is when a corporation fails to abide by corporate formalities (like keeping notes of business meetings, following company bylaws, and maintaining separate financial accounts).

However, if the shareholders of a close company unanimously vote to eliminate the burden of corporate formalities, then failure to abide by them is no longer a valid reason to pierce the corporate veil. In other words, the shareholders can form an agreement, change their bylaws, or modify the corporation's articles of incorporation to say they do not follow specific (or various) corporate formalities, which then enables the shareholders to be a bit more casual without worrying about being held personally liable for the corporation's debts.

This option is only available to closely held corporations.

Visual Aids

Related Concepts

Are shareholder proxies revocable?

How is an action approved at a shareholder meeting?

In regards to shareholder suits, what are derivative action?

In regards to shareholder suits, what are direct actions?

In what form may dividends be paid?

What are the liabilities of shareholders and controlling shareholders?

What are the minimum meeting requirements for a corporation?

What are the requirements for a shareholder to examine books and records?

What are the requirements for calling a special shareholder meeting?

What are the three most common forms of distributions?

What are the traditional limitations on distributions?

What are the ways in which a corporation may restrict the transfer of shares?

What is a professional corporation and how does it form?

What is a redemption right?

What is pooled or block voting?

What is the difference between traditional voting and cumulative voting?

What is the priority of distribution for dividends?

What is the procedure for a shareholder to bring a derivative action?

What is the procedure for a shareholder to vote by proxy?

When can or can't a board of directors declare a distribution?

Who has the right to vote at a shareholder meeting?