🥺

Trusts • Trustee Powers & Duties

TRUSTS#033

Legal Definition

A trustee can only delegate acts that are arguably unreasonable to require personal performance. However, though a trustee cannot delegate decision-making authority, they may delegate management functions that a *prudent trustee* would delegate. They must also exercise reasonable case, skill, and caution in selecting an agent, establishing the scope and terms of the delegation, and periodically reviewing the agent's actions.

Plain English Explanation

The trustee has a duty to serve the beneficiaries personally and directly. But it's not reasonable to require the trustee to do every little thing themselves - that would be absurd. Expecting a trustee to wear all the hats required to manage a complex estate would be as silly as expecting a CEO of a large company to find time to vacuum the floors.

So the law lets trustees offload some responsibilities, but not the keys to the kingdom. Delegating core decision-making would defeat the whole purpose of naming that person trustee. However, operations like accounting, investments, etc. can be farmed out if a <prudent trustee> would do the same.

The trustee just has to reasonably vet the new hire thoroughly, draw clear lines around the role, and check their work routinely. It's trust, but verify. The trustee took on an obligation to the beneficiaries, not to needlessly martyr themselves doing clerical work. But they still need to take care that whoever they delegate to doesn't muck things up or take advantage.

So the law lets trustees offload some responsibilities, but not the keys to the kingdom. Delegating core decision-making would defeat the whole purpose of naming that person trustee. However, operations like accounting, investments, etc. can be farmed out if a <prudent trustee> would do the same.

The trustee just has to reasonably vet the new hire thoroughly, draw clear lines around the role, and check their work routinely. It's trust, but verify. The trustee took on an obligation to the beneficiaries, not to needlessly martyr themselves doing clerical work. But they still need to take care that whoever they delegate to doesn't muck things up or take advantage.

Hypothetical

Hypo 1: Sam places 100 Bitcoins into a trust for Amy and names Bob as the trustee. Bob manages other trusts and decides to hire an employee to run Amy's trust for him. Bob asks his friend Carl if he's interested in the job. Carl is 85 years old and has never owned a computer. Result: Though Bob is allowed to delegate some duties to others to help him run the trust, he has no right to hand over the entire management to someone else, especially when that person lacks the technical ability to appropriately do the task correctly.

Hypo 2: Bob is named trustee of Sam's sizeable estate per Sam's will. Bob hires his cousin, who dabbles in stocks, to make all investment decisions for the trust. His cousin loses half the principal through risky trades. Result: Bob breached his duty of care by effectively making his cousin an all-powerful decision maker over trust investments without prudent vetting or ongoing oversight.

Hypo 3: Bob is trustee of Sam's estate. He hires a reputable national bank's trust management division to handle the trust accounting and government filings. The bank makes a minor accounting error that has no substantial impact. Result: Bob likely satisfied his duty of care here. A national bank's trust management services are a reasonable thing for a prudent trustee to rely on for help with clerical administration. The error was minor and Bob had a sound process for delegating.

Hypo 4: Bob delegates management of Sam's chain of restaurants to a seasoned restaurant executive, Wendy. Wendy skims cash profits for years before anyone notices. Result: Wendy had too much autonomy without oversight. A prudent trustee would have audited regularly.

Hypo 2: Bob is named trustee of Sam's sizeable estate per Sam's will. Bob hires his cousin, who dabbles in stocks, to make all investment decisions for the trust. His cousin loses half the principal through risky trades. Result: Bob breached his duty of care by effectively making his cousin an all-powerful decision maker over trust investments without prudent vetting or ongoing oversight.

Hypo 3: Bob is trustee of Sam's estate. He hires a reputable national bank's trust management division to handle the trust accounting and government filings. The bank makes a minor accounting error that has no substantial impact. Result: Bob likely satisfied his duty of care here. A national bank's trust management services are a reasonable thing for a prudent trustee to rely on for help with clerical administration. The error was minor and Bob had a sound process for delegating.

Hypo 4: Bob delegates management of Sam's chain of restaurants to a seasoned restaurant executive, Wendy. Wendy skims cash profits for years before anyone notices. Result: Wendy had too much autonomy without oversight. A prudent trustee would have audited regularly.

Visual Aids

Related Concepts

In assessing a duty to invest what are state lists?

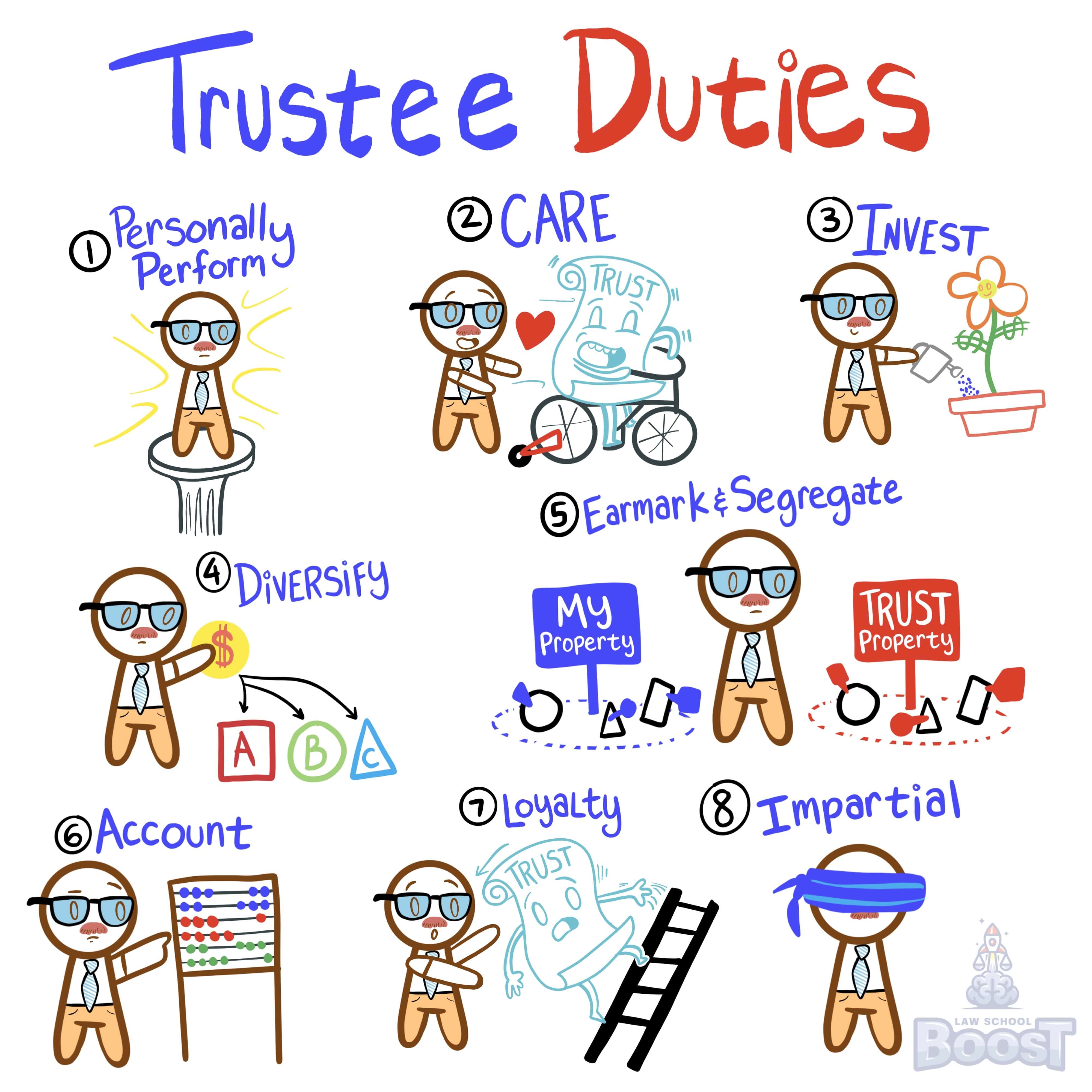

What are the trustee's duties?

What are the trustee's powers?

What is the duty of care?

What is the duty of loyalty?

What is the duty to account?

What is the duty to act impartially?

What is the duty to diversify?

What is the duty to earmark and segregate?

What is the duty to invest?

What is the Uniform Prudent Investor Act?