🥺

Trusts • Trustee Powers & Duties

TRUSTS#031

Legal Definition

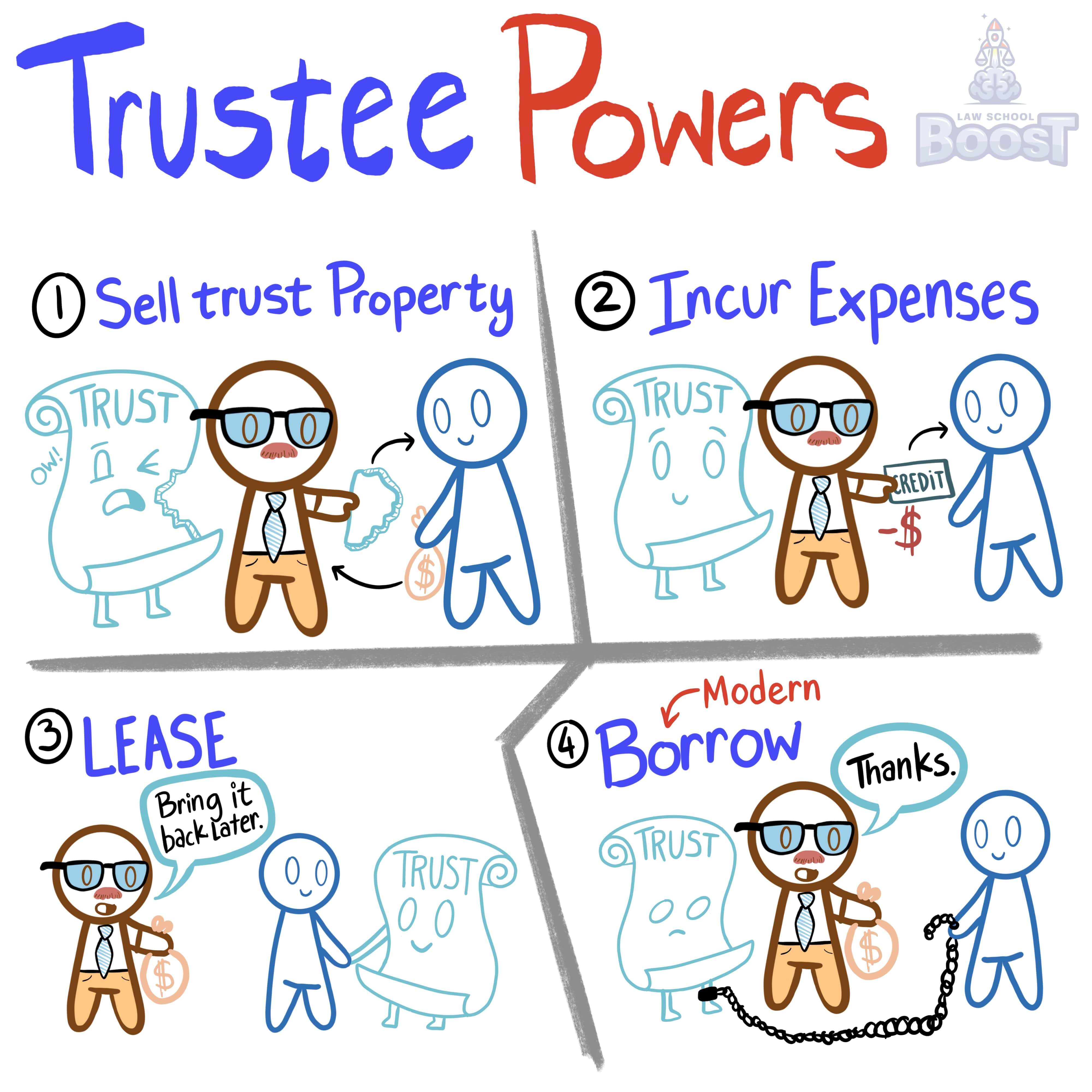

In addition to any enumerated powers, trustees have implied powers to: (1) sell trust property; (2) incur expenses; (3) lease, and; (4) under the modern view, borrow.

Plain English Explanation

At its core, being a trustee is kinda like being a temporary owner of someone else's stuff. The original owner is trusting you to manage their property for them. Of course, with great power comes great responsibility. While trustees have a good amount of freedom in managing the property, their goal always needs to be protecting the property for the true owner's benefit.

So when it comes to managing the property, trustees don't just have specific enumerated powers, but also some automatic, implied general powers to help them be flexible in responding to different situations. These include the ability to sell assets, pay the costs needed to upkeep the assets, rent out the property to generate income, and even borrow money secured by the property if there's a good reason to need temporary funds.

The idea is that while the original property owner is trusting the trustee to make decisions, the trustee should have the tools needed to actively manage the property in a reasonable way. But along with flexibility comes accountability. Trustees can't just do whatever they want - they need to always keep the best interests of the true owner in mind.

So when it comes to managing the property, trustees don't just have specific enumerated powers, but also some automatic, implied general powers to help them be flexible in responding to different situations. These include the ability to sell assets, pay the costs needed to upkeep the assets, rent out the property to generate income, and even borrow money secured by the property if there's a good reason to need temporary funds.

The idea is that while the original property owner is trusting the trustee to make decisions, the trustee should have the tools needed to actively manage the property in a reasonable way. But along with flexibility comes accountability. Trustees can't just do whatever they want - they need to always keep the best interests of the true owner in mind.

Hypothetical

Hypo 1: Sam dies and leaves a farm to Bob in trust for Sam's young son. Over the years, the farm falls into disrepair. Using his power to incur expenses, Bob takes out loans to fix up the property. Result: Bob acted properly within his powers as trustee. Yes, Bob's actions caused debt to be attached to the farm, and yes debt is generally not a good thing — however, here, the debt was a reasonable expense in order to maintain the trust property for the beneficiary's eventual use. In other words, had Bob not taken out a loan, he'd have no money to maintain the farm, and when Sam's son eventually took it over, it'd be a worthless (or worth less) piece of property.

Hypo 2: Bob is trustee for a trust holding Sam's antique car collection. Bob decides to sell a classic Mustang to pay off his own gambling debts. Result: Bob breached his duty as trustee by selling trust assets for personal gain unrelated to the trust.

Hypo 3: Sam creates a trust for his vacation home and names Bob as trustee. Bob believes renting out the home when not in use would generate needed income for the trust, so he lists it online. Result: Bob acted within his powers by renting out the vacation home to produce income for the trust when not being used by the beneficiaries (Sam).

Hypo 4: Bob is trustee of a farm Sam left to his children. A drought destroys the seasonal crops. Bob takes out a loan to be repaid after harvest to buy new seeds and equipment. Result: Bob properly exercised his power to borrow on behalf of the trust to preserve the farm's productivity.

Hypo 2: Bob is trustee for a trust holding Sam's antique car collection. Bob decides to sell a classic Mustang to pay off his own gambling debts. Result: Bob breached his duty as trustee by selling trust assets for personal gain unrelated to the trust.

Hypo 3: Sam creates a trust for his vacation home and names Bob as trustee. Bob believes renting out the home when not in use would generate needed income for the trust, so he lists it online. Result: Bob acted within his powers by renting out the vacation home to produce income for the trust when not being used by the beneficiaries (Sam).

Hypo 4: Bob is trustee of a farm Sam left to his children. A drought destroys the seasonal crops. Bob takes out a loan to be repaid after harvest to buy new seeds and equipment. Result: Bob properly exercised his power to borrow on behalf of the trust to preserve the farm's productivity.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

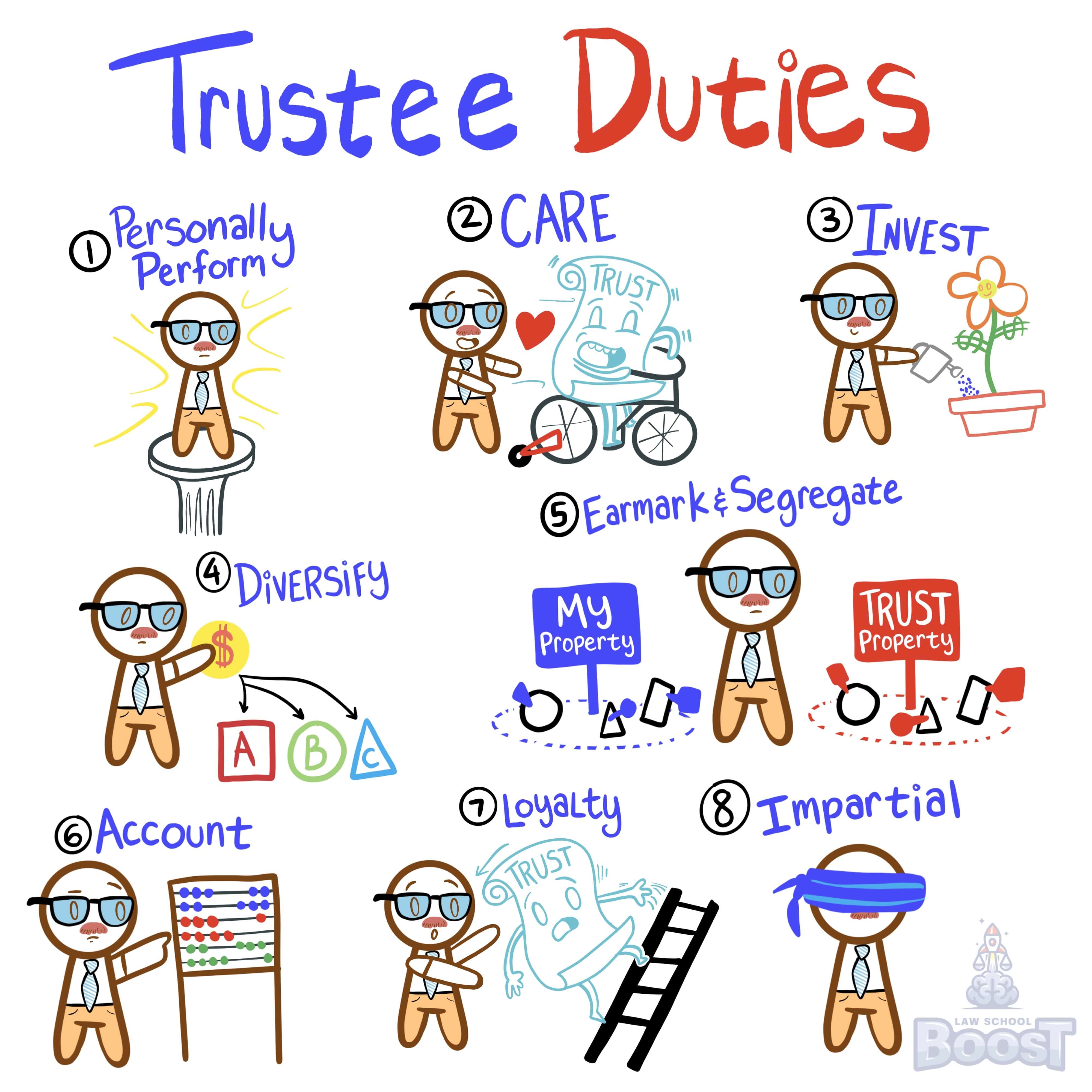

What are the trustee's duties?

What is the duty of care?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?