🌕

Corporations • Rights of Shareholders

CORP#039

Legal Definition

A shareholder may sue directly for a breach of duty owed directly to the shareholder by an officer or director, or by the majority shareholder (i.e., a suit against a controlling shareholder).

Plain English Explanation

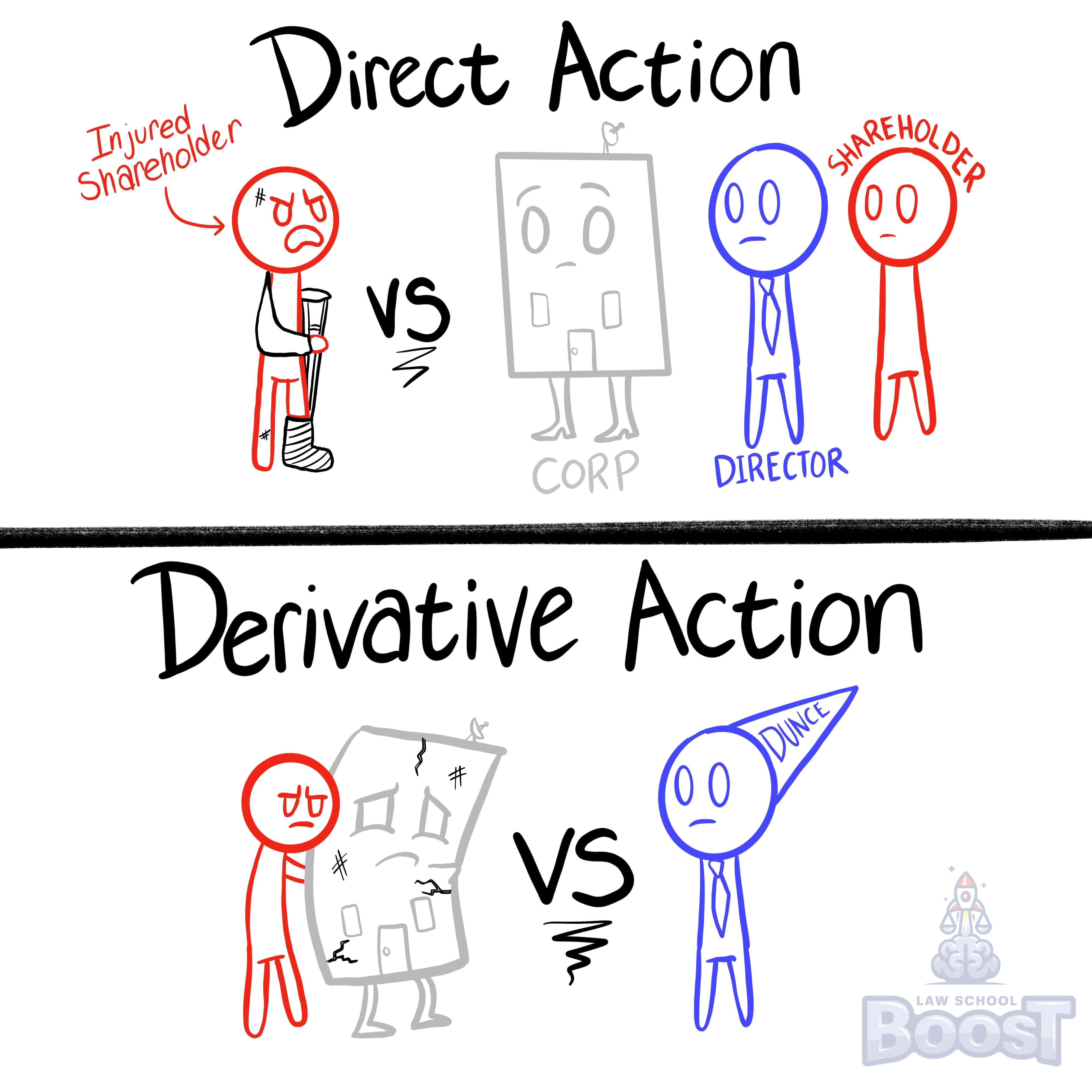

There are two types of shareholder lawsuits that are covered in separate cards, but it is helpful to discuss them together so you can compare them. They are: (1) direct actions, and (2) derivative actions.

A direct action is a lawsuit where the shareholder is directly and personally suing either the corporation, one of its directors or officers, or another shareholder that owns so many shares of stock in the company that they have control over it. What is the shareholder suing for in a direct action? They are suing because they feel as if they have been personally hurt due to a duty owed to them being breached by either the corporation, one of its directors or officers, or a controlling shareholder.

In contrast, a derivative action is a lawsuit where the shareholder believes the corporation has been harmed due to the people who run it breaching their duties owed to the corporation. In a perfect world, the corporation would bring the lawsuit itself to recover from the harm caused by its incompetent management but, as you can imagine, sometimes the people running a corporation aren't motivated to sue themselves. Thus, a derivative lawsuit allows a shareholder to come to the rescue of the corporation and sue on behalf of it.

So, to summarize, if a shareholder is suing because they have been harmed, then it is a direct action. In contrast, if a shareholder is suing because the corporation has been harmed, then it is a derivative action.

A direct action is a lawsuit where the shareholder is directly and personally suing either the corporation, one of its directors or officers, or another shareholder that owns so many shares of stock in the company that they have control over it. What is the shareholder suing for in a direct action? They are suing because they feel as if they have been personally hurt due to a duty owed to them being breached by either the corporation, one of its directors or officers, or a controlling shareholder.

In contrast, a derivative action is a lawsuit where the shareholder believes the corporation has been harmed due to the people who run it breaching their duties owed to the corporation. In a perfect world, the corporation would bring the lawsuit itself to recover from the harm caused by its incompetent management but, as you can imagine, sometimes the people running a corporation aren't motivated to sue themselves. Thus, a derivative lawsuit allows a shareholder to come to the rescue of the corporation and sue on behalf of it.

So, to summarize, if a shareholder is suing because they have been harmed, then it is a direct action. In contrast, if a shareholder is suing because the corporation has been harmed, then it is a derivative action.

Hypothetical

Hypo 1: Sam is a shareholder of HypoCorp. HypoCorp declared that it would distribute a dividend (a cash payment) to its shareholders by the end of April. On May 1st, no dividend had been paid. Sam sued for his dividend. Result: This is a direct action because Sam, a shareholder, has been harmed by HypoCorps failure to pay him a dividend like they said they would. Sam is directly suing HypoCorp.

Visual Aids

Related Concepts

Are shareholder proxies revocable?

How is an action approved at a shareholder meeting?

In regards to shareholder suits, what are derivative action?

In what form may dividends be paid?

What are the liabilities of shareholders and controlling shareholders?

What are the minimum meeting requirements for a corporation?

What are the requirements for a shareholder to examine books and records?

What are the requirements for calling a special shareholder meeting?

What are the three most common forms of distributions?

What are the traditional limitations on distributions?

What are the ways in which a corporation may restrict the transfer of shares?

What is a professional corporation and how does it form?

What is a redemption right?

What is pooled or block voting?

What is the difference between traditional voting and cumulative voting?

What is the priority of distribution for dividends?

What is the procedure for a shareholder to bring a derivative action?

What is the procedure for a shareholder to vote by proxy?

When and how may shareholders eliminate corporate formalities?

When can or can't a board of directors declare a distribution?

Who has the right to vote at a shareholder meeting?