🌕

Corporations • Rights of Shareholders

CORP#045

Legal Definition

Every corporation must have an annual meeting, in which at least one director slot is up for election. Proper notice must include the time and place of the meeting. There must be a quorum present at the meeting, determination of which focuses on the number of shares represented, not the number of shareholders. A quorum requires a majority of outstanding shares when the meeting begins, unless otherwise provided in the articles of incorporation.

Plain English Explanation

Annual meetings play an important role in corporations. Since corporations can have many different shareholders, annual meetings allow an efficient, effective way to schedule a day where they can all come together and have an opportunity to participate in the corporation's activities. One important opportunity is the ability to elect at least 1 new director to replace an existing director.

In order to make sure all the shareholders have an opportunity to clear their schedule and plan to attend the meeting, proper notice must be given that lets the shareholders know the time and place of the meeting. In other words, a corporation can't send its shareholders a postcard that says only "See you at this year's meeting!" Shareholders need to know (a) where exactly do you want me to show up, and (b) when exactly do you want me to show up?

Finally, the last important thing to know about shareholder meetings is even though every shareholder has a right to attend the shareholder meeting, not every shareholder is required to attend. What's important is a "quorum."

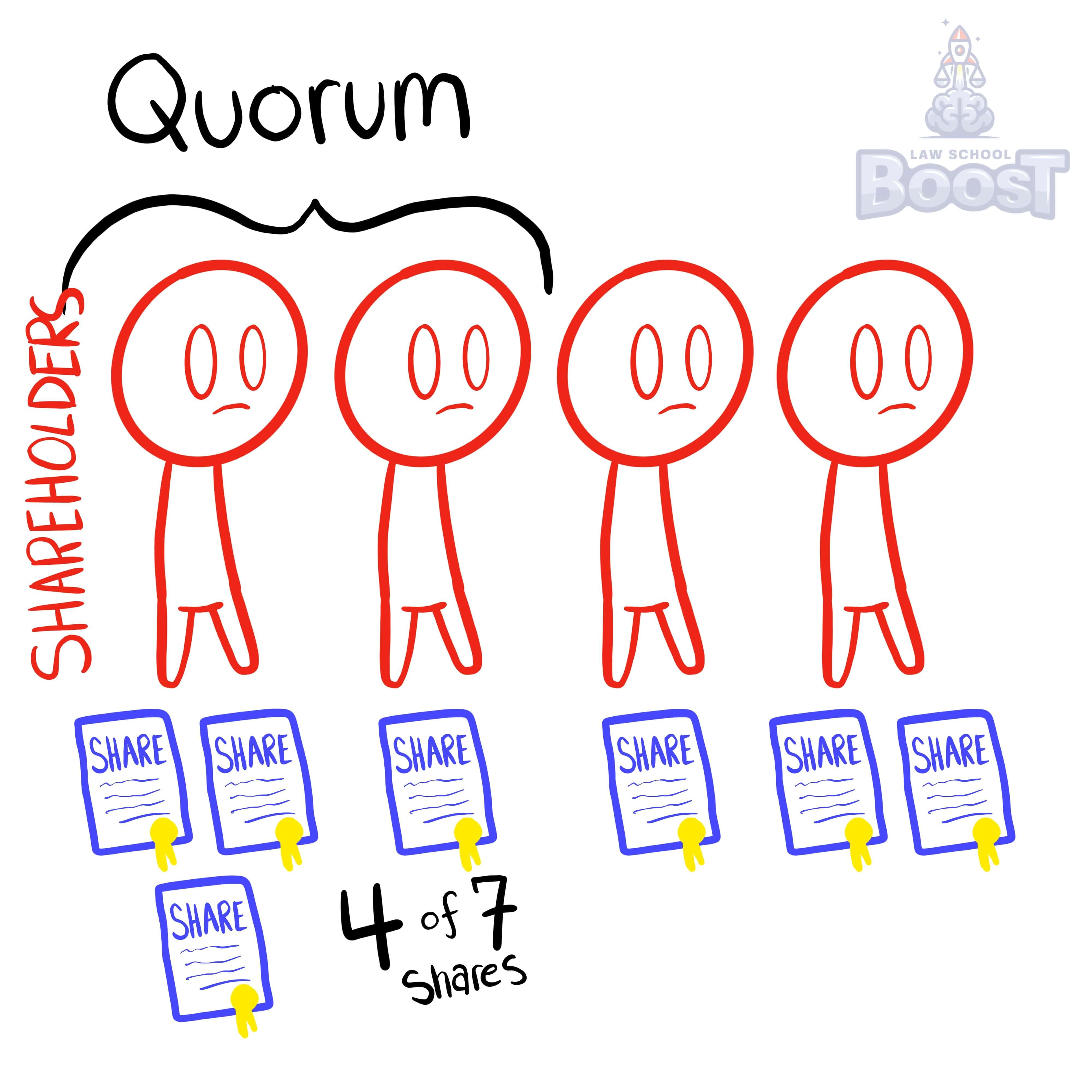

A quorum is a fancy Latin word that basically means "enough people have showed up to a meeting to make it fair to say we actually held a meeting." Note that when it comes to shareholders, the importance isn't necessarily how many people show up to a meeting, but how many shares show up to vote. Hop over to the hypos for an example.

In order to make sure all the shareholders have an opportunity to clear their schedule and plan to attend the meeting, proper notice must be given that lets the shareholders know the time and place of the meeting. In other words, a corporation can't send its shareholders a postcard that says only "See you at this year's meeting!" Shareholders need to know (a) where exactly do you want me to show up, and (b) when exactly do you want me to show up?

Finally, the last important thing to know about shareholder meetings is even though every shareholder has a right to attend the shareholder meeting, not every shareholder is required to attend. What's important is a "quorum."

A quorum is a fancy Latin word that basically means "enough people have showed up to a meeting to make it fair to say we actually held a meeting." Note that when it comes to shareholders, the importance isn't necessarily how many people show up to a meeting, but how many shares show up to vote. Hop over to the hypos for an example.

Hypothetical

Hypo 1: HypoCorp has a shareholder meeting scheduled for Tuesday. HypoCorp has a total of 100,000 outstanding shares held by 100 shareholders. Bob owns 60,000 shares and is HypoCorp's majority shareholder. On Tuesday, Bob was in a car accident and unable to attend the shareholder meeting. All 99 of the other shareholders showed up. Result: The shareholder meeting will not be able to proceed because in order to reach a quorum, at least 50,001 shares must be present. Here, we see that Bob owns 60,000 of the 100,000 shares, which means that only 40,000 (less than a majority) of shares were represented by the 99 shareholders that showed up.

Visual Aids

Related Concepts

Are shareholder proxies revocable?

How is an action approved at a shareholder meeting?

In regards to shareholder suits, what are derivative action?

In regards to shareholder suits, what are direct actions?

In what form may dividends be paid?

What are the liabilities of shareholders and controlling shareholders?

What are the requirements for a shareholder to examine books and records?

What are the requirements for calling a special shareholder meeting?

What are the three most common forms of distributions?

What are the traditional limitations on distributions?

What are the ways in which a corporation may restrict the transfer of shares?

What is a professional corporation and how does it form?

What is a redemption right?

What is pooled or block voting?

What is the difference between traditional voting and cumulative voting?

What is the priority of distribution for dividends?

What is the procedure for a shareholder to bring a derivative action?

What is the procedure for a shareholder to vote by proxy?

When and how may shareholders eliminate corporate formalities?

When can or can't a board of directors declare a distribution?

Who has the right to vote at a shareholder meeting?