🥺

Trusts • Trustee Powers & Duties

TRUSTS#040

Legal Definition

The trustee must, on a regular basis, give the beneficiaries a statement of income and expenses of the trust.

Plain English Explanation

A trust is like a special bank account. The person who opens the account is called the trustee. The people who benefit from the account are called the beneficiaries. Because the beneficiaries don't directly control the account, the trustee must send them regular reports. These reports list all money earned by the trust's investments (income) and any money paid out for taxes, fees, etc. (expenses). This rule makes sure beneficiaries know what's happening with their money. It keeps the trustee honest and makes sure no one takes advantage of the beneficiaries.

Hypothetical

Hypo 1: Bob is the trustee for a trust set up by Sam's grandparents to pay for Sam's college tuition. Bob fails to provide Sam with a statement of income and expenses for 5 years. When Sam finally asks Bob for an accounting, Bob provides statements showing that almost all the trust assets were spent each year on "miscellaneous expenses." Result: Bob violated his duty to account by failing to provide regular statements. The statements he finally provided fail to adequately account for trust expenditures over several years. Sam can sue Bob to force a proper accounting and recover any improper expenditures.

Hypo 2: Sam sets up a trust to care for his disabled sister after Sam dies. Sam names his friend Bob as trustee. Over the next 10 years, Bob regularly provides Sam's sister with detailed statements of trust income and expenses as required. Result: Bob fulfilled his duty to account by regularly providing account statements to the sister.

Hypo 3: Bob is trustee of a trust set up by Sam for his son Billy. Billy moves frequently and fails to keep Bob updated with his contact information. Bob makes reasonable efforts to locate Billy but is unable to provide him with annual trust accountings. Result: Bob likely fulfilled his duty to account because he made reasonable efforts to provide accountings to Billy. His duty may be excused because he lacks current contact information despite reasonable efforts.

Hypo 2: Sam sets up a trust to care for his disabled sister after Sam dies. Sam names his friend Bob as trustee. Over the next 10 years, Bob regularly provides Sam's sister with detailed statements of trust income and expenses as required. Result: Bob fulfilled his duty to account by regularly providing account statements to the sister.

Hypo 3: Bob is trustee of a trust set up by Sam for his son Billy. Billy moves frequently and fails to keep Bob updated with his contact information. Bob makes reasonable efforts to locate Billy but is unable to provide him with annual trust accountings. Result: Bob likely fulfilled his duty to account because he made reasonable efforts to provide accountings to Billy. His duty may be excused because he lacks current contact information despite reasonable efforts.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

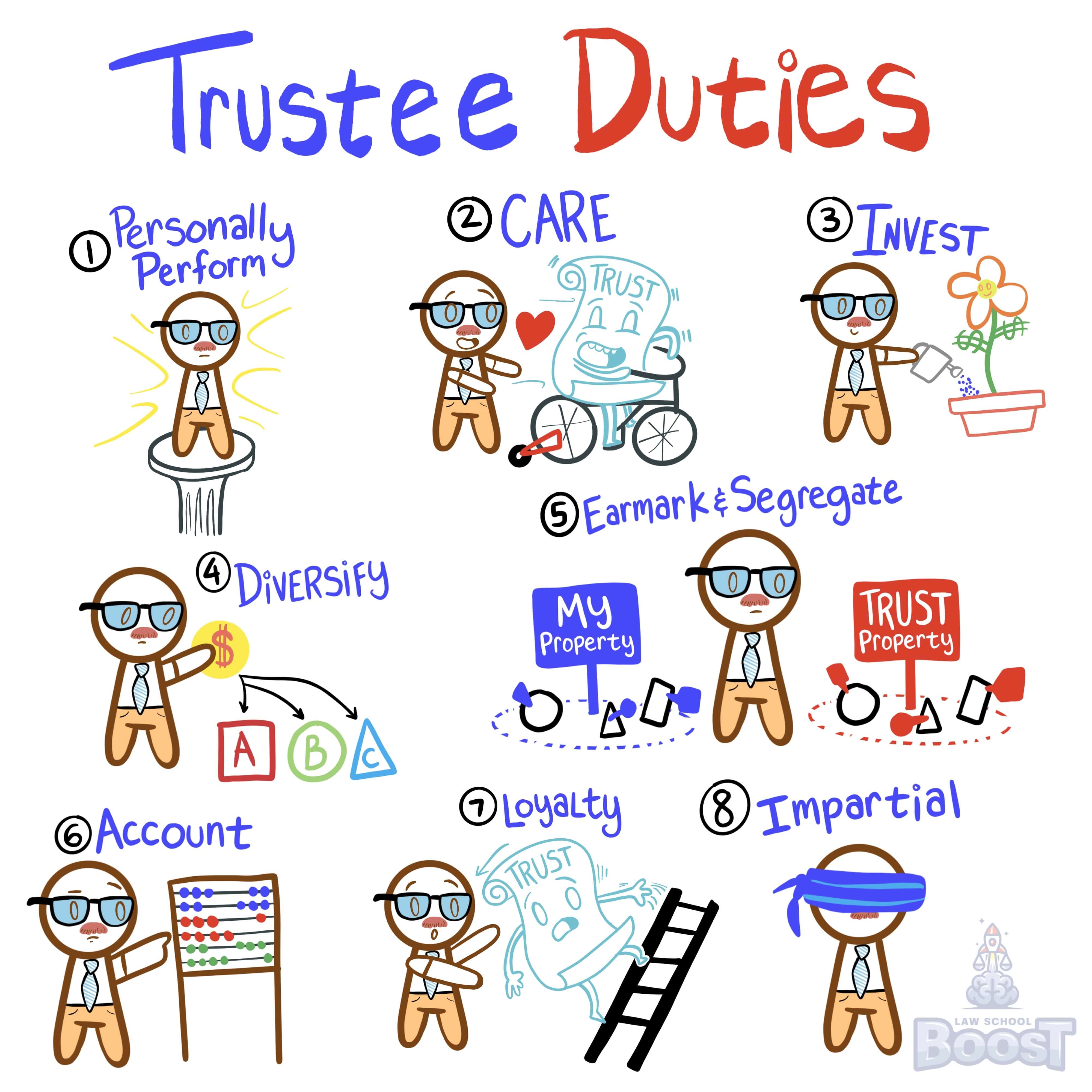

What are the trustee's duties?

What are the trustee's powers?

What is the duty of care?

What is the duty of loyalty?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?