🥺

Trusts • Trustee Powers & Duties

TRUSTS#032

Legal Definition

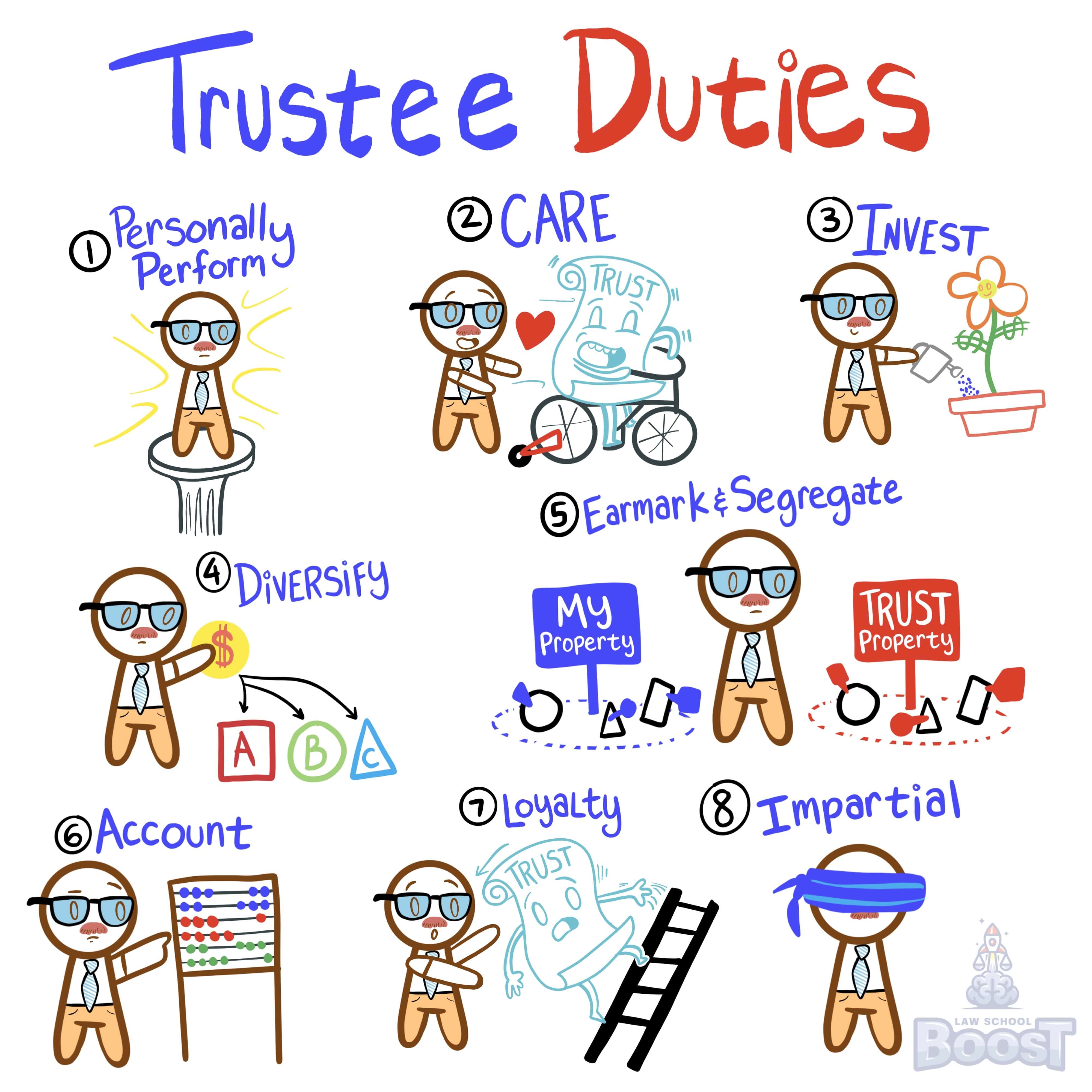

(1) Duty to Perform Personally

(2) Duty of Care

(3) Duty to Invest

(4) Duty to Diversify

(5) Duty to Earmark and Segregate

(6) Duty to Account

(7) Duty of Loyalty

(8) Duty to Act Impartially

(2) Duty of Care

(3) Duty to Invest

(4) Duty to Diversify

(5) Duty to Earmark and Segregate

(6) Duty to Account

(7) Duty of Loyalty

(8) Duty to Act Impartially

Plain English Explanation

When you agree to be the trustee of a trust, you take on a lot of responsibility. Basically, you have to manage the trust's money and assets to benefit whoever the trust was set up for (the beneficiaries). Since you're handling other people's assets, the law puts duties on you to make sure you do a good job and don't take advantage of your position.

For example, you have to actually do the trustee work yourself - you can't just hand it off to someone else. And you have to be careful and make smart choices when investing the trust's assets to try to earn decent returns without taking too much risk. It's not your money after all - it belongs to the beneficiaries.

You also can't mix the trust's assets up with your own money or other trusts you might manage. That could get confusing and create conflicts of interest.

Overall, the duties require you to put the beneficiaries' interests first, not your own. You have to be loyal to them and treat them all fairly. That's why you have to provide regular reports too - so they can make sure you're doing your job properly.

The law puts all these duties in place to protect trusts and the people they are meant to benefit. Without the duties, unethical trustees could misuse trusts for personal gain.

We will cover each of these in their own cards.

For example, you have to actually do the trustee work yourself - you can't just hand it off to someone else. And you have to be careful and make smart choices when investing the trust's assets to try to earn decent returns without taking too much risk. It's not your money after all - it belongs to the beneficiaries.

You also can't mix the trust's assets up with your own money or other trusts you might manage. That could get confusing and create conflicts of interest.

Overall, the duties require you to put the beneficiaries' interests first, not your own. You have to be loyal to them and treat them all fairly. That's why you have to provide regular reports too - so they can make sure you're doing your job properly.

The law puts all these duties in place to protect trusts and the people they are meant to benefit. Without the duties, unethical trustees could misuse trusts for personal gain.

We will cover each of these in their own cards.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

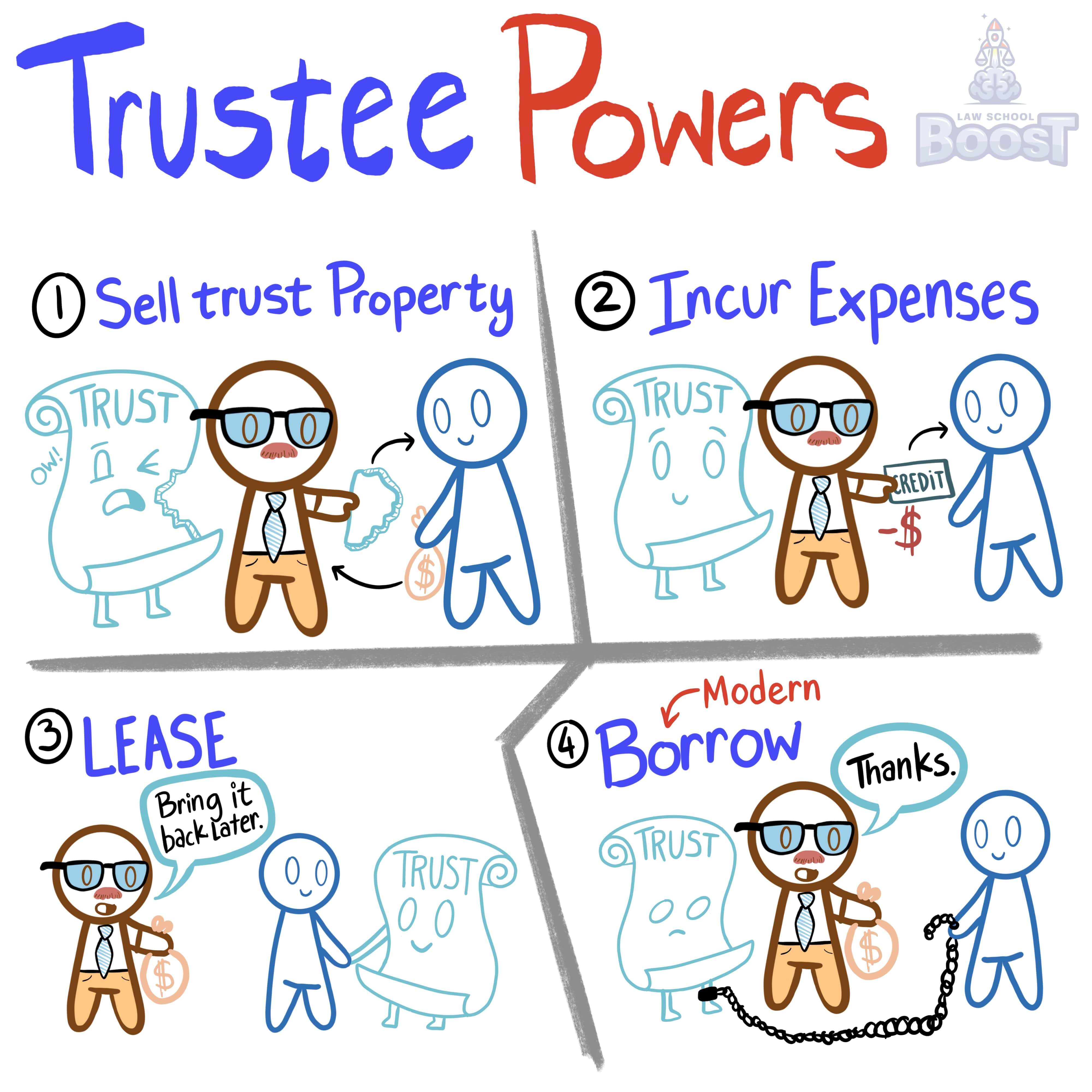

What are the trustee's powers?

What is the duty of care?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?