🥺

Trusts • Trustee Powers & Duties

TRUSTS#035

Legal Definition

The duty to invest requires the trustee to act as a reasonably prudent person investing their own property, trying to maximize income while preserving the corpus of the trust. Under the common law test, each individual investment (as opposed to the portfolio as a whole) is scrutinized. Good investments include: federal government bonds, a first deed of trust, blue chip stocks, and mutual funds. Good investments never include second deeds of trust or new businesses.

Plain English Explanation

Trusts aren't simply a bag of cash that the trustee is responsible for handing out until it is gone. Rather, a trust should be managed in a way to maximize the amount of value for its beneficiaries. In other words, a trustee should look to see how much money is required to pursue the trust's purpose while looking for reasonable opportunities to invest other portions of the trust's assets into things that can grow into even more money. For example, federal government bonds, reliable stocks with proven histories of being secure, and mutual funds are great examples of "good investments."

In contrast, it would never be a good investment choice to put money into something volatile, like most cryptocurrencies, or a startup company.

In contrast, it would never be a good investment choice to put money into something volatile, like most cryptocurrencies, or a startup company.

Hypothetical

Hypo 1: Sam is trustee for a trust set up by Bob's late father. The trust terms say to generate income for Bob. Sam invests $100,000 in government bonds earning 3% annually. Result: Sam met the duty to invest by placing the money in a low risk, income generating investment.

Hypo 2: Sam invests $50,000 from Bob's trust into his brother's struggling new vegan restaurant. Sam thinks the business has potential. Result: Sam breached his duty to invest by putting trust money into a high risk, speculative new business.

Hypo 3: Sam diversifies the stock investments in Bob's trust, including some blue chip stocks like Apple and Microsoft. Result: Purchasing reputable blue chip stocks helps satisfy Sam's duty to invest.

Hypo 4: Bob's trust terms say Sam can distribute trust corpus (meaning cash out of the trust) to Bob for living expenses. Sam distributes $5,000/month to Bob. Result: Distributions permitted by the trust do not undermine Sam's duty to invest. His duty relates to investing trust assets.

Hypo 2: Sam invests $50,000 from Bob's trust into his brother's struggling new vegan restaurant. Sam thinks the business has potential. Result: Sam breached his duty to invest by putting trust money into a high risk, speculative new business.

Hypo 3: Sam diversifies the stock investments in Bob's trust, including some blue chip stocks like Apple and Microsoft. Result: Purchasing reputable blue chip stocks helps satisfy Sam's duty to invest.

Hypo 4: Bob's trust terms say Sam can distribute trust corpus (meaning cash out of the trust) to Bob for living expenses. Sam distributes $5,000/month to Bob. Result: Distributions permitted by the trust do not undermine Sam's duty to invest. His duty relates to investing trust assets.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

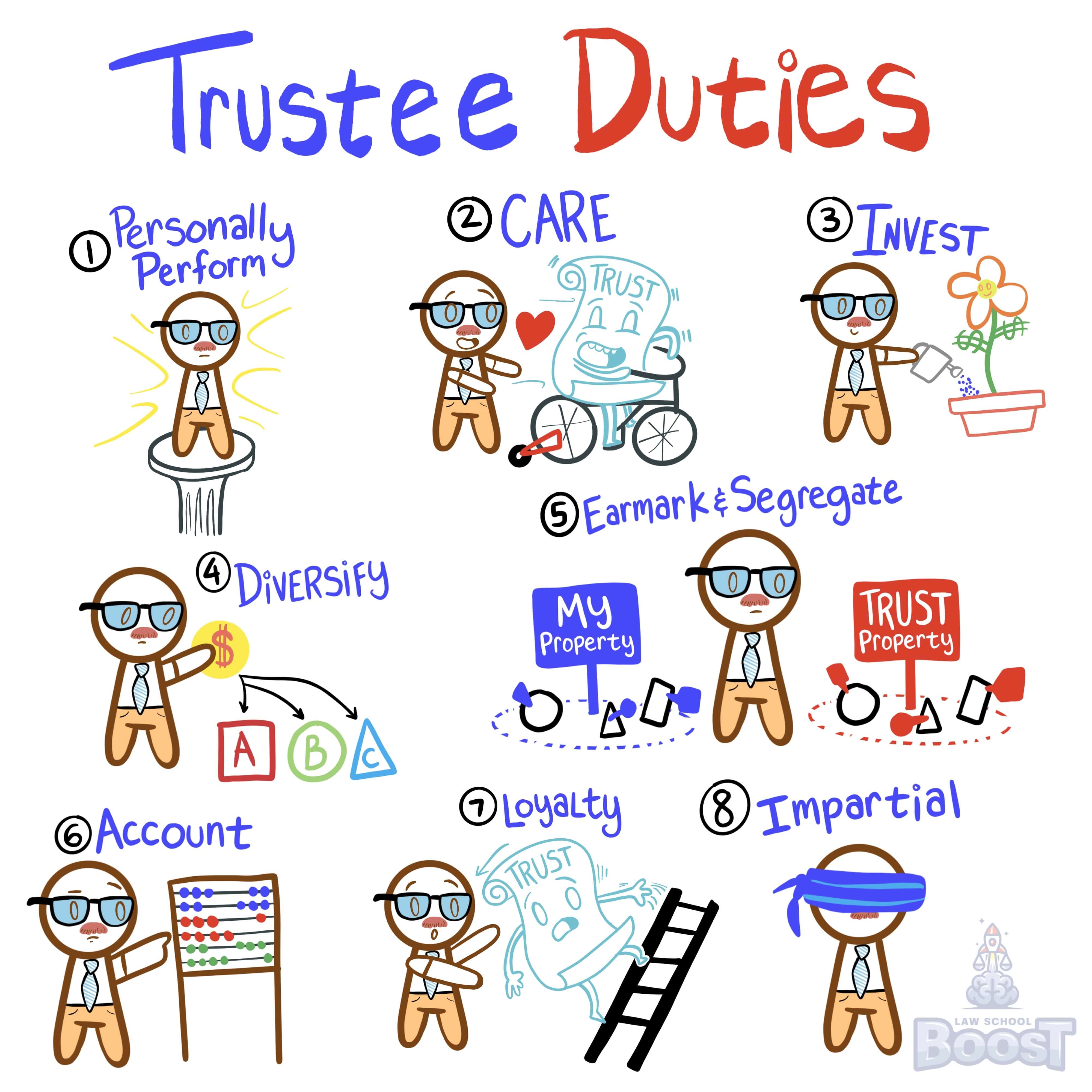

What are the trustee's duties?

What are the trustee's powers?

What is the duty of care?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?