🥺

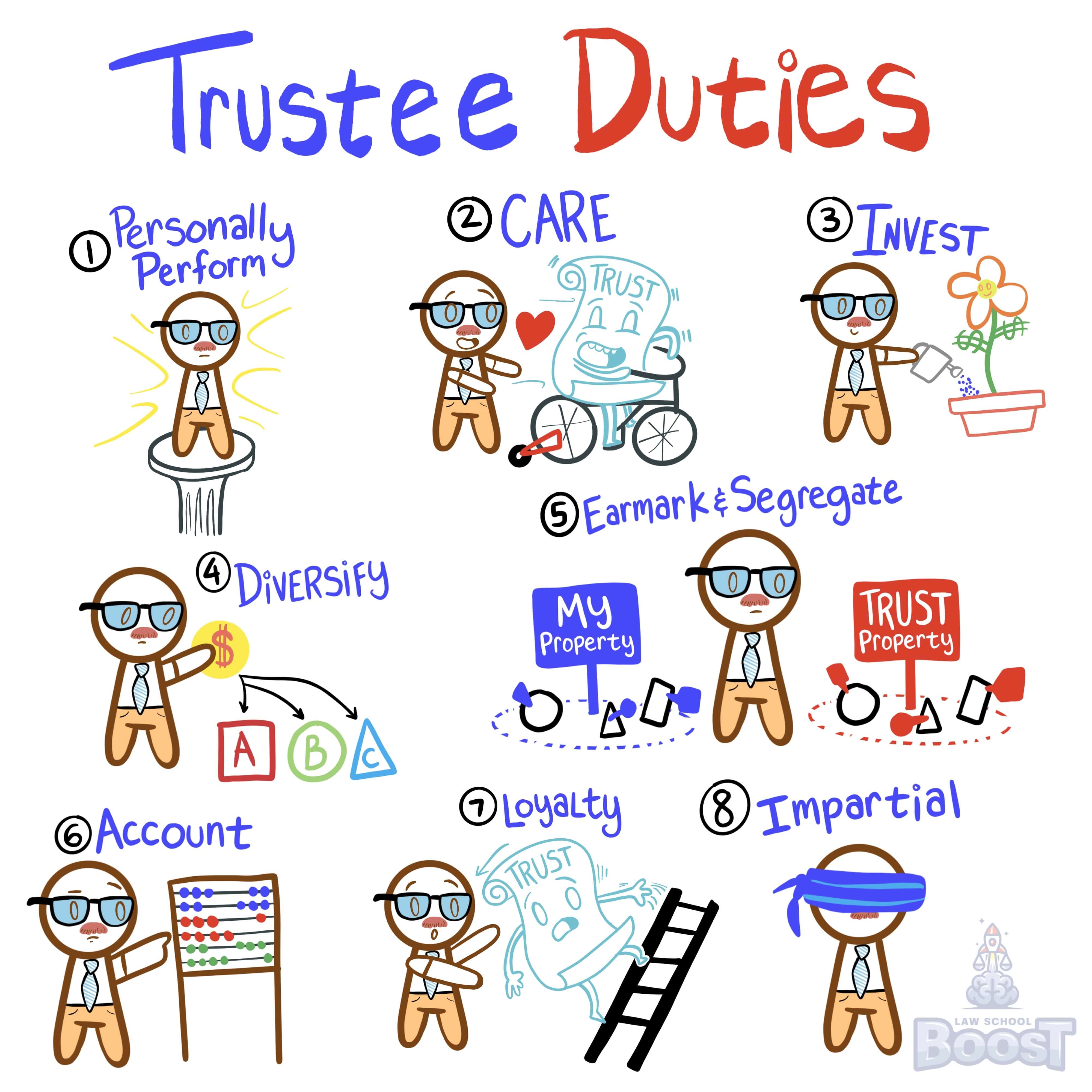

Trusts • Trustee Powers & Duties

TRUSTS#034

Legal Definition

A trustee must manage investments as a prudent investor would, and thus must exercise reasonable care, skill, and caution. Care relates to the trustee's diligence and efforts, skill to his capabilities and caution to conservatism in managing the trust. The duty of care includes the duty to investigate (i.e., to make a reasonable effort to research and verify information likely to affect the value of investment assets).

Plain English Explanation

The law expects a trustee to be as careful with the trust's property as they would be with their own property. This means taking the time to research decisions before making them, knowing their limitations, and knowing when to seek outside assistance or advice.

Hypothetical

Hypo 1: Bob is trustee for Sam's $1M inheritance. Bob invests the money into his friend's new company without researching it. The company goes bankrupt. Result: Bob breached his duty of care by failing to skillfully and cautiously investigate the investment.

Hypo 2: Bob is trustee of Sam's trust. Bob is a sophisticated investor. He uses advanced techniques to choose risky startup stocks for Sam's trust. The stocks lose 50% of their value. Result: Bob met the standard of care expected of his investing skill level. Just because the investment lost money doesn't mean Bob breached his duty.

Hypo 3: Bob is trustee of Sam's modest $50K trust. Bob puts 30% in risky derivatives, violating prudent investing rules for that trust size. He loses money. Result: Bob breached his duty of care through overly speculative investing beyond Sam's risk appetite.

Hypo 4: Bob invests Sam's trust after thorough research. The company CEO is later convicted of fraud that Bob couldn't have known about. Result: Bob upheld his duty of care through prudent research efforts, even though the investment soured.

Hypo 5: Bob fully divests Sam's gun company stocks simply because he personally dislikes guns, losing money. Result: Duty of care focuses on financial prudence, not personal beliefs. Sam can argue breach.

Hypo 2: Bob is trustee of Sam's trust. Bob is a sophisticated investor. He uses advanced techniques to choose risky startup stocks for Sam's trust. The stocks lose 50% of their value. Result: Bob met the standard of care expected of his investing skill level. Just because the investment lost money doesn't mean Bob breached his duty.

Hypo 3: Bob is trustee of Sam's modest $50K trust. Bob puts 30% in risky derivatives, violating prudent investing rules for that trust size. He loses money. Result: Bob breached his duty of care through overly speculative investing beyond Sam's risk appetite.

Hypo 4: Bob invests Sam's trust after thorough research. The company CEO is later convicted of fraud that Bob couldn't have known about. Result: Bob upheld his duty of care through prudent research efforts, even though the investment soured.

Hypo 5: Bob fully divests Sam's gun company stocks simply because he personally dislikes guns, losing money. Result: Duty of care focuses on financial prudence, not personal beliefs. Sam can argue breach.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

What are the trustee's duties?

What are the trustee's powers?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the duty to perform personally?

What is the Uniform Prudent Investor Act?