🥺

Trusts • Trustee Powers & Duties

TRUSTS#038

Legal Definition

A trustee is required to make prudent investments, which requires diversification and placing trust assets into investments that will maximize their value.

Plain English Explanation

You've likely heard the saying, "Don't put all of your eggs in one basket." Why? Because if you trip and fall while carrying the basket, all of your eggs are now broken. Similarly, healthy investment strategies will spread money across many types of investments so if one type of investment stumbles, it doesn't completely tank your portfolio. For example, if you had $1000 and invested it all into oil, you may seem some substantial returns on your investment, but all it takes is one national disaster or international supply chain issue (like a global pandemic that reduces the demand for gasoline, which drops the price of oil) and suddenly you are broke.

A smart investor will invest portions of their money into various types of investments (stocks, bonds, even precious metals or cryptocurrencies) so that the underperformance of one asset is offset by the overperformance of another. For example, if you were invested in stocks and rental property, if the stock market crashes, you could still have passive income through the rental property while you wait for the markets to recover.

A smart investor will invest portions of their money into various types of investments (stocks, bonds, even precious metals or cryptocurrencies) so that the underperformance of one asset is offset by the overperformance of another. For example, if you were invested in stocks and rental property, if the stock market crashes, you could still have passive income through the rental property while you wait for the markets to recover.

Hypothetical

Hypo 1: Sam leaves $1 million to a trust for his young nieces. The trustee invests the entire amount in a risky tech startup that fails. The trust assets are wiped out. Result: The trustee violated his duty to diversify by concentrating all assets in a single risky investment, failing his fiduciary duties.

Hypo 2: Bob creates a trust to care for his disabled sister. The trustee conservatively invests only in CDs getting 2% returns. Over 30 years, returns do not keep pace with inflation, significantly reducing purchasing power. Result: While CDs are low risk, the complete lack of diversification into any stocks/bonds failed the duty to diversify.

Hypo 3: Sam wins $500k in the lottery and places it into a trust, stating growth should be moderate. The trustee allocates 60% in index funds, 30% in bonds, 10% in a tech fund. After 5 years the tech fund loses 50% of its value but overall trust assets grow 6% annually. Result: This is likely reasonable diversification given Sam's moderate growth wishes. The high-risk tech allocation was small enough to not overly expose the trust.

Hypo 4: Bob places $2 million into a trust for his children’s education and names his brother trustee. His brother invests heavily in his own struggling startup. When Bob finds out, he is furious. Result: The duty to diversify helps limit trustee self-dealing by requiring reasonable diversification. Here, the concentration in the trustee’s own business breaches that duty and raises conflict of interest issues.

Hypo 5: Sam decides to manage his own $100k inheritance and invests everything into lottery tickets as a retirement strategy. Result: The rule doesn't apply because Sam isn't a trustee with fiduciary duties to others. He can invest his personal funds however he wants, even if extremely risky.

Hypo 2: Bob creates a trust to care for his disabled sister. The trustee conservatively invests only in CDs getting 2% returns. Over 30 years, returns do not keep pace with inflation, significantly reducing purchasing power. Result: While CDs are low risk, the complete lack of diversification into any stocks/bonds failed the duty to diversify.

Hypo 3: Sam wins $500k in the lottery and places it into a trust, stating growth should be moderate. The trustee allocates 60% in index funds, 30% in bonds, 10% in a tech fund. After 5 years the tech fund loses 50% of its value but overall trust assets grow 6% annually. Result: This is likely reasonable diversification given Sam's moderate growth wishes. The high-risk tech allocation was small enough to not overly expose the trust.

Hypo 4: Bob places $2 million into a trust for his children’s education and names his brother trustee. His brother invests heavily in his own struggling startup. When Bob finds out, he is furious. Result: The duty to diversify helps limit trustee self-dealing by requiring reasonable diversification. Here, the concentration in the trustee’s own business breaches that duty and raises conflict of interest issues.

Hypo 5: Sam decides to manage his own $100k inheritance and invests everything into lottery tickets as a retirement strategy. Result: The rule doesn't apply because Sam isn't a trustee with fiduciary duties to others. He can invest his personal funds however he wants, even if extremely risky.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

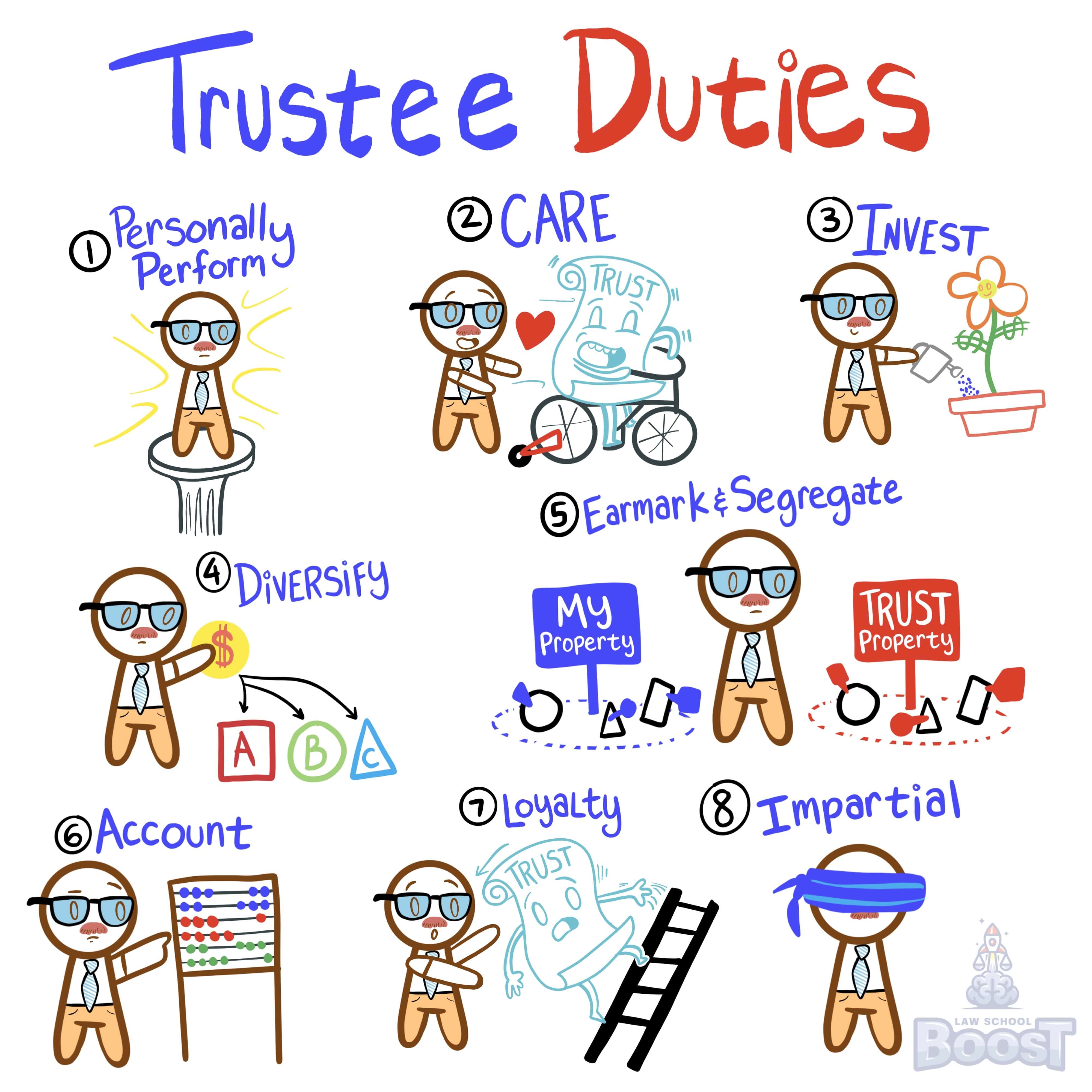

What are the trustee's duties?

What are the trustee's powers?

What is the duty of care?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?